Equities exchange IEX has tripled its displayed market share since June 2024 after introducing new pricing tiers, but said it has maintained market quality.

Bryan Harkins, president of IEX Group, told Markets Media: “We are particularly proud of our displayed market share as market quality has not been sacrificed for growth. On the contrary, our displayed growth has improved the performance of our dark venue.”

IEX Group announced the appointment of Harkins as its president in May 2024. Before joining IEX his roles included head of markets at Cboe Global Markets overseeing equities, derivatives and foreign exchange trading; president of BIDS Trading; and head of markets at BATS Global Markets.

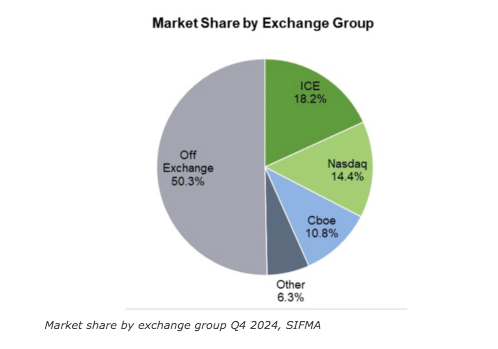

IEX embarked on a journey last year to find the sweet spot between performance and pricing and because of this, the exchange tweaked its pricing a few times throughout the year, according to Harkins. As a result, some liquidity providers gave IEX a shot and had a positive experience, which propelled growth in displayed trading. This growth comes as off-exchange trading of US equities grew to over 50% in the final quarter of 2024, according to data from industry association SIFMA.

Harkins admitted the displayed trading on exchanges has become increasingly challenging over the last five to 10 years.

“That makes our product especially useful in this environment where the Speed Bump and the Signal provide protection mechanisms for liquidity providers and allow them to post with greater consistency and confidence,” he added.

IEX was the first US equities exchange to power its order types with a machine learning-based mathematical formula, the Signal, also known as the crumbling quote indicator. The Signal predicts which way the market will move in order to protect customers from trading at a price that will imminently become stale.The Signal is enabled by the IEX Speed Bump, which gives IEX Exchange a time buffer in which to determine if a price is unstable before trades are executed.

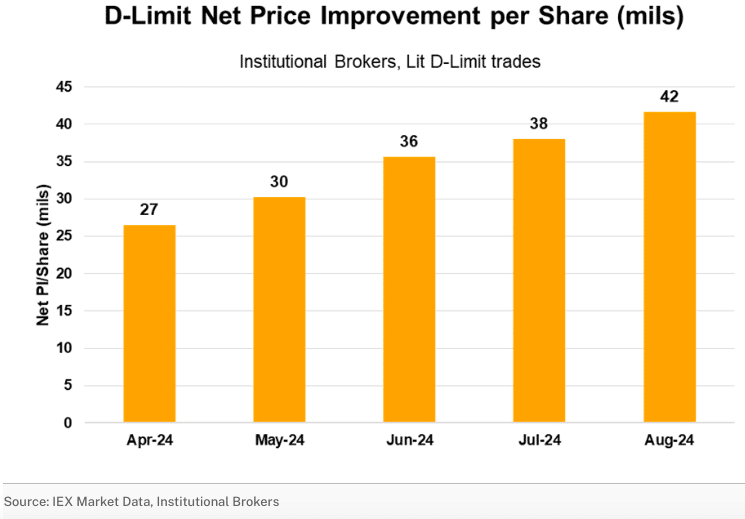

In addition, the SEC approved IEX’s Discretionary Limit, or D-Limit, order type in 2020. D-Limit protects liquidity providers from potential adverse selection resulting from latency arbitrage trading strategies, and was introduced to encourage members to submit more displayed limit orders to the exchange. D-Limit uses the power of the IEX Signal to move an order out of the way if the price is about to become imminently stale i.e. the order avoids being “run over” when the price is unstable.

IEX said in a blog in August 2024 that institutional brokers using the lit D-Limit order receive over 40 mils per share in pre-trade price improvement, which comes out to nearly 0.65 basis points across all D-Limit volume, an increase of over 50% from April 2024.

Harkins argued the displayed public market is essential in providing a healthy overall U.S. equity market.

“At IEX, we are pro-competition, and we understand the utility of off-exchange trading and alternative trading systems (ATSs), but it is very important to allow exchanges to be able to compete,“ he added.

SIFMA said the ATSs with the largest shares in the fourth quarter of last year were UBS ATS, Intelligent Cross and Goldman Sachs’s Sigma X2. IntelligentCross uses AI to optimize price discovery and matches orders near-continuously to achieve maximum price stability after trades.

“There is more innovation in how to design a market to improve outcomes and that is a great trend,” said Harkins. “We continue to be a leader in the space and welcome the competition.”

Options exchange

Harkins said: ”I think 2024 was the start of our next chapter at IEX, and we’re building from an amazing foundation.”

IEX has filed with the US Securities and Exchange Commission to expand outside equities and launch an options exchange. The new venue’s rule book has been published on the SEC website, according to Harkins.

“We continue to work with options market participants on the design of our exchange and we are knee-deep in the development phase,” Harkins added.

If IEX receives regulatory approval, it will become the nineteenth US options exchange. In August 2024 Miami International Holdings launched the newest options exchange, MIAX Sapphire electronic exchange, which will be followed by a physical trading floor this year.

Harkins said: “We can’t just clone our equities exchange, but the core focus of improving outcomes for liquidity providers by protecting against adverse selection remains.”