The IMP+ACT Alliance has launched a digital tool to allow fund managers to classify the social and environmental impact of their funds after initially being developed within Deutsche Bank.

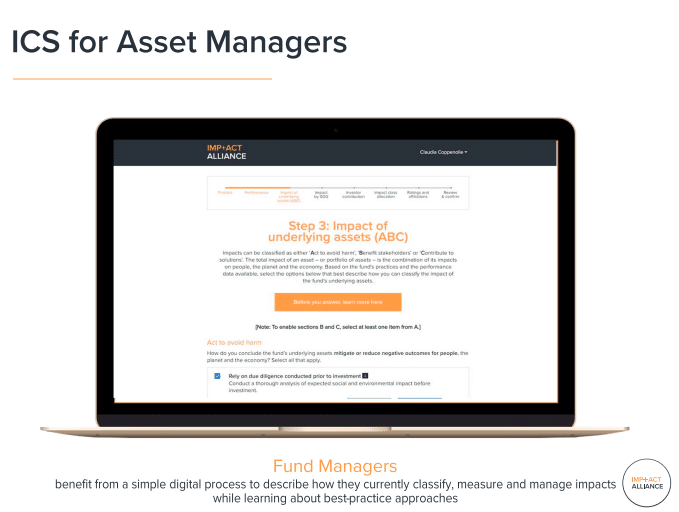

Last month the IMP+ACT Alliance launched ICS (IMP+ACT Classification System), which allows fund managers to easily input how they manage, measure and assess the social and environmental impact of their portfolios.

Claudia Coppenolle, co-founder and chief executive of the IMP+ACT Alliance, told Markets Media that before starting IMP+ACT Alliance she had worked at Deutsche Bank for ten years looking at the impact of fintech on the bank and its clients.

In 2018 she took part in the intrapreneur programme at Deutsche Bank which allowed employees to submit ideas for development and IMP+ACT Alliance was spun out last year with additional funding from the City of London Corporation.

Coppenolle said: “From idea to development it was 18 months, as we worked with over 150 organisations including asset managers, asset owners, other tech providers, academia, non-governmental organisation and government bodies on the concept of the underlying logic and process to ensure it meets the market where it is today.”

She added that as part of the testing ICS has 32 funds publicly classified, across 22 asset managers. ICS is a global offering and funds have been classified from the US, Europe, Africa and New Zealand. For example, the platform represents 30% of managers in the leading US network for private capital impact managers, Impact Capital Managers.

Ben Constable-Maxwell, head of sustainable and impact investing at M&G, said in a blog that the fund manager is developing new performance indicators to gauge the impact of companies on society. He gave the example of a healthcare investment where the manager would analyse positive health outcomes rather than just drug sales.

"To understand the social and environmental impact of their portfolios, investors need fund managers to use a common language" read how Ben Constable-Maxwell from @mandgplc thinks the @alliance4impact ICS platform can help the #investment community https://t.co/1hoxXS9BOT pic.twitter.com/BBUSx5XANd

— IMP+ACT Alliance (@alliance4impact) June 30, 2020

Constable-Maxwell wrote: “ICS can help fund managers like M&G clearly communicate differences between their investment approaches. M&G has already trialled the platform on its Positive Impact Fund and is looking to roll it out across other funds in its ESG/sustainable fund range and beyond.”

M&G launched an Impact Financing Fund in 2017 and a Positive Impact Fund investing in global listed equities the following year.

He continued that ICS encourages transparency and comparability of the impact of different investment products and can ultimately help scale up the impact achieved. “It can also help investors segment their portfolios to understand which funds are aligned with their sustainable investment goals,” he added.

Fund managers self-report to ICS using the data they select, although the platform will show a link to the data, without collecting the underlying data itself.

A questionnaire walks the fund manager through how to interpret this data using set guidelines to reach a self-classification against the impact classes and they receive a classification statement to show to investors and asset owners. The process can be as quick as 15 or 30 minutes.

Coppenolle said: “The ICS therefore encourages consistency through the classification, whilst remaining agnostic to the specific data sources used.”

Impact classes are a concept that are already used by many practitioners and provide a matrix framework for different kinds of impact for investments across asset classes. Coppenolle gave the example of PGGM, the Dutch pension fund, which classified its €220bn portfolio according to impact classes, although this had been a manual process rather than using a digital tool like ICS.

As asset managers are self-reporting on ICS there could be concerns about ‘greenwashing’.

Coppenolle explained that ICS enables fund managers to self-report while pointing and linking to where the fund has been independently assured against publicly available standards and to the data and metrics.

“That way investors can get an initial understanding where funds have decided to provide investors with the additional level of confidence connected with these processes and assurance,” she added. “We think this is an interim step until the market moves towards globally accepted standards for measuring, managing, and reporting social and environmental impact.”

We’re delighted to be supporting this initiative from @alliance4impact. It will increase transparency and help investors identify funds that are socially and environmentally responsible. We hope it will help to catalyse ESG and impact investing in the UK and beyond. https://t.co/bmiEOehq1r

— Catherine McGuinness (@City_McGuinness) June 24, 2020

The IMP+ACT Alliance is a public-good technology initiative, sponsored by the City of London Corporation, Deutsche Bank and the Impact Management Project. Strategic partners, among others, including the UK Impact Investing Institute, Toniic and the Make My Money Matter campaign.

As ICS is designed to encourage transparency the information in intended to be kept publicly available and not have barriers that might limit flow of information. So the alliance is connecting with other platforms, for example, Toniic Tracer and Impact Agora, and aiming to integrate the ICS process into existing tools used for portfolio analysis and construction.