Amundi, the largest European asset manager, has warned that asset managers that do not develop an onchain offering will risk losing share to both more agile legacy managers and new “Web 3.0” asset managers.

In a report, Fund Tokenization Beyond the Horizon Line: The Cost of Missing Out, in December last year Amundi Business Intelligence said the tokenized fund market currently has $10bn of assets under management. In comparison, the mutual fund industry stands at €61.2 trillion and the global asset management industry oversees $128 trillion globally. Tokenization potentially offers benefits including faster settlement, lower operational cost and risks, as well as fractional ownership, which provides clients greater accessibility to investment opportunities.

“We believe that changes or intended changes to financial regulation aimed at accommodating the DLT technology such as regulators launching sandboxes and pilot regimes, the provision of digital currencies by private or public entities, as well as adaptation in historical capital market practices will ultimately enable these promises to be fulfilled,” added Amundi. “With these enablers, the theoretical use cases of fund tokenization will then become increasingly a reality.”

Amundi Business Intelligence has estimated that tokenized fund assets will grow to $30bn by 2030 on a conservative basis, assuming an ongoing compound annual growth rate of 25% per year. If there is more uptake from traditional distributors, Amundi Business Intelligence said assets could grow to $120bn in the same time period. Over the same period, Amundi expects the possible global annual net revenue opportunity from tokenised funds to reach $4bn by 2030 versus the current $310bn net revenues of the asset management industry.

However, beyond 2030 Amundi believes it is realistic that tokenized funds could exceed $1 trillion as the endgame of tokenization will be a convergence between the onchain and offchain world.

“At that stage, the industry will shift from a fragmented and constrained onchain distribution model to a more standardized, scalable, and interoperable distribution ecosystem for tokenized assets, with the potential to break the $1trillion mark and beyond,” added Amundi. “In the end, whereas the revenues to be generated from tokenized funds in the short term may be underwhelming, asset managers that look beyond the horizon line and that prepare for an onchain world that is already in the making may well end up on the winning side of the industry.”

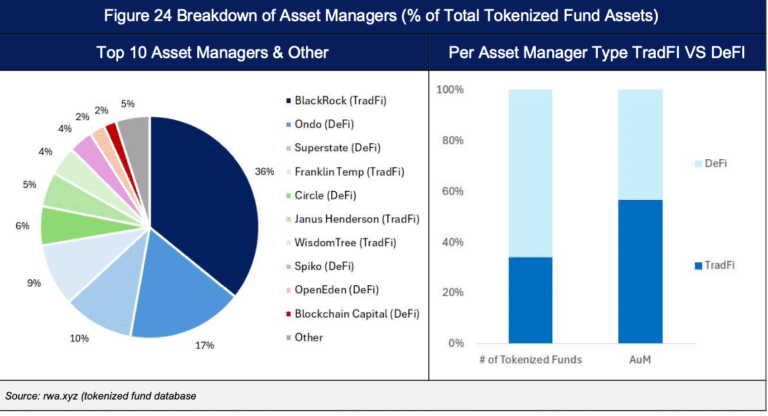

The market will remain concentrated in the U.S., which has a head start in decentralized finance and represents over half of the fund industry worldwide, according to the report. There are 75 fully onchain funds active on the market, with BlackRock, Franklin Templeton, Ondo Finance, and Superstate leading in the US, Spiko in Europe, and China AMC in Asia.

Collateral

BlackRock USD Institutional Digital Liquidity Fund (BUIDL), the $2.8bn tokenized money market fund, accounts for one third, 35%, of the market, with seven funds controlling 80% of total value, according to Amundi. In addition nearly all, 90%, of tokenized assets remain in money market funds, with demand driven by onchain investors seeking cash-like instruments.

For example, In November last year Binance said in a statement that the BUIDL would be accepted as off-exchange collateral for trading on the crypto exchange. In parallel, BUIDL launched a new share class on the BNB Chain network to expand investor access and interoperability with other onchain financial applications. Catherine Chen, head of VIP & institutional at Binance, said in a statement that institutional clients had asked for more interest-bearing stable assets they can hold as collateral while actively trading on the exchange.

Sarah Song, head of business development at BNB Chain, said in a statement: “BUIDL is turning real-world assets into programmable financial instruments, enabling entirely new types of investment strategies onchain.”

BUIDL was launched in March 2024 as BlackRock’s first tokenized fund on a public blockchain. The fund was tokenized by tokenisation platform Securitize to offer qualified investors access to U.S. dollar yields with flexible custody, daily dividend payouts, and 24/7/365 peer-to-peer transfers.The integration with Binance adds to BUIDL’s availability across other blockchain networks including Arbitrum, Aptos, Avalanche, Ethereum, Optimism, Polygon and Solana.

Robbie Mitchnick, global head of digital assets at BlackRock, said in a statement: “By enabling BUIDL to operate as collateral across leading digital market infrastructure, we’re helping bring foundational elements of traditional finance into the onchain finance arena.”

Consultancy Crisil Coalition Greenwich said in its report, Top market structure trends to watch in 2026, that tokenizing high-quality collateral is “shaping up to be a 2026 game changer.”

Tokenizing highly liquid U.S. Treasuries and similar cash equivalents onchain allows assets to move 24/7 and settle almost instantaneously while collateral cannot move overnight or during weekends under the traditional infrastructure. This increased speed may prove critical in times of market stress and will help the markets prepare for 24/7 trading.

“While the utility of the expanded trading hours is hotly debated among institutional market participants, preparing for around-the-clock trading is a must,” added Crisil Coalition Greenwich. “Although some might be OK with pre-funding margin accounts on Friday for weekend trading, most won’t want to tie up funds unnecessarily.”

In December last year Caroline Pham, then acting chairman of the Commodity Futures Trading Commission Acting announced the launch of a digital assets pilot program for certain digital assets, including bitcoin, ether and the USDC stablecoin, to be used as collateral in derivatives markets. The U.S. regulator also provided guidance on tokenized collateral for real world assets like U.S. Treasuries and money market funds.

Heath Tarbert, president of stablecoin issuer Circle, said in a statement: “Enabling near-real-time margin settlement will also mitigate settlement-failure and liquidity-squeeze risks across evenings, weekends, and holidays.”