Integral, which provides cloud-based foreign exchange and digital asset technology, said it has launched the first stablecoin-based crypto prime brokerage to provide institutional-grade credit, trading, and net settlement in an integrated platform.

In foreign exchange, Integral already provides front office capabilities. In addition prime brokers provide credit and clearing and CLS, which was created by market participants, provides netting and settlement.

However Harpal Sandhu, chief executive of Integral, told Markets Media that this integrated ecosystem does not exist in the crypto market. Therefore, Integral launched PrimeOne in beta six months ago. The crypto prime brokerage service has been built on the CoDEX blockchain which Sandhu said is Ethereum compatible, and a high performance, high volume and low cost protocol.

“PrimeOne is to traditional prime brokers as Uber is to traditional taxis,” Sandhu added. “It is a platform which connects all market participants with each other and is cheaper, faster and easier to use.”

The critical role of prime brokerage in solving the market’s fragmentation problem was highlighted in a panel at the Digital Asset Summit 2025 in London in October. The panel was moderated by Melvin Deng, chief executive of QCP, and the Singapore-based market maker in digital asset derivatives,

QCP said in a blog: “The recent market crash served as a case study, where liquidity dried up not due to risk aversion, but because assets were physically stranded on multiple exchanges. Effective prime brokerage, built on robust balance sheets and modern tech, is the key to unlocking this trapped capital and ensuring liquidity during stress.”

Sandhu argued that PrimeOne has been designed using onchain infrastructure and stablecoins in order to be able to offer credit without a balance sheet. In traditional finance, prime brokers calculate collateral requirements based on the volatility of the asset and the time to deliver additional margin, which Sandhu dubbed “T+1 day,” the day after a trade. In contrast, PrimeOne uses stablecoins for variation margin, which can be delivered 24/7 and almost immediately after a trade, which Sandhu described as “T+1 minute.”

Scott Moegling, head of business development for digital assets at market maker Virtu Financial, said in a statement: “PrimeOne will enable investors access to greater competitive pricing with less risk, unlocking significant growth potential for crypto trading on the platform.”

In order to trade, clients have to pass Integral’s know your customer (KYC) / anti-money laundering (AML) checks and then set up a funding wallet, for which they control the keys. As a result, PrimeOne allows clients to trade with crypto market makers and exchanges through a single account, which eliminates the need to maintain separate relationships across venues.

In order for a client to trade, they transfer funds from their funding wallet to a margin wallet which instantly enables credit and allows transactions. As clients trade and their positions change in value, US dollar stablecoin-based margin automatically moves between counterparties’ wallets in real time, which Sandhu said virtually eliminates counterparty credit risk. Trading limits are dynamically set based on margin balances held by PrimeOne participants – if they do not have margin balances, they do not see prices and cannot trade.

Sandhu added that Integral holds reserves for the stablecoin in a U.S. bank account, with the notional values published every 10 minutes. Integral also intends to become a stablecoin issuer under the GENIUS Act, the U.S. legislation passed in July which provides a federal framework for stablecoins.

Disruption

JM Mognetti, co-founder and chief executive of CoinShares, the digital asset fund manager, said in a report that adoption of digital assets will be the story for 2026.

“A financial system does not change because prices move,” he added. “It changes because products become useful at scale.”

In 2026 Mognetti expects payment companies, fintechs, and banks to expand stablecoin settlement, custody, and trading services. He said: “These developments may be gradual, but they are structural. Once embedded, they do not reverse easily.”

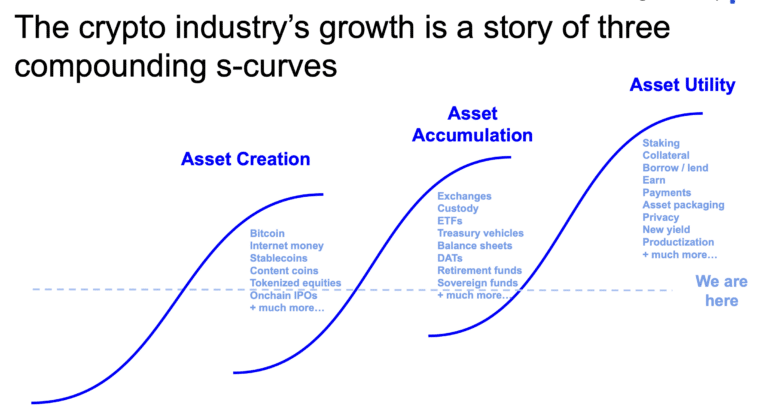

Alana Levin, investment partner focusing on infrastructure at Variant Fund, said in a report that the crypto industry is in phase three of growth i.e. utilization. She described crypto assets as the most composable, accessible, and programmable financial assets that have ever existed and said a number of robust use cases have begun to emerge including stablecoin payments and providing liquidity to onchain exchanges.

“Yet we are still at the very early innings of the different ways in which tokenized assets can and will be used; we have barely begun to climb the s-curve,” she added. “I see the design space for expanding and enabling greater asset utility as some of the largest and most exciting blue ocean opportunities over the coming years.”

Integral has over 250 institutions operating their foreign exchange businesses on its cloud-based FX platform and trade more than $100bn in a day, according to Sandhu. He said Integral clients surpassed $2 trillion in FX trading volume during the month of October.

Sandhu believes the FX will eventually move onchain. He added: ”We are in business to serve our customers and, as market structure evolves, if we don’t disrupt our own technology offering to meet these changing needs, someone else will.”