ICE is aiming to find ways to use its mortgage data to increase transparency in the secondary capital markets and plans to launch secondary whole loan trading platform in the second half of this year

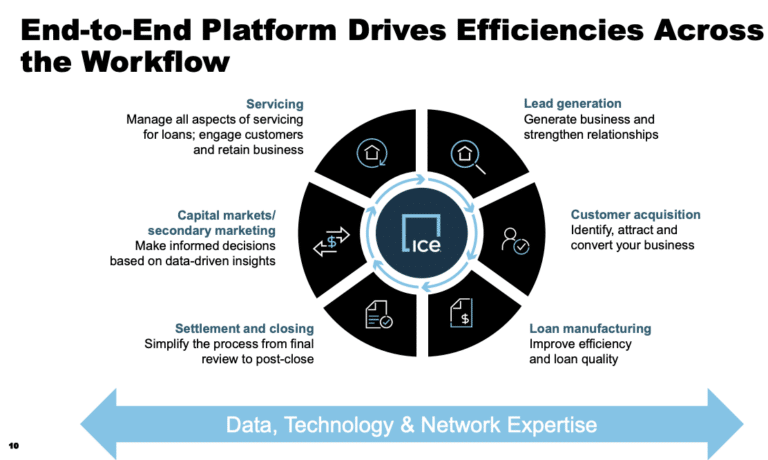

Ben Jackson, president of ICE and chair of ICE Mortgage Technology, said on the results call on 31 July 2025 that the group’s strategy is to drive greater automation across the mortgage space to meet rising customer expectations for a digital first experience and to drive long-term operational efficiency.

Jackson said: “ICE has been building an end-to-end digital mortgage platform that spans from customer acquisition all the way through to the secondary capital markets.”

ICE completed the acquisition of Black Knight, a software, data and analytics company for housing finance, including real estate data, mortgage lending and servicing, as well as the secondary markets. The Black Knight acquisition followed ICE’s 2020 purchase of Ellie Mae, its 2019 acquisition of Simplifile, and its 2018 acquisition of Mortgage Electronic Registrations Systems (MERS), which were combined to create the foundation of its ICE Mortgage Technology business segment.

ICE Mortgage Technology combines data and expertise to help automate the mortgage process, from consumer engagement through loan registration, and every step in between.

For example, in April this year ICE launched a request for quote (RFQ) protocol for mortgage-backed securities.

“ICE Bonds plans to integrate pricing and analytics from mortgage technology to help traders make more informed trading decisions,” he added.

In the second half of this year, ICE plans to launch the first version of its secondary whole loan trading platform, which Jackson said is designed to automate and provide significant efficiencies to a very analog process.

Financials

ICE reported record second quarter net revenues of $2.5bn, up 10% year-on-year and record operating income of $1.3bn, an increase of 22% year-on-year. Warren Gardiner, chief financial officer of ICE said on the results call that record results came from growth contributions from all three of the group’s operating segments.

Through the first half, ICE returned over $1bn to shareholders through both buybacks and dividends.

“We did this while also investing in our business and reducing leverage, so we ended the second quarter at our target of three x EBITDA ahead of our initial target when we closed the acquisition of Black Knight less than two years ago,” Gardiner added.

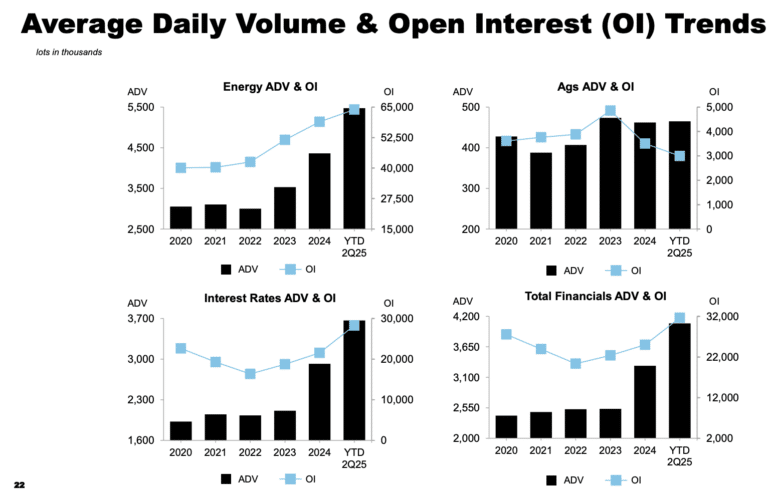

In the exchanges business, second quarter net revenues were a record $1.4bn, up 12% year-over-year.

Record transaction revenues of over $1bn were up 15%, driven by a 20% increase in interest rate revenues, record, NYSE cash equities and option revenues, and another quarter of record energy revenues which grew 25% year-over-year.

Gardiner said: “Volumes in July continued to be strong with energy average daily volume up 11%, interest rate average daily volume up 24% and cash equity average daily volume up 54%. Importantly, open interest continues to build up 12% year-over-year, including 40% growth in global interest rates and 5% growth in our energy markets.”

Jackson said a record of more than one billion contracts traded on ICE through the first half of this year including a record 673 million energy contracts and a record 462 million interest rate contracts.

“This record performance drove 19% revenue growth in our futures and options revenues in the first half, and is strong evidence of the ever growing need for global risk management as our customers continue to turn to ice to manage risk across the thousands of contracts offered on our platform,” added Jackson. “Our single platform model isn’t just efficient, it’s essential for navigating an increasingly dynamic energy landscape.”

Fixed income data and analytics business reported record second quarter revenues of $306m, an increase of 4%.

“Our high quality evaluated prices provide mission critical transparency for over three million global securities daily across our reference data business,” said Jackson. “We’ve improved the precision of our underlying data, reduced the time to capture newly issued bonds and have continued to add to our coverage, thus providing a truly comprehensive offering.”

Revenue in the index business grew double digits with passive ETF assets under management benchmarked to ICE indices growing to a record of $743bn.

Jackson argued that the long tail secular trends such as electronification of bond markets, workflow automation and the shift to passive investing means that the data offering is positioned to continue to deliver compounding growth well into the future.