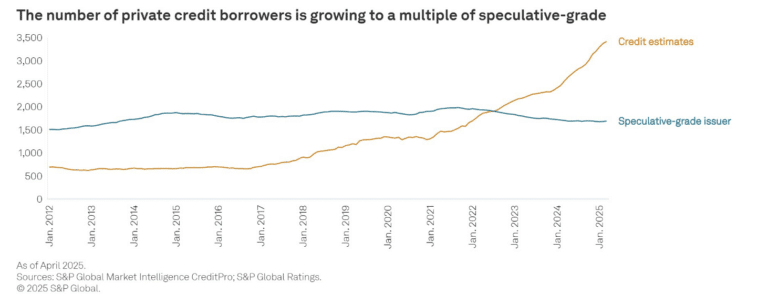

S&P Global Ratings warned that as private credit reaches more borrowers, it risks making the credit market more fragmented.

Evan Gunter, lead research analyst for private markets analytics at S&P Global, said in a webinar on 10 July that there are more borrowers of private credit and more new types of debt but it lacks the transparency of public markets.

“This makes it more challenging for investors to navigate that market between new structures and new technologies and new asset classes,” said Gunter. “Private credit is becoming more complex, and this makes it more difficult for investors to assess risks and opportunities.”

In a report, S&P said assets under management of private credit funds total nearly $1.7 trillion globally, with more than $450bn in dry powder including nearly $150bn earmarked for distressed debt or special situations. Therefore, private credit is poised to expand its footprint in corporate lending.

“Where uncertainty and volatility can lead to sudden slowdowns in primary market activity for bonds and broadly syndicated leveraged loans, the certainty of execution that private credit offers, coupled with its accumulated dry powder, demonstrates the capacity for private credit growth as an integral source of funding for leveraged finance in the coming years,” said the report. “This shift marks a sea change in credit markets.”

In the webinar, Look Forward: The Future of Capital Markets, Gunter said that private credit instruments are customised between the lender and borrower as the debt does not have to be standardized to meet the needs of a large syndicate of lenders. This lack of standardization also means the market is also largely illiquid and not traded.

However, the flexibility of private credit means that smaller and middle market borrowers are a large part of the market but it is also expanding to large corporates, funding for infrastructure, including energy transition and digital infrastructure and fund managers who are including private credit as a source of funding or leverage at various stages of the fund’s lifecycle.

“If the future of credit markets have a growing share of instruments that are more illiquid, less commoditized, and more complex than the number of potential buyers for a given asset could shrink,” added Gunter. “You could find a market that consists of many smaller pools of capital, where credit becomes less liquid, while the growth of private credit could lead to a credit market that’s increasingly fragmented.”

Tokenization

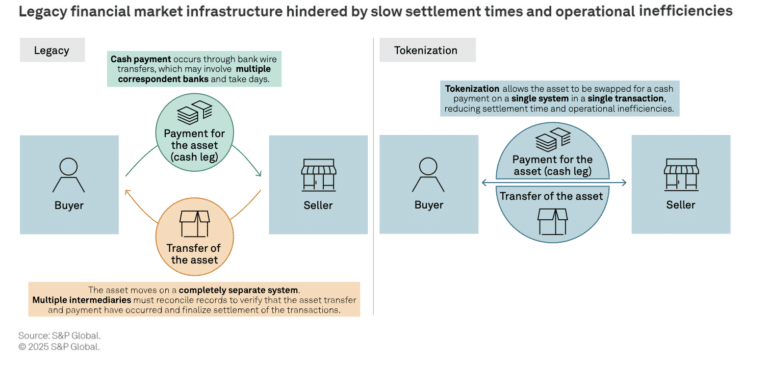

On the webinar Andrew O’Neill, analytical lead for digital assets at S&P, said new technologies and innovations, such as tokenization and AI, could open up new avenues for private credits, distribution, trading and access. O’Neill said tokenization could lead to the creation of new open networks that can deliver new pools of liquidity to markets at the risk of fragmentation.

O’Neill acknowledged that blockchain technology has faced challenges in its institutional adoption, such as institutions using private blockchains that have not delivered on building secondary markets around tokenized assets and the lack of consensus on digital forms of money for making payments onchain.

“We’re seeing those hurdles start to fold, particularly with regulatory change in the U.S since the start of this year,” O’Neill added. “As these hurdles begin to fall, we think early use cases will begin to scale with the longer term impact of creating new open networks and new pools of liquidity.”

In addition to facilitating more efficient and lower cost cross-border payments, O’Neill highlighted that blockchain allows increased collateral mobility with the ability to use collateral intraday and generate new earnings, especially with the increased adoption of tokenized money market funds.

“The real story of 2024 and 2025 has been the tokenization of money market funds and we’ve seen a pick-up in large traditional institutions creating these alongside their existing traditional fund products,” he said.

O’Neill gave the example of Janus Henderson’s AAA CLO ETF that is now being tokenized, and said the first investor will be one of the main decentralized finance protocols. S&P said in a report that CLO ETFs were launched in 2020 and reached $30bn in assets under management in the first quarter of this year.

“Although ETFs own just roughly 3% of the US CLO market, the largest CLO ETFs already anchor some new CLO issues in the primary market,” said the report. “This influx of demand from ETFs for CLOs appears to be lowering the cost of funding for new CLOs.

O’Neill gave the example of alternatives manager Apollo Global Management tokenizing a private credit fund, the Apollo Diversified Credit Securitize Fund. ACRED is integrated with a decentralized finance (DeFi) protocol, Morpho, to allow investors to manage their leverage against their shares in that particular fund.

“This is a very early example of something that we expect to see throughout this phase of tokenisation interacting with private credit and solving for some of those liquidity fragmentation risks that were described,” O’Neill added.

🚨 BREAKING: The tokenized Real-World Asset (RWA) market just broke an all-time high, surpassing $25 BILLION for the first time ever!

Securitize is leading the charge on the way to $1 TRILLION.

From tokenized treasuries to private credit, and institutional funds to equities,… pic.twitter.com/bNuxTnCpcF

— Securitize (@Securitize) July 9, 2025

ETFs

David Easthope, senior analyst and the head of fintech research at consultancy Crisil Coalition Greenwich, said on the webinar that in crypto institutional investors are concerned about slippage, a lack of liquidity for large orders for traders, information leakage around public wallet addresses and counterparty risk. In addition, crypto venues and custodians are typically less regulated than traditional financial market infrastructures.

He said: “We believe ETFs can be a simple yet elegant solution to these crypto investor challenges. Simple point and click and ease of trading ETFs has brought major accessibility improvements to the crypto markets.”

For institutions, ETFs offer trading through established regulated channels and custody of the underlying assets custodian. They do not have to manage self custody or trust in an exchange performing custody, but benefit from the existing infrastructure or plumbing of traditional financial markets.

However, private credit ETFs are still in their early days and Easthope said only a handful have been launched so far. However, ETFs could introduce a new route for price discovery and private credit, addressing some of the transparency concerns.

O’Neill gave the example of Janus Henderson’s AAA CLO ETF being tokenized, and said the first investor is one of the main decentralized finance protocols. In June this year Grove said in a statement that it allocated $1bn allocation into the Janus Henderson Anemoy AAA CLO Strategy (JAAA), a tokenized, onchain vehicle launched in partnership with Centrifuge, using Grove’s decentralized infrastructure.

Nick Cherney, head of innovation at Janus Henderson Investors, said in a statement: “Last year, our pioneering AAA CLO strategy attracted the most inflows among all actively managed fixed income ETFs, underscoring the growing investor appetite for innovative fixed-income solutions. When Grove approached us to bring this strategy onchain, we were impressed by their clear vision for building the onchain economy.”

The tokenized, onchain vehicle was launched in partnership with Centrifuge, using Grove’s decentralized infrastructure. Anil Sood, chief strategy and growth officer of Centrifuge, said in a statement that while tokenized treasuries have paved the way, there is a growing demand for more diversified, high-quality assets onchain,. He continued that instead of simply wrapping an offchain ETF, together with Janus Henderson the firm has brought JAAA fully onchain, unlocking operational efficiencies, reducing intermediary costs, and expanding access to a broader, global base of capital allocators.

“Innovations and new technologies such as private credit and tokenization may be creating the infrastructure for the future of capital markets, and some of the building blocks of this future already sit in the ETF portfolios of today,” added the S&P report.