HSBC Global Asset Management has launched a suite of sustainable exchange-traded funds after Fidelity International debuted three actively managed environmental, social and governance ETFs this week.

Three of HSBC’s new ETFs were listed on the London Stock Exchange today and three more are expected in the coming weeks according to a statement.

Daniel Klier, our Global Head of Sustainable Finance, talks to @NewClimateCap about green finance, the importance of resilience during the crisis, and what to expect in the post-pandemic recovery: https://t.co/UqURvaE3vs#SustainableFinance pic.twitter.com/C6qIvE4tSf

— HSBC (@HSBC) June 5, 2020

The ETFs track the newly created FTSE Russell ESG Low Carbon Select Indices which target a 20% rise in ESG score, a 50% reduction in carbon emissions and a 50% reduction in fossil fuel reserves relative to the parent index.

Olga De Tapia, global head of ETF sales at HSBC Global Asset Management, said in a statement: “Due to the evolution of the energy industry, the indices aim to capture stocks with lower fossil fuel reserves intensity, including alternative energy companies. The indices’ target of a 50% reduction on fossil fuels reserves allows them to include those companies that are at the forefront of this transition.”

HSBC Global Asset Management said it also plans to develop a fixed income ETF platform and a passive platform for precious metals. The firm currently manages $60bn (€53bn) in passive strategies and $8bn in ETF strategies.

Fidelity International

This week Fidelity International also launched three actively managed ESG ETFs which reference the firm’s proprietary Sustainable Ratings. The ETFs started trading on 3 June on the London Stock Exchange and Deutsche Börse Xetra.

Jenn-Hui Tan, global head of stewardship and sustainable investing at Fidelity International, said in a statement: “Sustainable investing has proven to be one of the most significant shifts in asset management in a generation, heightened by increasing evidence that ESG investing can enhance financial returns. This trend was reaffirmed in our own research where stocks with higher ESG ratings outperformed lower rated stocks during the recent Covid-19 induced market sell-off.”

ESG outperformance

ESG-focused stocks outperforming the market was confirmed by analysts at Berenberg, the German financial group.

In January the bank launched the Berenberg Adjusted Sustainable Development Goal (BSDG) Framework which analysed each of the 169 targets supporting the United Nations’s 17 Sustainable Development Goals. The analysts have since mapped the revenue exposure of 285 pan-European stocks to the framework.

The analysts said in a report this week: “Our analysis suggests that ESG-focused stocks outperform the market. Our pan-European mid-caps with high alignment to the SDGs have outperformed the rest of the coverage by c45ppt since the start of 2015, and, importantly, they have also outperformed during the recent downturn.”

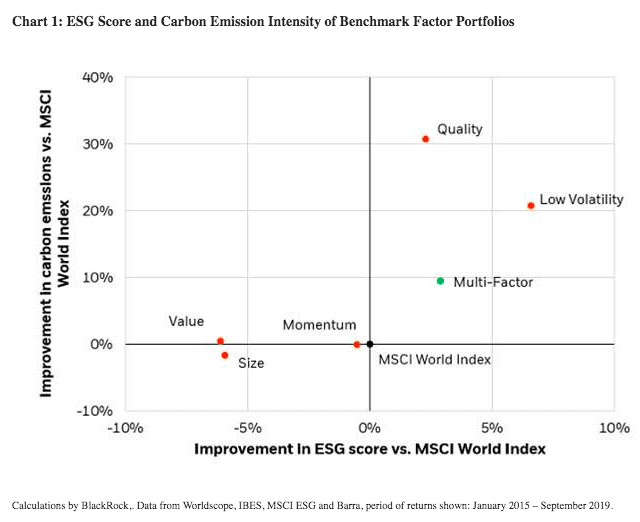

Andrew Ang, head of factor investing strategies at BlackRock, said in a report that the asset manager’s recent research shows that a diversified factor portfolio can have better ESG characteristics and lower carbon emissions than the market.

“For investors who would like to explicitly combine factors with improved ESG characteristics, our research has found that building portfolios that optimize for both factor exposures and ESG criteria can potentially benefit performance as well as sustainability,” Ang added. “We can take the incorporation of ESG one step further, by combining ESG measures in the definitions of factors—like green patents in value and corporate culture in quality—to complement the traditional measures of factors.”

ESG futures

In the futures market, six new Eurex equity index futures on ESG indices received approval from the U.S. Commodities Futures Trading Commission this week.

#ESG on the rise: The current portfolio shift from existing benchmarks to sustainable alternatives will continue to change the investment landscape. Find out about the implications of expanding ESG beyond equities at our Digital #DerivativesForum. https://t.co/OUt7sB3z7S pic.twitter.com/cRzOk4DVTV

— Eurex (@EurexGroup) June 3, 2020

“This regulatory permission opens the U.S. market – both buy side and sell side – allowing the new ESG derivatives to be utilized by U.S.-based investors that apply ESG criteria to their portfolios,” Eurex said in a statement.

In addition Taiwan Futures Exchange said in a statement this week that it is launching the first ESG futures in Asia.

Taiwan Futures Exchange (TAIFEX) has licenced the FTSE4Good TIP Taiwan ESG Index for its latest futures offering launching on 8 June, the first ESG based future product launched in the APAC region, and the first product by TAIFEX linked to the index. #ESG https://t.co/UuFNYKwJJZ

— FTSE Russell (@FTSERussell) June 4, 2020

Bing-Jing Huang, president of TAIFEX, said: “The new product addresses the growing demands for ESG investment across the globe and has gained traction as the first ESG futures in Asia. We believe this product provides an effective tool for investors to trade and hedge their exposure to ESG portfolios.”