Intercontinental Exchange reported record net revenues in the first half of this year and highlighted record quarterly data revenue and growth in the new ETF Hub.

ICE reported second quarter revenues this morning which included record data revenue of $574m, up 4% year-on-year.

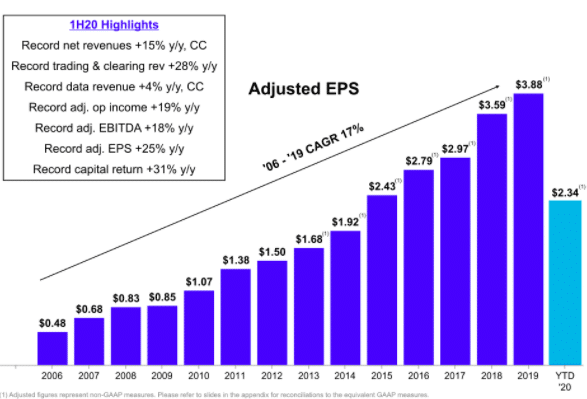

$ICE reports strong 2Q20:

* Second quarter revenues of $1.4 billion, +8% y/y

* GAAP diluted EPS of $0.95, +13% y/y

* Adj. diluted EPS of $1.07, +14% y/yhttps://t.co/komKvpH6B5— ICE (@ICE_Markets) July 30, 2020

Jeffrey Sprecher, chairman and chief executive of ICE, said on the results call that Data Services had its 42nd consecutive quarter of year-on-year growth and he thinks this will continue for the remainder of this year.

Sprecher added: “In the third quarter we expect Data Services will earn between $575m and $580m and an additional $7m to $10m in quarter four.”

Scott Hill, chief financial officer of ICE, said on the call that the requirement to work from home had boosted demand for pricing and reference data.

“Increased sales were driven by new customers and increased consumption of fixed income pricing, feeds, environmental, social and governance analytics and regulatory products,” Hill added. “There was also record exchange-traded fund assets under management of $263bn tracking our indices.”

ICE ETF Hub

Hill also highlighted the growth of ICE ETF Hub, which launched in October last year to standardise and simplify exchange-traded fund creation and redemption trading.

Creating and redeeming ETFs requires the negotiation of large baskets of securities between issuers, authorized participants and market makers. However, the existing process for custom negotiations is extremely manual with market participants using a combination of phone, email, chat or spreadsheets to agree to baskets. The need to manually copy and paste data leads to errors and the process taking much longer than it should.

ICE ETF Hub Announces Launch of Innovative Custom Basket Negotiation Technology

Read the press release here:https://t.co/Ylgbs9MHfi

— ICE (@ICE_Markets) July 22, 2020

The ETF Hub streamlines this process through its centralized portal and FIX APIs, reducing the time and manual steps involved. FIX messaging is a standard for the financial industry.

Last month both Credit Suisse and Wells Fargo joined the ICE ETF Hub as Authorized Participants

“There are now seven APs on the ETF Hub, who in aggregate are responsible for two-thirds of creation and redemption activity,” said Hill. “In an important milestone that we have also added market makers and an issuer.”

The exchange has launched a pilot program so market makers can experience the custom basket negotiation functionality in a live production environment. Several market makers, including Jane Street, Old Mission and CTC, have joined the program according to ICE and additional firms are expected to enrol in the coming months. ICE ETF Hub has processed more than $330bn in notional value since launch.

This week ICE announced that JP Morgan Asset Management has joined the ICE ETF Hub advisory committee as a development partner for the platform.

Joanna Gallegos, global head of ETF strategy at J.P. Morgan Asset Management, said in a statement: “As an issuer serving fast-growing ETF markets, we’re aware of the critical need for a robust infrastructure for the primary market that can support our customers’ needs for both investment returns and innovation.”

J.P. Morgan Asset Management joins ICE ETF Advisory Committee

— ICE (@ICE_Markets) July 27, 2020

Sprecher said: “Our focus is on settlement as our strategy has been to enter markets through the back office and with our reference data.”

ICE is launching connectivity between ICE ETF Hub and ICE FI Select, enabling a trader involved in a custom basket request to send a bond or list of bonds to secondary market liquidity with a click of a button. ICE Select provides connectivity to the entire ICE fixed income ecosystem, including all the ICE Bonds execution platforms and ICE Data Services evaluated pricing and analytics.

Sprecher said ICE will enter fixed income execution in the same way.

“We establish an institutional network with ICE Data Services which takes time,” he added. “However, we are very well positioned for a medium to long-term opportunity in fixed income execution through a combination of our data and making workflows more efficient.”

Trading and clearing

In the second quarter of this year, trading and clearing revenue rose 13% year-on-year. At the New York Stock Exchange cash equities average daily volume was up 61% year-on-year and equity options ADV rose 44%.