CME Group is launching options on solana and XRP futures on 13 October 2025 after average daily volume in cryptocurrency derivatives reached a record in the third quarter of this year.

The group reported record cryptocurrency average daily volume for the third quarter of this year of 340,000 contracts, or $14.1bn notional. Micro ether futures had record average daily volume of 209,000 contracts and ether futures had record average daily volume of 236,000 contracts.

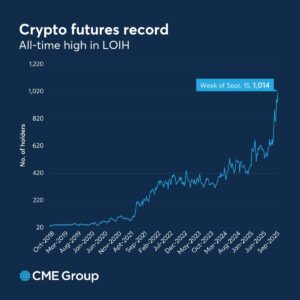

Giovanni Vicioso, global head of cryptocurrency products at CME Group, told Markets Media that open interest in the crypto complex has also risen, with notional open interest reaching a record $39bn on 18 September 2025.

September's Crypto futures and options highlights. 📈

→ Crypto options daily OI reached a record $7.1B.

→ 1,014 large open interest holders.

→ SOL futures hit $2.1B notional OI, becoming the fastest contract to double OI past $1B.

→ Ether futures suite set a daily average… pic.twitter.com/Kgpwq3Qkek— CME Group (@CMEGroup) October 3, 2025

Vicioso said growth in institutional interest in crypto can be seen in the increase of large open interest holders, which reached an all-time high exceeding 1,000 contracts. Large open interest holders are entities holding more than 25 contracts, a position worth more than $14m in notional in bitcoin, $5m in ether and $3m in solana and XRP.

CME’s cryptocurrency futures and options will be available to trade 24 hours a day, seven days a week beginning in early 2026, pending regulatory review.

Options on Solana and XRP futures

Vicioso said the firm is “super excited” about options on Solana and XRP futures going live on 13 October 2025. Clients will have the ability to trade options on solana, micro solana, XRP, and micro XRP futures, with expiries available every day of the business week, every month and every quarter.

Joshua Lim, global co-head of markets at market maker FalconX, said in a statement that the rise of digital asset treasuries and other access vehicles for crypto has only accelerated the need for institutional hedging tools on solana and XRP.

“The futures are relatively new but we have seen very strong pickup in terms of both institutional and retail interest for those products and we feel the market can support interest in options,” Vicioso added.

More than 370,000 XRP futures, $16.2bn in notional, have traded since they launched on 19 May this year. Solana futures launched in March this year and are available in a large- and micro-size. The solana futures crossed $1bn in open interest on 22 August according to Vicioso, and exceeded $2bn just 18 days later

“This makes it the fastest contract to double in open interest after crossing the $1bn mark,” he added. “This points to rising institutional interest.”

There are 40 large open interest holders, which Vicioso said indicates that institutions are moving beyond bitcoin. One reason for the increased interest in solana, according to Vicioso, is the passage of the GENIUS Act as ethereum and solana blockchain networks are used to mint stablecoins.

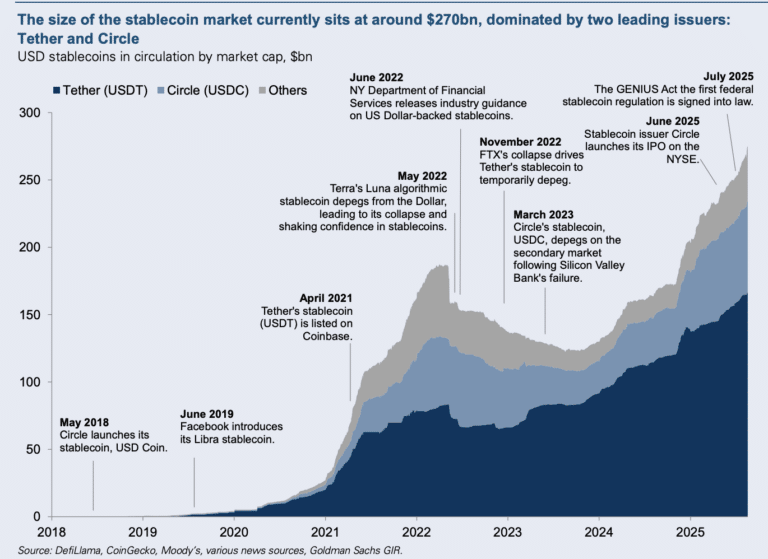

The GENIUS Act was signed into U.S. law in July this year and provides the first federal framework for stablecoins. Stablecoins are digital currencies on blockchains which are designed to maintain a stable value, typically pegged one-to-one with conventional fiat currencies, most commonly the US dollar. In contrast, the value of other cryptocurrencies is determined by the supply and demand of the coins.

Goldman Sachs said in a report that it has been the “summer of stablecoins.” The bank said that in addition to the passage of the GENIUS Act, major companies are exploring launching their own stablecoins and Circle, issuer of the USDC stablecoin, went public in June this year.

On 9 October 2025 Citi Ventures said in a statement that it has invested in BVNK, the global stablecoin infrastructure platform which has also had recent backing from Visa, Haun Ventures and Tiger Global. BVNK’s platform processes over $20bn annually for global enterprises and payment service providers according to the statement.

Arvind Purushotham, head of Citi Ventures, said in a statement: “Stablecoins are seeing increased interest in use for settlement of on-chain and crypto asset transactions.”

Crypto indices

CME Group, in partnership with CF Benchmarks, the cryptocurrency benchmark indices provider, also has a suite of crypto reference rates and real-time indices. For example in June this year CME and CF Benchmarks launched four new cryptocurrency reference rates and real-time indices for arbitrum, ondo, NEAR and sui.

Vicioso said the CME’s crypto indices cover about 96% of the investable market and the firm is seeing greater interest for futures on a basket of cryptocurrencies.

“We could also introduce additional single coin futures, dependent on client demand and further regulatory clarity,” he added.

He continued that CME is the only exchange to offer perpetual-like products for equity index contracts.

“Crypto participants familiar with trading perpetuals now have the ability to trade similar products on a regulated exchange, with the added benefit of cross-asset diversification between our crypto and equity Spot-Quoted futures products,” he added. “We have crossed $500m in notional traded across all six contracts.”

Spot-Quoted futures launched in June this year and allow investors to trade futures positions in spot-market terms (i.e., the price quoted on screen on financial media and investment sites) in bitcoin and ether, and across the four major U.S. equity indices, including the S&P 500, Nasdaq-100, Russell 2000 and Dow Jones Industrial Average. Investors can hold these contracts for up to five years, without having to roll positions frequently.

Tim McCourt, global head of equities, FX and alternative products at CME Group, said in a statement: “In response to growing retail demand for smaller-sized, longer-duration products, these capital-efficient contracts – designed with similar features of perpetual contracts – will provide greater precision and market accessibility to clients.”