JP Morgan Asset Management is reviewing how to expand in private credit, as fund managers have grown the most in private assets over the last few years.

Daniel Pinto, president and chief operating officer of JPMorgan Chase, said the firm has an asset management business that is a “fantastic” franchise with “amazing” growth. He spoke at the Barclays Global Financial Services Conference in New York on 10 September.

“We have a great franchise in real estate and in infrastructure,” Pinto said. “We have been analyzing what is our way into the private credit space.”

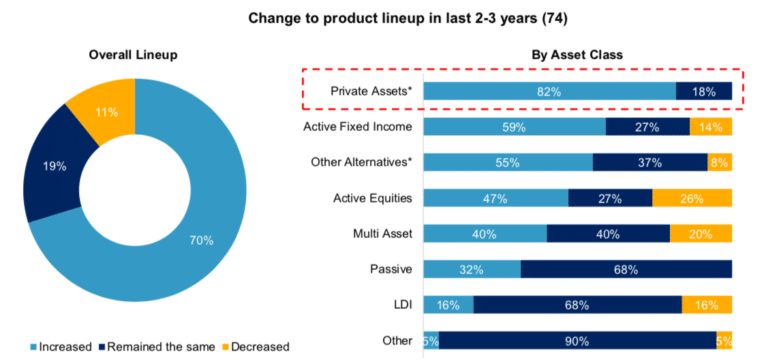

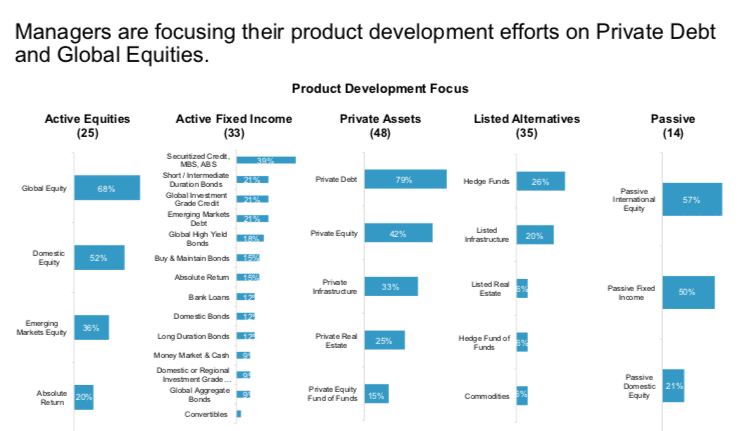

Over the last few years, asset managers have made the greatest expansion in private assets, according to a report from Coalition Greenwich.

The consultancy said in the report: “Looking ahead, managers remain bullish on this asset class with 84% expecting their private asset product lineup to increase.”

For example, AXA IM Alts, which has over €18bn of assets under management said in a statement in August 2024 that it was increasing its position in CAPZA from majority shareholder to full ownership by 2026. CAPZA is a private investment platform focused on mid-market corporates across private debt and private equity in EMEA with more than €9bn of assets under management.

The statement said the acquisition provides AXA IM Alts with global expertise in mid-market direct lending, which is highly complementary to its existing private debt offering, alongside entry into the private equity leveraged buyout market, a growth sector of strategic importance.

In asset management, JP Morgan has been expanding in exchange-traded funds. Pinto described the bank as being “a bit late to the party” in ETFs because it took time to choose the right strategy, as the business was not going to compete with franchises such as BlackRock’s iShares.

“Today, we have the most successful managed ETF platform and that was built organically,” he added. “There are opportunities in ETFs but you need to be smart about it, rather than trying to be everything for everyone.”

In August this year JP Morgan Asset Management said in a statement that it had appointed Travis Spence as global head of ETFs. Spence had previously been head of EMEA ETF distribution at the firm since 2023.

ETFs are projected to have double-digit growth to reach $35 trillion by 2035, with active ETFs expected to grow at twice the rate of the overall ETF industry, according to the statement. JP Morgan Asset Management said that over the past decade its global ETF platform has expanded to nearly $190bn across more than 100 funds, positioning the firm as the second-largest in active ETF assets and eighth overall in ETF assets

Commercial and investment banking

In January this year JP Morgan combined its wholesale businesses – global investment banking, commercial banking, corporate banking, markets, securities services and global payments – into the commercial & investment bank division, led by Troy Rohrbaugh and Jennifer Piepszak.

Pinto said the businesses were very successful as separate units but the bank had been discussing the right time for the combination over several years.

“We wanted to be sure we had the correct focus on different client segments,” he added. “We didn’t want to be distracted by the large clients and not pay attention to the middle market, which is a huge opportunity.”

Putting the businesses together has also provided more effective ways to cover the high end of the middle market outside the United States. Pinto said: “It makes all the sense in the world.”

In the markets business, JP Morgan has a market share of 12.3% between fixed income and equities according to Pinto. He said the bank has lost some share in fixed income in the last three or four years, as some marginal players have increased their share as the wallet has grown. In contrast, in equities the bank has been gaining market share and is currently ranked number one according to Pinto.

The bank will continue to invest in the markets franchise, because there is a strong belief that the wallet will consolidate. Pinto explained that the overall wallet has been stable for the last two or three years, but it is a low-return proposition unless banks have scale.

“As the world stabilizes, the wallet will consolidate towards the top five to 10 players,” added Pinto.

For the third quarter, Pinto expects investment banking to have a solid quarter, with revenues around 15% higher than the third quarter of 2023. He said debt capital markets had a very strong performance, with volumes in institutional loans and leveraged loans almost doubling over that period due to refinancings

M&A volumes in the third quarter were flat year-on-year and markets revenues were slightly positive, approximately 2% higher in the same period, mainly driven by equities trading.

Technology

Pinto continued that the group’s agenda continues to be focussed on technology and artificial intelligence. The firm is in the process of modernizing its technology stack to make it more efficient, migrating to the cloud, moving to new data centers, redesigning applications and having a technology stack that is smaller and more efficient.

“Artificial intelligence will be very transformational,” he added. “Last year we saw a benefit related to the deployment of AI of between $1bn and $1.5bn.”

This year, he expects that benefit to move towards $2bn, much of that related to fraud prevention. Pinto predicted that every process within the firm will eventually be optimized using AI and large language models.