In June 2022 ICE said it would stop clearing credit default swaps in Europe and in October this year the exchange closed out the final open interest at ICE Clear Europe and re-established positions in the US at ICE Clear Credit. The process involved developing a new matching algorithm at ICE Link, a post-trade affirmation platform for buy-side and sell-side CDS market participants, in just three months.

Stan Ivanov, president of ICE Clear Credit, told Markets Media that when the announcement was made last year to close CDS clearing at ICE Clear Europe, Osttra said they would build services to move open interest to ICE Clear Credit or LCH, the London Stock Exchange Group’s clearing arm, depending on position holders’ destination of choice. OSTTRA is a joint venture for post-trade between S&P Global & CME Group that brought together MarkitServ, Traiana, TriOptima & Reset.

Hester Serafini, president of ICE Clear Europe, said in a statement in May this year: “In collaboration with market participants and Osttra, ICE Clear Europe has reached an important milestone in the work towards the cessation of its CDS clearing service. The compression service allows market participants to smoothly migrate their CDS positions and the first cycles have been very successful.”

The counterparty risk optimization service, Osttra triBalance, completed five rebalancing cycles and reduced more than $190bn equivalent in open interest in indices and selected single name CDS at ICE Clear Europe according to a statement from Osttra in May. In July Osttra said in a statement it had completed nine cycles and successfully moved $330bn of open interest for single name and index cleared CDS, approximately 85% of the total open interest that needed to be transferred by 27 October 2023.

Ivanov continued that Osttra had moved positions for clearing members, the big banks, but this was less than 20 distinct financial institutions and excluded many positions held by clients and clearing participants. As ICE monitored the overall transition, the firm saw a need to provide something to the marketplace to facilitate the closure of positions at ICE Clear Europe and re-establish them at a destination of the position holders’ choice.

Even when Osttra was performing those services, more than two thirds chose ICE Clear Credit according to Ivanov. For example, in May this year Intesa Sanpaolo, the Italian banking group, became a clearing participant at ICE Clear Credit.

“Osttra was first to market and did the initial heavy lifting but it was a brute force type of movement,” Ivanov added. “The final phase, however, needed a neurosurgeon with a scalpel to make very fine adjustments to the transition process approach, which is exactly what we did.”

Ice Link

In order to move positions to LCH, ICE had to do the same as Osttra and match two counterparties bilaterally, which is a complex process as matches may not exist due to different destination choices.

“However, in the transition from ICE Clear Europe to ICE Clear Credit, ICE Link was the crucial factor as it is de facto the gateway to both clearing houses,” said Ivanov.

Ian Springle, head of ICE Link, told Markets Media that after the completion of the Osttra cycles, which were able to transition clearing participants’ net long or short positions, some dealers were left with a large inventory of substantially offsetting positions at ICE Clear Europe, that they also maintain in their internal account structures.

“It was an operational challenge for them to collapse these position sets and re-create the same structure facing the new clearinghouse; but this is what the ICE Link algorithm was able to achieve with ease,” Springle added.

Ivanov continued that ICE Link developed the algorithm to transfer positions from ICE Clear Europe from scratch but it was something that ICE had thought about before. It was necessary to test the algo, polish it and optimise it to build the hierarchy of matching in every cycle, ensure that the formation of every single pair was practically risk neutral and that transitions were the most cost efficient without breaking any established netting sets.

ICE showed clients and members the test runs, but Ivanov explained that it was another challenge to run a cycle in reality against near real-time standing instructions because they can change. In addition, clients can also decide to move accounts to a later cycle which immediately changes the outcome as different matching sets are formed.

Springle said ICE Link closed out and re-established over 30,000 position records representing $400bn to $500bn in notional amount, and transitioned around $75bn of open interest. More than 90% of the remaining notional amount was captured in just three cycles, with eight cycles overall and ICE estimated that total capital savings to the industry from the migration was around $5bn.

“The nice thing was that three weeks before the closure, we had emptied pretty much all the open interest and there were no tear-ups, which was a very good result for the industry,” Springle added. “There were two key reasons that we were successful – the innovative and efficient matching algorithm that we developed and the high quality of execution in tight collaboration with the industry.”

Ivanov described it as an interesting experience to see how matches occurred and the overall dynamics of bringing new positions to the ICE Link services, that created the opportunities for more matching. He said the most satisfying piece was the last run when they could see all the positions fully collapse by virtue of being matched and transitioned to ICE Clear Credit.

“Our biggest achievement was that we provided a near continuous service,” Ivanov added. “Market makers were fully confident that there would be a service that would be able to match their positions resulting from executed trades across their account structures and readily move them to their clearinghouse of choice.”

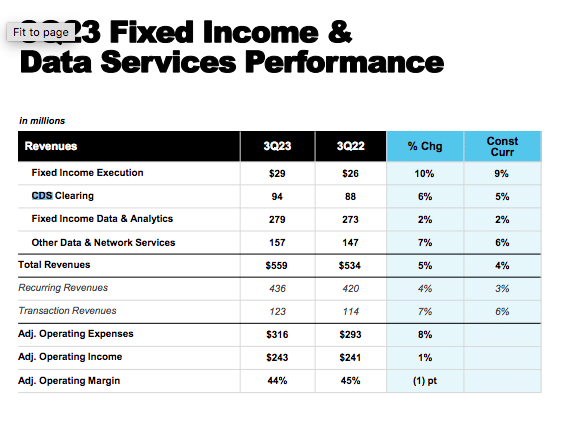

In its third quarter results call, ICE reported a 6% increase in revenues for CDS clearing from the third quarter of 2022 to $94m.