LMAX Digital, part of LMAX Group, a regulated marketplace for foreign exchange and digital assets, traded over $2bn during the weekend as an estimated $19bn in leveraged positions were liquidated, the largest in crypto history.

Jenna Wright, managing director at LMAX Digital, spoke at the Digital Asset Summit in London on 13 October 2025. She said: “I know our team was very busy helping move assets around all weekend to facilitate our clients. We traded over $2bn this weekend, while you wouldn’t be able to trade anything in traditional markets.”

After Friday's liquidation, @LMAX traded over $2 billion, says LMAX Digital's Jenna Wright pic.twitter.com/uWPDJ7mBtl

— Digital Asset Summit 2025 (@blockworksDAS) October 13, 2025

Wright also highlighted that the $19bn of liquidations were more than the bankruptcy of exchange group FTX in November 2022.

“After FTX we were all crying for days, weeks and months and trying to recover,” she added. “We’re now in a position where that’s okay, it can happen.”

The structure of FTX also meant the firm was involved in every part of the trade lifecycle including execution, custody and providing credit which would not be allowed in traditional markets. Wright argued that digital asset market infrastructure has improved and become more professional.

“Exchanges, custodians and the credit piece are coming together and the ecosystem is much better,” she said. “We can start to trade in the correct manner as we would expect in the traditional world.”

Bitwise Europe, the digital asset fund manager, said in a note that this flush out of leverage represents a “very attractive” opportunity to increase exposure into a seasonally strong fourth quarter, especially in light of the strong macro tailwinds.

Perpetual futures

QCP, the Singapore-based digital asset trading firm in Singapore and a global market maker in digital asset derivatives, said in an update that markets were thrown into turmoil overnight on Friday 10 October 2025 after the White House announced a 100% tariff on all Chinese imports and new export restrictions on critical software. Traditional equity markets fell and a drop in bitcoin led to an estimated $19bn in leveraged positions being liquidated, which QCP said was the “largest in crypto history.”

The note said attention quickly turned to Binance, the largest exchange for crypto derivatives, and market makers withdrew liquidity, which amplified the price spiral.

“The exchange had pre-announced system updates for the same three assets just days earlier, potentially creating a window of vulnerability,” added the note. “The targeted sequence of selloffs has led some traders to suspect manipulation aimed at triggering cascading liquidations.”

Bitwise Europe said in its Crypto Market Compass that its in-house ‘Cryptoasset Sentiment Index’ fell to the lowest level since the ‘Yen Carry Trade Unwind’ in early August 2024 “signalling a significant degree of seller exhaustion. A clean contrarian buying signal was triggered.”

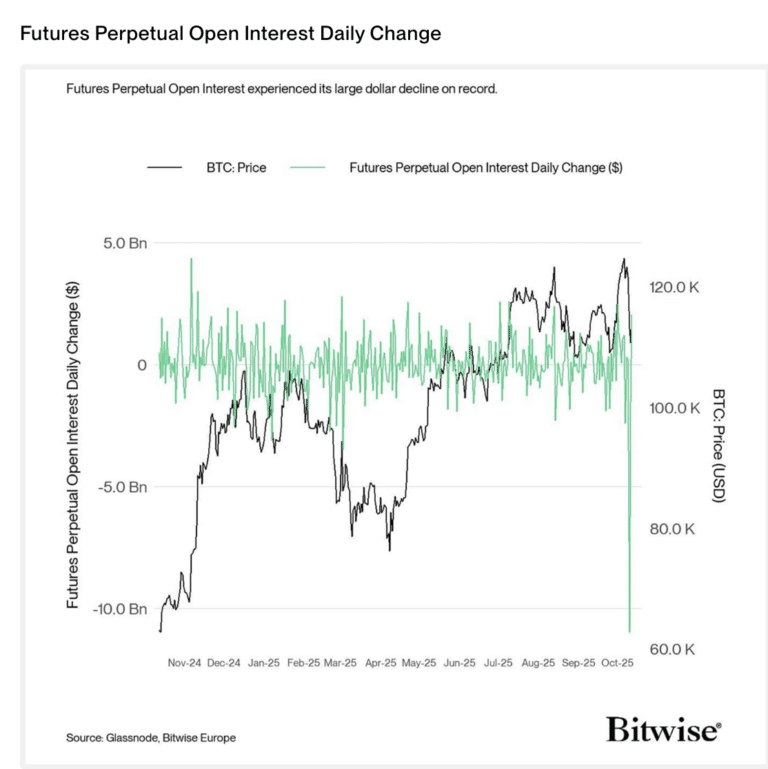

The drop was intensified by an unprecedented wave of long futures liquidations, with perpetual futures open interest plunging by nearly $11bn, the largest decline on record, according to Bitwise Europe. Perpetual futures do not have an expiry date, which allows investors to speculate, with leverage, on the price of a cryptoasset without having to own the underlying.

“In particular, Asian futures exchanges saw a downside cascade that was exacerbated by so-called auto-liquidations where exchanges automatically start to liquidate long positions pre-emptively when traders can’t maintain the mandatory margin requirements anymore,” added Bitwise Europe.

Market maker Wintermute said in a note that both centralized and decentralized perpetual markets were tested to their limits during Friday’s crash, as billions in leveraged positions were wiped out within minutes. Wintermute described this as a “real-world stress test for the resilience of on-chain trading and margin systems” as most leading decentralized exchanges (DEX) platforms stayed fully operational and solvent throughout.

— Wintermute (@wintermute_t) October 13, 2025

“As some users were running long–short spread strategies, they were ADLed on the short leg, leaving them temporarily non-neutral and subsequently exposed to liquidation on their long positions as prices continued to fall,” added Wintermute.

The firm added that more than 1,000 wallets on the Hyperliquid platform were automatically deleveraged, potentially contributing to parts of the liquidation cascade during the event.

“All of this is a reminder that in crypto markets it is critical to manage risk and leverage and to expect the unexpected,” said Wintermute.

LMAX Group launched perpetual futures on 17 September 2025, initially in BTCUSD and ETHUSD pairs, with more to be added. The firm said in a statement that perpetual futures are entering a new phase of legitimacy and scale as regulatory clarity emerges, with trading volumes totalling $60 trillion last year.

David Mercer, chief executive of LMAX Group, added in a statement: “This launch enables our clients to confidently participate in digital asset derivatives and capitalise on crypto market momentum through the same trusted, regulated institutional trading infrastructure that handles over $40bn average daily spot FX and digital assets flow.”

Wright said LMAX needs to offer a full suite of digital assets to institutional clients. The firm already offers spot trading and CFDs to its retail broker clients but was missing perpetuals.

“We think perpetuals have legs and are what people want to trade,” she added. “We think the offset of trading the spot and the perpetual is important and, for us, having everything under one roof is key.”

The top 10 exchanges traded just under $60 trillion in perpetuals last year, according to Wright, while the crypto market has a $4 trillion market cap. Therefore, she believes the perpetuals market is very small and has room to grow. Wright also believes in the converge of traditional finance and digital assets.

She argued that the lack of credit and regulatory frameworks were holding institutions back from entering into crypto, and these issues are being resolved. In addition, more traditional custodians are entering the space.

“We’re seeing prime brokers come through and Hidden Road is a great example of a traditional prime broker that has entered the space and is doing particularly well,” Wright said.

In addition, as soon as banks are able to trade spot crypto, they will be able to provide prime brokerage, as they do in other asset classes, which Wright described as a “game changer.”

“2026 will be the year of financial institutions trading,” she added. “We are going to see a big change and I am genuinely not going to sit here next year and say ‘institutions are coming’ as they will be here. We’ll be having a different conversation.”