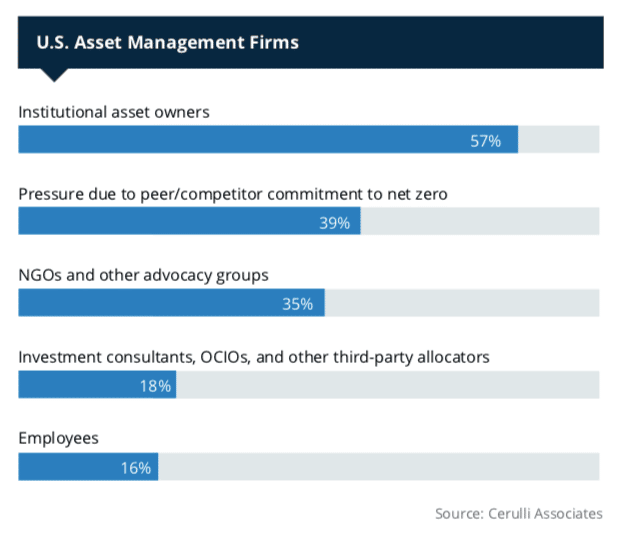

The majority of US asset managers, 57%, said pressure to turn net zero pledges into action comes from asset owners according to a white paper from research provider Cerulli Associates.

Cerulli’s paper, Net-Zero Investment, said institutional asset owners globally are making a formal commitment to net zero: 43% in Europe, 44% in Asia, and 32% in the US.

“As they implement measures to achieve this commitment, they will increasingly evaluate portfolio-level metrics,” added Cerulli.

In Europe nearly all, 80%, of institutional investors request data on their exposure to energy transition risks and physical climate risks and 61% request the carbon footprint of their portfolios. In the US, asset owners increasingly plan to embed climate risk into mandates. Currently one third, 38%, of firms already require climate risk reporting from managers and 34% plan to within two years.

“Over the next 12 to 24 months, asset managers should anticipate a strong uptick in interest in measuring portfolio temperature,” said Cerulli.

However, Cerulli highlighted that sourcing data remains an obstacle. As a result Cerulli expects fund managers, especially those in Europe, that offer strong expertise in climate risk assessment and reporting will be well positioned.

“Such tools will be highly sought after by European institutional investors that are increasingly focused on scenario analysis and stress testing,” said the report.

SEC proposal

In order to help improve data the US Securities and Exchange Commission proposed new reporting requirements in March this year on greenhouse gas emissions for certain public companies in their registration statements and annual reports.

“The agency notes that it aims to compel firms to provide not only physical risk but also steps companies are taking to lower GHG emissions,” said Cerulli. “As the proposal stands at the time of this writing, the SEC’s language includes explicit net zero targets.”

The SEC has received approximately 11,000 comments on the proposal, which is far more than usual, according to ISS Corporate Solutions’ paper SEC Climate Disclosure Comments Reveal Diversity of Views.

ISS, which provides corporate governance and responsible investment data and analytics, said: “Our analysis shows that while there was overwhelming investor support for climate disclosure regulation in general, comments diverge significantly on the recommended regulatory path ahead.”

The comment period closed in June and the SEC has indicated it will release the final rules before the end of 2022.

Posted: SEC Climate Disclosure Comments Reveal Diversity of Views, https://t.co/QUb7Go1pNf @issgovernance #corpgov #ESG #ClimateDisclosure

— Harvard Law School Program on Corporate Governance (@HarvardCorpGov) August 31, 2022

There was significant support for alignment with Task Force on Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB), International Sustainability Standards Board (ISSB) disclosure frameworks among both investors and corporations in the comments according to ISS.

“California public pension fund CalSTRS said these guidelines and standards should form the foundation of the proposed rules, and asset manager Allianz Group said that alignment would be particularly useful for international comparisons,” added ISS.

Fidelity Investments also asked that foreign issuers filing reports in the US be allowed to follow ISSB standards.

Cerulli added that the TCFD framework’s implied temperature rise measure is likely to become the default metric for measuring a manager’s portfolio temperature. The report said: “An alliance of investors with more than $5 trillion in combined assets under management backs this metric.”

SFDR

In the European Union, the Sustainable Finance Disclosure Regulation (SFDR) came into force in 2021 and requires asset managers to use a uniform set of reporting standards to disclose the impact of their portfolios.

Half, 51%, of institutional investors surveyed by Cerulli in 2021 have between 50% and 75% of their portfolio in non-ESG funds. However, only 2% plan to allocate between 50% and 75% of their portfolio to non-ESG strategies during the upcoming year.

Cerulli finds that the carbon footprint of investment portfolios is more commonly requested than transition and physical #climaterisk analysis by French (75%) and Dutch (70%) #institutionalinvestors than their Italian counterparts (47%). Download?: https://t.co/9WWKrER9wX pic.twitter.com/2sh0nc2UhR

— Cerulli Associates (@cerulli_assoc) August 30, 2022

“Cerulli expects SFDR will spur a significant re-allocation of investors’ portfolios into Article 8 and Article 9 strategies,” said the report. “Thus, firms managing Article 8 or 9 funds will have a clear advantage going forward.”

Article 8 funds are defined as those that promote environmental or social characteristics. The funds must invest in companies that “follow good governance practices” but are not required to have an objective specifically aimed at an environmental or social issue.

Article 9 funds must have clearly defined sustainability objectives such as reducing carbon emissions, with an index designated as a reference benchmark.

Cerulli said: “SFDR is likely to be a chief driver of progress toward the broader global investment community’s net zero objective.”