The U.S Securities and Exchange Commission said in a statement on 17 September 2025 that it had voted to approve proposed rule changes by three national securities exchanges to adopt generic listing standards for exchange-traded products that hold spot commodities, including digital assets.

Spot crypto ETPs are currently approved by the regulator on a case-by-case basis, which can be a lengthy process. Under generic listing standards, SEC approval is virtually guaranteed as long as a filing meets the stated requirements, so approval should take less than 75 days.

Jamie Selway, division of trading and markets director at the SEC, said in the statement: “The Commission’s approval of the generic listing standards provides much needed regulatory clarity and certainty to the investment community through a rational, rules-based approach to bring products to market while ensuring investor protections.”

Alex Thorn, head of firmwide research at digital asset firm Galaxy, said:

we wrote a big report about this 3 weeks ago: which coins might get through, what the implications are, what additional standards they might adopt https://t.co/ViiGynfVIu

— Alex Thorn (@intangiblecoins) September 17, 2025

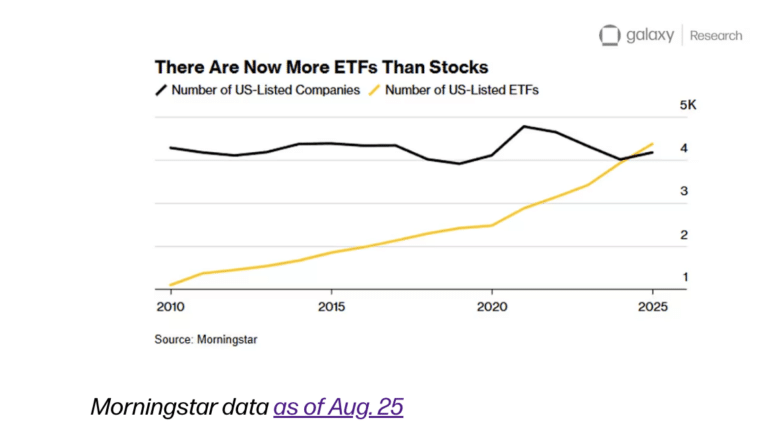

Thorn said in a report that the need for a fast-track process for crypto ETFs follows the precedent in traditional equities. The SEC adopted the “ETF Rule” in September 2019, which he said “transformed” the market.

“Previously, ETF sponsors had to apply for and receive case-by-case exemptions, a process that could take months or even years, exactly where the crypto ETF industry finds itself today,” he added. “The ETF Rule dramatically reduced the time and cost associated with launching ETFs.”

As a result, there are now more ETFs listed than individual stocks.

Matt Hougan, chief investment officer of crypto asset manager Bitwise, agreed in his CIO memo that that the adoption of generic listing standards is likely to usher in a “ton of new crypto ETPs.”

Hougan said: “We should see dozens of single-asset crypto ETPs and the rise of index-based crypto ETPs, and I suspect we’ll see many—if not most—traditional asset managers launch spot crypto ETPs as well.”

He described the SEC adopting generic listing standards as a “coming of age” moment for crypto. Hougan said it is a signal that “we’ve reached the big leagues. But it’s also just the beginning.”

Eric Balchunas, senior ETF analyst at Bloomberg, said:

This is such a good point. The last time they implemented a generic listings standards for ETF, launches tripled. Good chance we see north of 100 crypto ETFs launched in the next 12mo. https://t.co/5sxMKL9FEE

— Eric Balchunas (@EricBalchunas) September 17, 2025

Here's a list of all the coins that have futures on Coinbase = eligible for spot ETF-ization pic.twitter.com/8hIo95GebT

— Eric Balchunas (@EricBalchunas) September 17, 2025

Should be interesting to see whether investors want the xth most popular cryptocurrency in an ETF. Pretty steep drop-off in interest from bitcoin to ETH

— Bryan Armour (@MstarArmour) September 17, 2025

Jake Chervinsky, chief legal officer at early-stage crypto fund Variant, said:

The approval of generic listing standards for spot crypto ETPs is a huge deal.

It’s the end of an era where the SEC allegedly “protected investors” by denying them access to products they wanted on the venues they preferred.

This SEC continues to knock it out of the park 👏 https://t.co/ZwhnoRqVMM

— Jake Chervinsky (@jchervinsky) September 17, 2025

With the SEC’s new general listing standards, many more (though not all) crypto assets will have spot ETPs trading on securities exchanges.

This raises the bar for DATs, which are less efficient for exposure to the underlying than ETPs.

DATs must do more than passive holding.

— Jake Chervinsky (@jchervinsky) September 18, 2025