KCx, the execution services division of independent European broker Kepler Cheuvreux, accelerated the development of its trading technology stack by using historical data from BMLL to build a new smart order router.

The firm is building KCx Omni, an advanced event-driven equities trading system. The first phase was to implement KCx Spark, a new smart order router designed to intelligently access the right liquidity across fragmented European markets to ensure best execution.

Robert Miller, head of market structure & liquidity solutions at Kepler Cheuvreux, told Markets Media that buy side, sell side, and exchanges are now far more focused on the execution experience: what information you have at the point of execution, how you execute, and the resulting impact on orders. Trading in one venue versus another offers a completely different experience.

“As curators of liquidity, we must know exactly when and where to engage specific liquidity pools,” Miller added. “That’s why we rely on historical Level 3 data through our partnership with BMLL.”

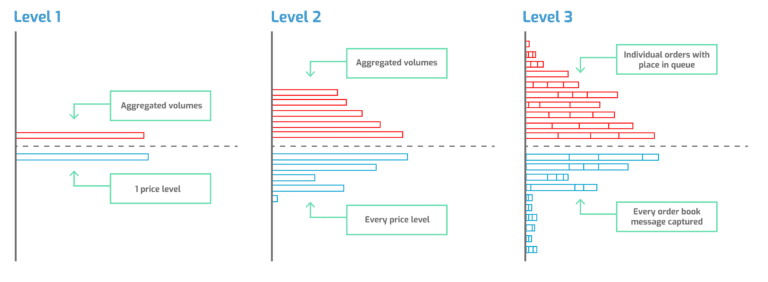

Level 3 Data captures and displays the trading intentions of all market participants. BMLL collects raw exchange data directly from trading venues and presents it in a globally harmonized and normalized format and also provides access to the BMLL Data Lab, a cloud-based Python environment containing a library of custom-built APIs for large- scale market structure research and algorithm back-testing.

Paul Humphrey, chief executive of BMLL, described this as a new paradigm for supplying market data. He told Markets Media: “We are taking historical data, which was traditionally the exhaust of the industry and turning it into the best quality pre-trade data.”

Humphrey argued that this provides an opportunity for firms like Kepler to be more dynamic when it comes to competing with the bulge brackets.

“They can skip the landline phase and go directly to mobile,” he added.

Miller highlighted that building and maintaining the infrastructure to store massive data volumes would be enormously complex and costly, especially since data classifications are always changing. He said: “With BMLL handling that for us, we never have to pause to reengineer our data systems.”

Elliot Banks, chief product officer at BMLL, told Markets Media that exchanges make upgrades all the time by adding new order types, different trading mechanisms or more trading flags. Firms then have to go through all their history to make sure it is still consistent.

“The whole point of BMLL is to provide curated, easy to use, harmonized data,” added Banks. “A firm like Kepler doesn’t want to focus on collecting and cleaning data but wants to focus on value added analytics.”

Kepler has also joined BMLL’s products advisory board, which allows the buy and sell side to help guide the direction of the firm’s data.

Banks said: “The purpose of BMLL is to make sure market participants do not have to worry about data and can spend their time focusing on their value, such as their smart order routers or capturing alpha.”

Growth

KCx Spark has gone live and features a new dark-order placement model powered by BMLL data. The new smart order router is now much faster, allowing the firm to tap into more liquidity and choose the optimal venue for each strategy according to Miller. He said Kepler’s market share has risen significantly this year.

“We’re on the radar of many buy-side firms and continue to win new business,” added Miller. “We’re steadily expanding KCx Omni and staying agile with new models and workflows.”

Humphrey is bullish on the market share of firms like Kepler because he believes they can be more dynamic in their infrastructure decisions. He argued that it used to be a unique selling point to own data, but BMLL has democratized ownership. Therefore, firms can differentiate themselves on what they do with the data.

“We have had a fantastic relationship with Kepler Cheuvreux since 2022 and we like to think that we played our part in watching their fantastic growth,” said Humphrey. “Hiring BMLL means brilliant people at Kepler Cheuvreux can spend more time being brilliant on innovation, rather than doing the boring data crunching.”