Proprietary large language models in ICE Chat have helped boost the number of users and driven a nearly 60% rise in energy volume executed via the exchange’s messaging platform.

Warren Gardiner, chief financial officer of ICE, said on the second quarter results call on 3 August that there has also been continued growth in the ICE Chat offering, a messaging system that can be tailored to support firms’ compliance requirements.

ICE Chat also helps to automate workflows by automatically identifying trade opportunities in real time with features that include quote and trade recognition logic, blast messages and a directory of market participants.

The number of ICE Chat users has grown at a 15% compound annual growth rate over the last five years to nearly 120,000 at the end of the second quarter.

“This growth has been driven by investments we have made to reduce friction across the workflow, including the development and refinement of a proprietary large language model with ICE Chat,” Gardiner added. “As a result of these enhancements we have seen a nearly 60% increase in energy volume executed through our ICE Chat platform in the first half of this year.”

Lynn Martin, president of NYSE and chair of fixed income and data services, said on the call that the big buzzwords this year have been around developing and implementing large language models. She explained that ICE has been using large language models for about a decade but they have been increasingly refined over the last five years.

ICE Chat allows for automation as, for example, it can detect when a trade idea is being discussed and then allow seamless transmission of that trade to ICE’s clearing houses and trading platforms. Additionally, it can provide some fair value analytics and additional metrics to give traders confidence they have a good price.

“ICE Chat is helping traders to automate their workflow which is why it has gained popularity over the last couple of years as the technology has improved,” Martin added. “Quite honestly, we think we are still in the early stages of this and it is something that we are incredibly excited about.”

The offering has applicability across all the markets in which ICE operates according to Martin, even though the early stage benefits are only being seen in the energy markets today.

Martin said: “Fixed income automation is a trend that we continue to be uniquely positioned to capitalise on with products like Continuous Evaluated Pricing, which has seen outsized growth relative to the other portions of the fixed income data and analytics side of the business.”

The growth of fixed income data and analytics also boosts ICE Bonds, the execution side of the business, according to Martin.

“ICE Bonds outpaced the industry in spite of muted volatility in our core municipal bonds markets because of share gains due to automation, the transparency provided by our data, as well as the adoption of institutional customers for these services,” she added.

There was a 51% increase in the ICE Bond business in the first half of this year versus last year.

On the execution side, Martin said Martin said it was encouraging that there was strong growth in the second quarter although the muni markets have been muted.

“We have spent the last couple of years building our distribution framework and getting access to the institutional users, as well as continuing to gain share in retail and wealth,” she added.

As a result of more integration into the institutions and investment in technology, the Treasury markets were able to drive growth in the second quarter.

This month the group announced the relaunch of ICE Risk Matching Auction (RMA), an enhanced sweeps session-based protocol for dealer-to-dealer fixed income trading. ICE RMA was initially launched in 2015 and now conducts multiple auctions each week, with 50 registered firms and over 400 users with access to the protocol.

The relaunch has allowed ICE to gain share in corporate bonds, particularly in US investment grade, although Martin described this as still in its very early days.

“We are optimistic because of the investments that we have made in the platform, not just on the technology side, but also building the distribution,” she added.

Martin continued that the attractive yield in US Treasuries has driven some of these gains in the execution business. In addition, she said assets under management in the fixed income index business were continuing to grow.

“Over the last years it has been particularly tough for fixed income asset managers and the number of funds declined,” added Martin. “We are starting to see green shoots and the reemergence of new funds being created.”

Environmental complex

Ben Jackson, president of ICE and chair of ICE mortgage technology, said on the call that the company began investing in the globalisation of natural gas and the evolution towards cleaner energy more than a decade ago.

“Today cleaner energy sources, including global natural gas and environmental contracts, make up over 40% of our energy revenues and have grown by double digits, on average, over the past five years,” added Jackson.

Corporates and market participants remain committed to reducing carbon emissions over the longer term according to Jackson.

“Importantly, because we offer one of the broadest suite of environmental products across the carbon cycle, we remain excited about our position to serve customers as they navigate the journey to cleaner energy and as the demand for transparent pricing and carbon grows,” he added.

He gave the example of ICE launching carbon futures based on Washington State’s “Cap-and-Invest” program in June and the planned launch of futures on Alberta’s carbon programme, which are expected to go live in the third quarter.

Jackson added that the environmental complex continues to be one of the most significant areas of investment in the futures business.

“The world is going to continue to have a dynamic of moving towards a cleaner energy environment,” he added. “The road is going to be bumpy but we can enable customers with our complete suite of products across oil, gas, power and environmental products in one place.”

Additionally, in the oil business there is high demand for low carbon fuels as the US EPA sets guidelines for the amount of renewable fuels that need to be blended into transportation fuels each year in order to create sustainable jet fuel or diesel.

“In the last couple of months, we saw roughly 20% to 25% of the physical market under the EPA mandate trading via futures,” said Jackson. “As futures markets mature, they often trade a multiple of the physical market.”

Financials

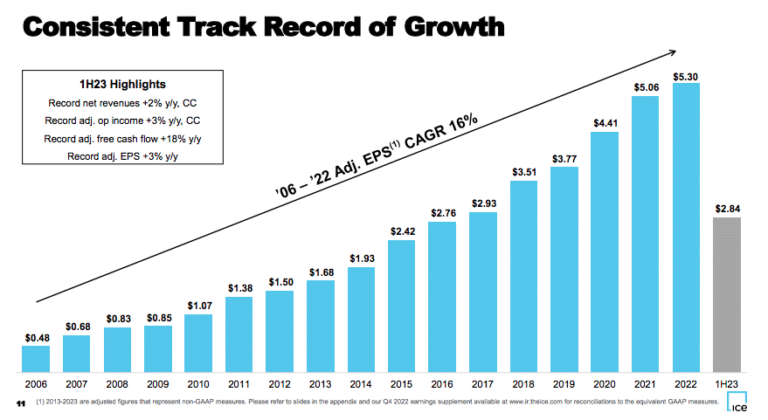

Gardiner said the second quarter was the best in the company’s history as earnings per share rose 8% year-over-year, driven by total net revenue of $1.9bn.

Transaction revenue was $736m in the second quarter, up 12% from a year ago driven by 33% growth in energy revenues and 9% growth in environmental revenues.

“We continue to see robust trends across our global oil business,” said Gardiner. “Importantly, this is helping to drive strong open interest trends across our global commodity futures and options complex.”

Exchange data services also had double digit growth as the number of customers consuming global energy and environmental data was partially offset by muted listings and capital markets activity.

However, Gardiner said the initial public offering market started to open up towards the end of the second quarter.

Management said ICE had increased pricing on a handful of oil contracts last summer by a few pennies per contract as it was a good moment to capture some of the value ICE had brought to the asset class over a number of decades. Using the same philosophy ICE may increase the price of other contracts next year and beyond.

“This was a record first half,” added Gardiner. “We continue to make strategic investments across our business and future profitable growth opportunities.”

Jeff Sprecher, chair and chief executive of ICE, said on the call that he could not speak about the announced acquisition of mortgage technology provider Black Knight and the pending litigation with the Federal Trade Commission.

“We remain very excited about the value and efficiencies that the combined ICE and Black Knight entities will bring to the end consumer as well as to other stakeholders across the mortgage ecosystem,” Sprecher added.