Technology costs have grown disproportionately in asset management, but increased spending has not always translated into higher productivity according to research from consultancy McKinsey.

The consultancy said in a report that costs in asset management have become increasingly sticky and revenues have become unpredictable. As a result, pre-tax operating margins fell 3% in North America and 5% in Europe between 2019 and 2023. In North America, asset managers saw an 18% increase in costs over this period – which was higher than the revenue growth of just 15% in the same timeframe.

McKinsey said: “Against this backdrop, technology costs have grown disproportionately, yet this increased spending has not consistently translated into higher productivity.”

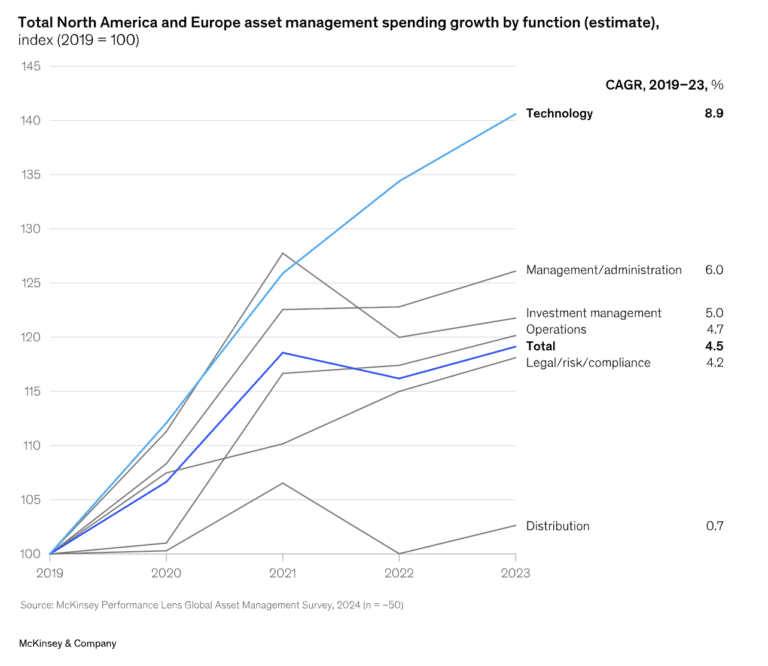

Technology investment has risen at a compound annual growth rate of 8.9% in North America and Europe over the past five years, according to McKinsey. However, the consultancy’s analysis found that asset managers investing more in technology are not consistently more productive than peers across key metrics such as cost-to-assets under management ratio and revenue per full-time equivalent employee.

“While the data is noisy, there is no clear correlation between higher tech spend and improved productivity,” said the report. “In fact, while the trendline is slightly positive, the R2 value (or coefficient of determination—a statistical measure that indicates how well a statistical model predicts the outcome of a dependent variable) is 1.3%, suggesting there is virtually no meaningful relationship between spend and productivity.”

The consultancy’s research is based on firms representing 70% of global assets under management, and interviews with senior executives from leading asset managers in the U.S and Europe.

The complexity of asset managers’ systems meant they allocated 60% to 80% of their technology budget on average to “run-the-business” initiatives, according to the research. This leaves only 20% to 40% for change-the-business operations, with 10% to 30% of this portion is directed toward firmwide digital transformation.

AI

McKinsey said artificial intelligence can help asset managers recover margin levels, but it needs to be executed well.

“For example, a mid-sized asset manager with $500bn in assets under management could capture 25% to 40% of total cost base in efficiencies through AI opportunities enabled by end-to-end workflow reimagination,” said the report. “To realize the value at stake, taking a role-based approach to automation by embedding virtual agents and traditional automation in seamless ways, alongside human roles, while focusing on change management and adoption, will be crucial.”

In investment management, the report highlighted that generative AI is transforming the way insights are generated and decisions are made, and can have an 8% efficiency impact.

For example, analysts are using gen AI-powered research assistants to synthesize data from earnings calls, financial reports, and conferences, accelerating the insight generation process. Portfolio managers are using gen AI tools to refine strategies, narrow investment options, and optimize portfolio construction and enhanced risk models and automated reporting are supporting a more data-driven investment approach.

“For the asset management industry, embracing AI-driven transformation is no longer optional but essential,” said McKinsey. “If effectively embedded into the organization, AI can address mounting margin pressures and unlock significant value. However, doing so will require a step-change in how they approach these technologies.”

The full report can be read here