IEX Exchange updated ‘The Signal’, its predictive model that targets adverse price changes in April this year and has now expanded Version 6 into displayed trading.

The Signal, also known as the crumbling quote indicator, was introduced to predict which way the market will move in order to protect customers from trading at a price that will imminently become stale.

In April the new version of The Signal was introduced for D-Peg, P-Peg, and C-Peg, IEX’s non-displayed Signal-enabled pegged order types. Since 10 November 2023 version six of The Signal has applied to all D-Limit orders as a default – both displayed and non-displayed.

Ronan Ryan, president and co-founder of IEX Group told Markets Media: “We wanted to roll out version 6 of The Signal and look at adoption and how it worked in production, and the results have been great.”

The Signal would just look at quote changes on exchanges until version 5. However, version 6 also looks at the size of the quote on an exchange and when it goes down, which is important in illiquid names.

Ryan said anyone who has tested Version 6 is now using it instead of Version 5. Version 6 captures 60% more adverse moves in the NBBO (National Best Bid Offer) which Ryan described as pretty remarkable. IEX felt that displayed trading , which is 80% of exchange volume, should definitely be paired with version 6 of The Signal.

“We had run a lot of data analytics with version 6 in production showing clients how much better performance would be for displayed trading,” Ryan added. “We believe it was a wholesale positive change.”

Matt Weinberg, head of business development for IEX Exchange, told Markets Medis that the exchange was able to compare when version 5 of The Signal fired versus 6.

“It is like an Etch A Sketch toy with two knobs at the bottom for coverage, how many ticks are preceded by a signal, versus the true positive rate or accuracy, how often was the signal firing followed by a price move that it predicted within two milliseconds and you can dial up either one,” said Weinberg.

Weinberg continued that version 6 increased coverage by 40% across all spreads.

Matt Weinberg, IEX

“Once spreads are two cents or wider, performance has been 64% to 100% better in terms of coverage and size has been a big input in driving that improvement,” he added.

Version 6 was introduced as a wholesale change, which meant it did not require clients to do anything, as a lot of brokers have a tech freeze near the end of the year.

“It takes time for users to build a sample set, evaluate performance, adjust models and then reallocate,” added Ryan. “Our expectation is that we will see an improvement in the existing D-Limit performance towards January.”

Quantifying Version 6’s performance upgrade

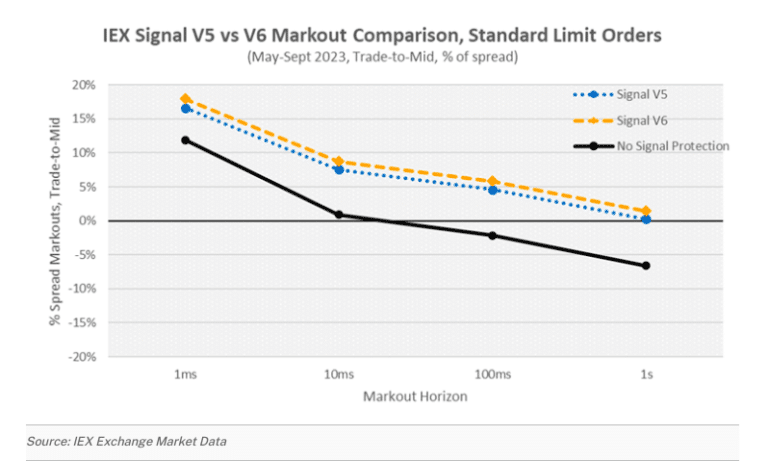

IEX said in a blog at the end of October that after 6 months of Signal V6 being available as an option for clients’ D-Peg and P-Peg orders, users saw marginal improvements in markouts while maintaining their hit and fill rates.

The production data collected over six months allowed IEX to retroactively evaluate how recent D-Limit volumes would have performed if they had also used version 6.

IEX wrote there was an incremental 11% of volume where Signal V6 is on and Signal V5 is off, compared to just 3% of volume where the opposite is true which suggests that the additional protection provided by Signal V6 is multiples of the would-be protection potentially lost by moving from Signal V5.

The production data showed that display orders executed while Signal V6 was on had strongly negative markouts.

“Clearly, this data suggests that these executions likely experienced adverse selection,” added IEX. “Therefore, Signal V6 effectively identifies additional situations when the market is unstable and likely to change, providing additional protection for displayed resting orders.”