Let Go Of The Wheel! Buy-Side Traders Need To Embrace Their Tesla Moment

By Raj Mathur, Co-head of AES, APAC, Credit Suisse

(This article first appeared in Global Trading magazine.)

Adoption of the latest technologies for mechanical aspects of the trading process allows human traders to focus on where they can add value.

The buy-side has developed trader workflows around the tools that they have had available for over a decade. However, the investment into and application of new technologies is challenging the heuristic approach to trading.

A buy-side trader has to consider several variables, including size, potential price impact of an order, as well as the urgency or alpha that the order carries. Doing this for ten orders is manageable; but doing it for hundreds of orders is not.

The nature of a trader serially inputting orders or instructions enforces limitations. As the themes of best execution have penetrated this workflow, packaging orders into bands or buckets based on average daily volume (ADV) or volatility has been a natural progression to bring homogeneity into the process.

In particular, buy-side algo wheels have helped provide a structure around how orders can be bucketed around key factors, to bring more statistical rigour into the evaluation of execution quality and to facilitate a comparison of execution quality amongst brokers.

However, introducing statistical observation to provide for an “apples-to-apples” comparison may also introduce certain approach biases which actually deviate from the overarching objective of seeking the outperformance we are looking for.

THE IMPLEMENTATION SHORTFALL PARADOX

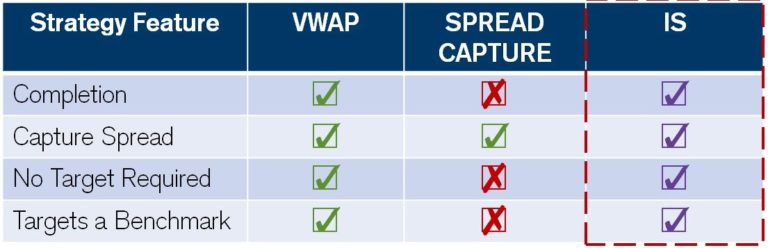

Implementation shortfall (IS) has become central to benchmarking broker execution. Historically, the tools to target IS have tried to capitalize on implicit short term bets by using price reversion or momentum models. That is to say, when traders are placing orders with IS in mind, more often than not, the tools at their disposal require the trader to decide participation bands, and then vary participation driven by price performance. If prices improve from arrival, participation increases (reversion) or alternatively decreases on the same basis (momentum). On the assumption that there is no clear alpha precipitating the trade, the net result is that while some orders may end up winning, the losing trades continue to run and as a whole produce very mixed results. That is possibly the reason why we have seen the buy-side gravitate away from traditional IS benchmark strategies into more spread capture focused strategies (see table above) for the purpose of IS benchmarking.

From a theoretical perspective, that makes a lot of sense for the buy-side: more prescriptive participation rates create less variability in performance outcomes and also allow a more apples-to-apples comparison of brokers’ algos performance.

But, although this achieves a certain level of homogeneity of results, it creates a paradox: the pursuit of standardising results for comparison sake may potentially be contrarian to our goal to find the best possible results.

In fact, the tools have not really been designed to address the heart of the problem. So far, the typical algo toolkit available in the IS space has necessitated that the buy-side trader implements the trade plan, and makes micro decisions: for example, take a bet on where the price will go, and choose appropriate participation rates, etc.

There has generally been a lack of trade planning assistance from the algos, yet with the advancement of machine learning and artificial intelligence to make more data driven decisions, the problem has shifted from a technological challenge to more of a philosophical challenge.

MAN VERSUS MACHINE

When it comes to trade planning, can a machine make more informed decisions than a human? Even without grandstanding breakthroughs in technology, we have seen the benefits of applying this idea to anticipating close volumes for market-on-close (MOC) style algos that address the “traders dilemma” to balance benchmark slippage against potential price impact. Meanwhile, volume weighted average price (VWAP) has been staring us in the face the whole time as the epitome of the driverless algo that can trade plan for us.

Indeed, VWAP embodies all the features of a benchmark algo that we are looking for. As we have found with spread capture implementations, the lack of assisted trade planning forces the need for components such as “must complete”, which essentially are the equivalent of an emergency parachute. The trajectory is deterministic, and if it runs out of road it needs to take emergency manoeuvres.

The art of trade planning should be replaced by the science of trade planning. Let the machine determine the initial participation, and re-factor it around the data it can assimilate from what is happening, and utilise what it expects could happen. No more “aim to complete” please!

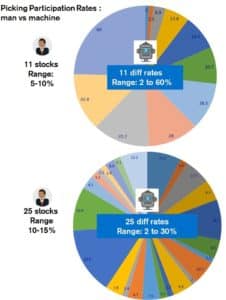

To illustrate, the difference in the human heuristic approach versus the data driven machine approach (see charts below), we have two small samples of orders, encompassing different ADV factors.

In group 1, 11 orders with an IS benchmark were given to a trader, and the decision was made to trade all of them between 5-10% participation.

In group 2, 25 orders were given to the same trader, and the decision was made to trade these between 10-15% participation.

Looking to the right, the same orders were given to our new IS algo, and it’s clear that the machine was able to determine a unique signature for each order. Individual participation rates from the machine ranged between 2% and 60% for group 1, and 2% and 30% for group 2.

By relying less on heuristics, and instead using the machine’s ability to assimilate historical and real-time data, provides for a wider window of possibilities, within which we may find some of the out-performance we are looking for.

Continuing down the conformist path may help make things easier to measure, but at the cost of finding ways to improve.

THE FUTURE OF TRADING

At present, the amount of investment and the potential for technology to make an impact on execution performance relies on our ability to re-think the way we approach things philosophically.

A good analogy is the moment Tesla drivers received the software update to allow their car to drive itself. Imagine the dilemma: you have driven the entire time with full control, and now you have to cede control to the car. Can you let go of the wheel or not?

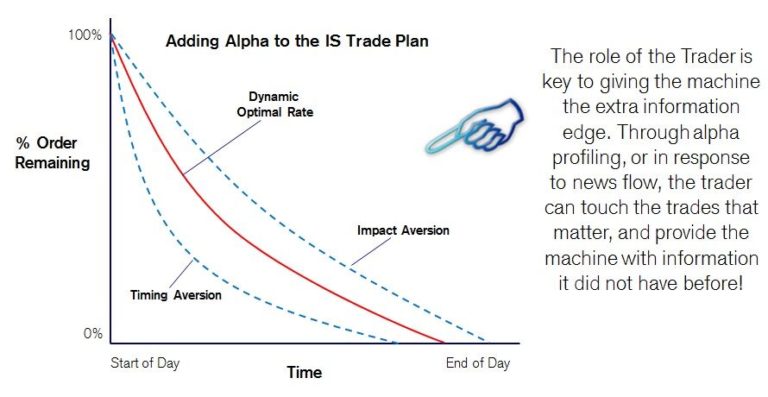

Abandoning the mechanical aspects of driving frees up the trader to do what they do best, which is to discover alpha.

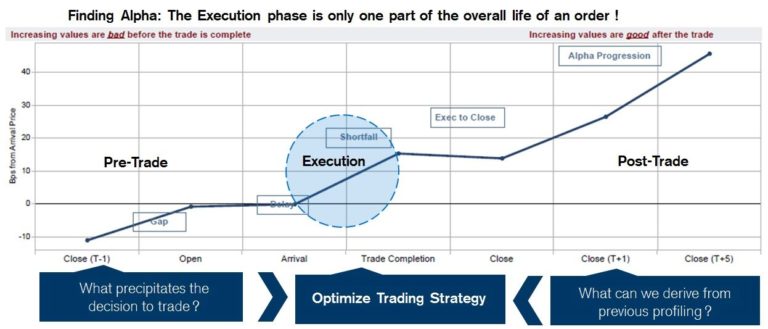

Machines should empower traders to find alpha: the actual trading piece is only a subsection of the overall trade lifecycle. Other elements can yield more insight and actually inform our approach, namely: What precipitates the decision to trade? What can we learn from previous results? How does this look at the portfolio level? Where can I find blocks?

The future does not mean less control; the role of the trader is more important than ever. The trader still has ultimate discretion over the outcome. Where the trader has information that a machine may not possess, such as momentum signals that precipitate the trading decision, or knowledge of the larger uncommitted order, the trader can inform the machine to find the extra edge.

So who wins between man and machine? It’s a no contest. The goal is to move beyond the heuristic and mechanical aspects of trading. The machines can find new ways to improve the overall average, and empower the human trader to realise opportunity beyond this – best execution.