Jeffrey Sprecher, chair & chief executive of ICE, said on the first quarter results call on 1 May 2025 that the company was pleased to report the best quarter in ICE’s history, highlighted by record revenues, record operating income and earnings per share growth. Net revenues rose 8% year-on-tear to $2.5bn.

Sprecher said: “We’ve mixed our footprint between financial markets which react to central banks, acts of man, physical markets which react to disrupted supply chains and acts of God.”

At the New York Stock Exchange, cash equity trading volumes increased 20% year-over-year, and equity options volumes increased 8% over the same time period. Equities and equity option trades were executed more efficiently in this period of high volatility than during the Covid outbreak, according to Sprecher.

“Handling all-time high volumes and messaging rates, our technology systems rose to the occasion twice, processing more than 1 trillion messages in a single day, with a median processing time of roughly 30 microseconds,” he added. “The NYSE’s opening and closing auctions grew more than 20% to handle over $37bn in trading activity per day.”

In March this year NYSE opened NYSE Texas, the first securities exchange to operate in the state, as Nasdaq has also announced the opening of a new regional headquarters in Dallas.

Lynn Martin, president of NYSE Group, said on the call that Texas has always been an incredibly important state across ICE, which started as an energy trading company, and so has had offices in the state for more than two decades.Texas is also largest state in terms of issuers on NYSE, who have a combined market cap of around $4 trillion.

“We’re in the process of bringing live functionality around the listing of exchange-traded products (ETPs), which we expect will go live in the second quarter,” she added. “This is the next evolution in the way that we stay close to our customers in an Incredibly important state where we have more than 3,000 customers across our entire ICE ecosystem.”

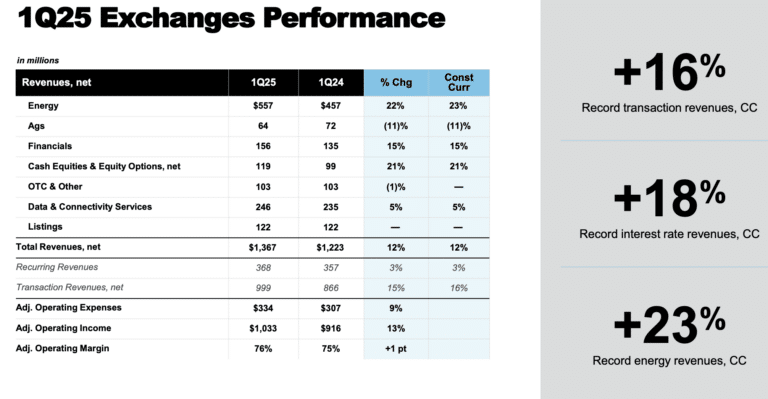

Consolidated revenues included $1.4bn from the exchanges segment, fixed income and data services revenues of $596m and mortgage technology revenues of $510m.

Warren Gardiner, chief financial officer at ICE said on the call: “These strong results were led by an 8% increase in net revenue to a record $2.5bn. Importantly, against the backdrop of macroeconomic uncertainty, we saw growth across all three of our operating segments.”

In the exchanges business, transaction revenues were a record of nearly $1bn, up 16% from a year ago. Gardiner said this was driven by an 18% increase in revenues from the interest rate business, 21% growth in New York Stock Exchange cash equities and options revenues, and another record quarter of energy revenues, which grew 23% year-on-year.

Energy volumes

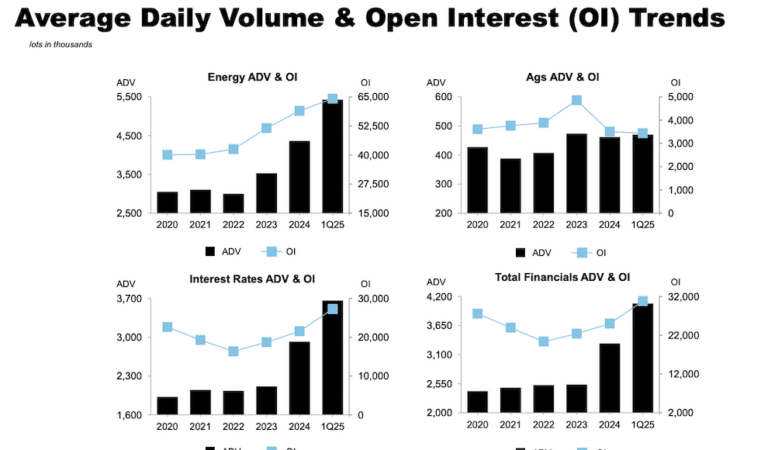

Ben Jackson, president of ICE and chair of ICE Mortgage Technology, said on the call that ADV in ICE’s futures markets increased 23% to a record 10 million lots in the first quarter of this year, including records across energy and interest rates.

Gardiner added that volumes accelerated in April, with energy average daily volume (ADV) up 39%, interest rate ADV up nearly 60%, cash equitIes ADV up 68% and equity option ADV up 11%. He said: “Importantly, amidst rising volatility, open interest continues to build up 8% year-over-year, including 21% growth in global interest rates and 7% growth in our energy market.

Jackson continued that for over two decades, ICE has worked closely with its customers to develop a diverse, liquid and globally interconnected energy network. ICE’s energy offering reported its eighth consecutive quarter of record revenues.

“This deliberate and long-term strategic direction contributed to our eighth consecutive quarter of record energy revenues, which increased 23% year over year,” he added. “That is on top of 32% growth achieved in last year’s first quarter.”

Open interest across the energy complex set a series of records in April, according to Jackson, which signals that customers are managing risk by adding to their positions rather than leaving the market.

Sprecher agreed that ICE continues to see strong energy trading volumes to start the second quarter, as market participants look to hedge exposures to geopolitical dynamics.

“This includes the single highest energy trading day ever experienced on ICE with nearly 10 million energy contracts traded on April 4,” Sprecher said.

Going forward, the new US administration has pledged to increase energy production, which Sprecher said could further reorder the global energy supply chain and the global risk that may need to be managed on ICE’s platform.

Interest rate complex

Sprecher added that a mixed inflation picture, ongoing political pensions and shifting trade policies are driving demand for interest rate risk management.

“As a result, we captured the highest quarterly volume in our company’s history, which increased 31% versus the prior year, and included records across our Euribor and Sonia markets, the most liquid benchmarks for European and UK interest rates, respectively,” said Sprcher.

In addition, volume in ICE’s gilts market, the benchmark for the UK government bond yield curve, volume increased 8% in the first quarter, including 12% growth in March. Gilts open interest is also up 62% year-over-year.

Fixed income and data services

First quarter fixed income and data services revenues were a record $596m.

Jackson said: “As fixed income markets automate and passive investing grows, our comprehensive platform continues to generate compounding revenue growth, delivering another quarter of record revenues, which group 5% year-over-year.”

He continued that growth continues to be fuelled by growing demand for ETFs and their expanded role in markets, with assets under management benchmarked to ICE indices growing to a record of $684bn to the end of the first quarter.

ICE also signed two additional licensing deals in the first quarter with large global asset managers. One will move existing assets under management to ICE’s index family, while the other will launch a new ETF.

Chris Edmonds, president of fixed income and data services at ICE, said on the call that the business continues to perform “incredibly well” due to investment that the group has made to be able to quickly customize certain indices to meet the client demand for new investment strategies.

“One ETF issuer is moving about $10bn of assets under management to our indices,” added Edmonds.

Data and network technology business revenues increased 7% year over year. Jackson said ICE continues to innovate to reduce friction across the workflow. For example, ICE recently launched ICE Voice, a cloud-based audio solution integrated directly with ICE Chat, which provides market participants with real-time voice communication capabilities alongside chat functionality.