Kinexys by J.P. Morgan, the bank’s blockchain business unit, has launched a permissioned US dollar deposit token, another form of digital money that could become the “new institutional default.”

Jason Barraza, chief operating officer at Security Token Market, said in a newsletter that Kinexys filed for a trademark application for a JPMD, a tokenized deposit token on the Base blockchain.

By leveraging a public blockchain, JPMD can offer an attractive alternative to stablecoins for clients seeking reliable liquidity and seamless integration with traditional banking systems.

This move will help accelerate digital asset adoption by bringing trusted financial rails…

— Coinbase Institutional 🛡️ (@CoinbaseInsto) June 17, 2025

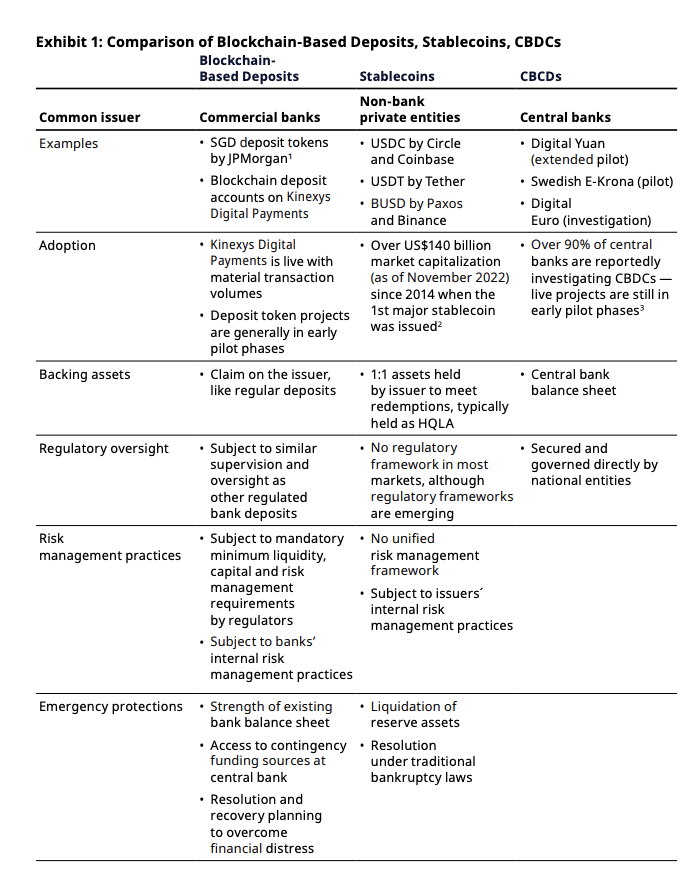

Consultancy Oliver Wyman and Kinexys by JP Morgan highlighted the difference between blockchain-based deposits, stablecoins and central bank digital currencies (CBDCs) in a report on deposit tokens. Distributed ledger-based deposits issued by a licensed depository institution, including deposit tokens, are forms of commercial bank money.

Stablecoins are digital assets designed to maintain a stable value relative to an external reference asset, such as a fiat currency, and serve as an alternative store of value for blockchain-native payments and liquidity needs. They are backed by pooled currency reserves or other high-quality liquid assets held in financial institutions, such as short-term Treasurys , and can be issued by firms other than banks. CBDCs are digital forms of national currencies issued by central banks.

Barraza said JPMD represents commercial bank money, i.e. existing deposits at the bank. He added: “They’re a bank… they don’t have to have it 1:1 backed, they just need the fractional reserves to meet required deposit thresholds meaning it’s a lot more scalable.”

In addition, deposit tokens could potentially pay interest, which regulated stablecoins cannot do.

“This announcement is going to once again drive internal pressure for stablecoin and yieldcoin issuers, but especially for other banks as J.P. Morgan slowly moves out of their private ecosystem and into the public one for commercial use,” Barraza added.

The token will be permissioned for institutional clients to use cross-border transactions within the regulated banking framework. There will be an initial transfer to Coinbase during this pilot with the potential for a multi-currency rollout pending regulatory approval, according to Barraza.

“Will deposit tokens become the new institutional default, or will stablecoin issuers respond with higher yields, increased transparency, and other utility to win some clients over?” he asked.

As deposit tokens are commercial bank money embodied in a new technical form, they are subject to commercial bank and regulation, including existing bank minimum capital and liquidity requirements, as well as risk management and compliance expectations associated with deposit-taking and related bank activities. The report highlighted that tokens allow instant atomic settlement, on-chain delivery versus payment if specified criteria are met to speed up transactions, automated payment operations and can operate 24/7.

“This integration with the traditional financial system will also enable deposit tokens to be used for complex, institutional use cases where the transaction party desires a high level of assurances, customer service, and protections from the issuer, or where the transaction itself requires integrations with other financial services,” said the report.

Deposit tokens are also better for certain smart-contract protocols than account-based deposits. The report highlighted a pilot transaction which was part of the Monetary Authority of Singapore’s’ Project Guardian to execute a foreign exchange transaction involving Singapore dollar deposit tokens issued by J.P. Morgan and a Japanese Yen tokenized asset issued by SBI Digital Assets.

They could also increase the efficiency of trading and settlement of tokenized assets on blockchains and be a new way to provide cash collateral for both traditional and digital assets markets, including providing intraday liquidity, by enabling collateral to move in real time.

“Deposit tokens are well positioned to help the digital money landscape stabilize and mature,” said the report. “Accordingly, they merit separate consideration by banks looking to innovate, regulators looking to establish appropriate regulation that shape this evolving space, and the broader set of participants in the financial system looking to interact with digital money.”

Stablecoins

On 17 June 2025 the United States Senate passed the bipartisan Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, which provides a regulatory framework for payment stablecoins,

Will Peck, head of digital assets at WisdomTree, the U.S. asset manager, said in an email that the legislation supports the increased investor appetite for better access and connectivity for tokenized assets.

These advancements and growing legislative momentum are powerful signals that tokenization is not just the future of finance—it’s happening now,” Peck added. “We look forward to seeing how this legislation progresses.”

WisdomTree has over $347m in tokenized assets under management WisdomTree Prime, a personal finance app for retail investors, and WisdomTree Connect, an institutional platform. WUSD, WisdomTree’s stablecoin, is the U.S. dollar payment rail on WisdomTree Prime and WisdomTree Connect.

Yuval Rooz, chief executive and co-founder at Digital Asset, said in an email that the Act provides banks with a clear framework to confidently engage with stablecoins.

“These guardrails boost regulatory and institutional trust, expanding the reach of secure, dollar-backed digital currencies across both retail and institutional markets,” Rooz added. “As adoption continues to accelerate, we must also prioritize authority, control, and privacy. These aren’t optional features; they are foundational to institutional trust.”

Alex Thorn, head of firmwide research at digital asset firm Galaxy Digital, said in a note that J.P. Morgan’s announcement of a tokenized deposit pilot was surprising given the passing of the GENIUS Act. He highlighted that a tokenized deposit is an IOU for a bank deposit in token form and so, presumably, can only be transferred among the bank’s account holders, while GENIUS stablecoins can be transferred to any non-blacklisted address.

Thorn argued that bank deposits are riskier than 1:1 collateralized stablecoins because all banks do not have the same risk of default.

“A future in which each bank issued deposit tokens would be much closer to the 1830s ‘wildcat banking’ era endlessly trotted out by stablecoin critics,” he added. “In reality, GENIUS stablecoins will adhere to a single, rigid federal standard, making them highly fungible among issuers.”

As a result, regulators may determine that tokenized deposits must be treated in the same way as regulated stablecoins. Thorn said authorities are not going to let J.P. Morgan’s tokenized deposits compete with the regulated stablecoins.

“It probably won’t come to that, though, because while tokenized deposits and bringing “commercial bank deposits” onchain might sound plausible and reasonable, they are unlikely to be widely adopted in the permissionless market of public blockchains,” said Thorn. “For all we know, J.P. Morgan may even know this, and is simply timing an innovation announcement to capitalize on stablecoins’ big moment.”

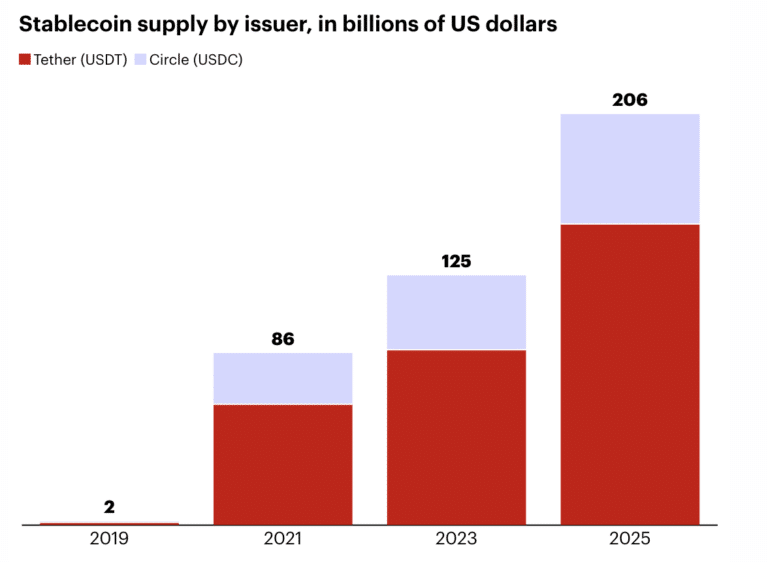

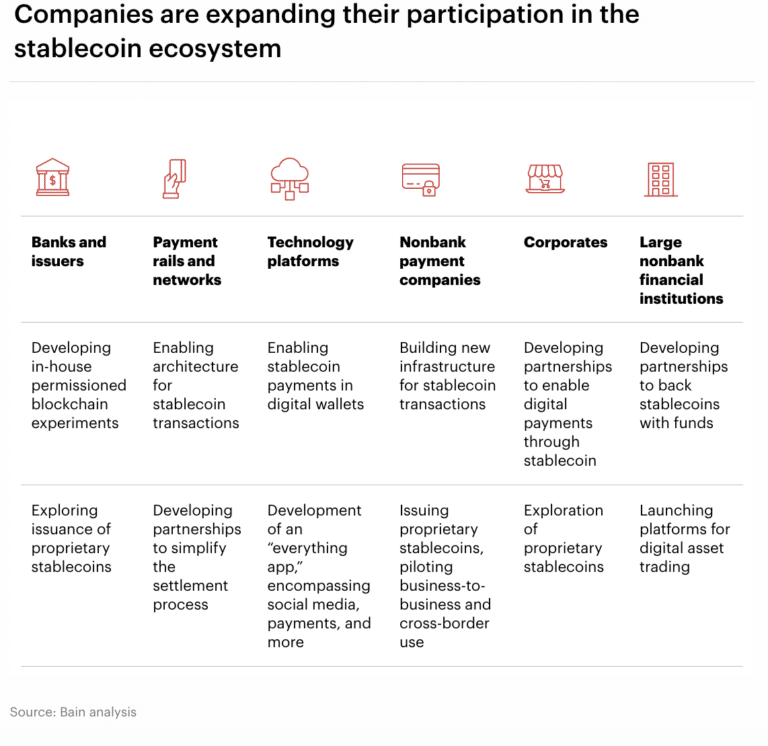

Consultancy Bain highlighted in a blog that the supply of stablecoins has increased from $2bn to more than $200bn since 2019.

Bain said: “Business-to-business payments and settlement is a major area of activity, with Circle, J.P. Morgan, and Société Générale piloting stablecoin-based solutions in round-the-clock liquidity and global payments.”

Julian Sawyer, chief executive of digital asset custodian Zodia Custody, said in a report that 2024 marked a pivotal moment and this year has continued that trend.

For example, stablecoin issuer Circle has completed an initial public offering. The report, The Age of Stablecoins, said stablecoins have moved firmly into traditional finance (TradFi).

In June this year Societe Generale-FORGE, the cryptoasset subsidiary of France’s Societe Generale Group, said it would launch a new stablecoin, the USD CoinVertible. The Bank of New York Mellon is reserve custodian, enabling seamless integration between traditional and digital financial ecosystems. This is the second stablecoin issued by SG-FORGE after the EUR CoinVertible launched in April 2023.

Jean-Marc Stenger, chief executive of Societe Generale – FORGE, said in a statement: “The stablecoin market remains largely US dollar denominated. This new currency will enable our clients, either institutions, corporates or retail investors, to leverage the benefits of an institutional-grade stablecoin.”

The French bank said the stablecoins allow instant 24/7 conversion between fiat currencies and stablecoin, enabling immediate, around-the-clock transactions. Both stablecoins are fully compliant with the European Markets in Crypto-assets (MiCA) regulation in the European Union.

“Institutional adoption, once a distant vision, is now a growing reality, fuelled by greater regulatory clarity, the emergence of non-USD stablecoins, and the urgent need for faster, borderless payments infrastructure,” added Sawyer.