Jim Toffey, chief executive and co-founder of LTX, said the technology being rolled out by the artificial intelligence-powered corporate bond trading platform is becoming more valuable in a rising rate environment.

In April 2022 Broadridge Financial Solutions, the fintech provider, formed a new buy-side advisory group for LTX, the AI-driven electronic trading platform that it launched in June 2020. The advisory group is comprised of senior credit traders at LTX client firms including AllianceBernstein, American Century Investments, BlackRock, Invesco, MetLife Investment Management, PIMCO, and PineBridge Investments.

Tom McClintic, head of high yield and emerging markets trading at MetLife Investment Management, said in a statement: “Best execution is a priority, especially amidst the current liquidity conditions. LTX is innovating with data science and a new trading protocol, and I look forward to advising on the continued development of the platform.”

LTX set out to work with the buy side about three years ago to find a solution that could improve price discovery and best execution for the part of the market that request for quote (RFQ) has not been able to reach. Toffey said the ability to aggregate liquidity was stressed by the buy side.

In 1997 Toffey founded electronic marketplace Tradeweb Markets and brought RFQ orders to the marketplace for rates and credit. He said RFQ has done a good job with smaller size trades of between $1m to $2m across rates and credit, but the majority of fixed income trades are still done over the phone.

“Creating a protocol to allow multiple buyers on a bigger block of bonds is an important fundamental market structure capability,” said Toffey. “The second thing is you need some mechanism around price discovery that RFQ doesn’t accommodate.”

For example, if there are four participants tied in an RFQ, there is no ability to break the tie. LTX combines artificial intelligence with RFX, a next-generation protocol, to help aggregate liquidity, and improve efficiency, and execution for corporate bond market participants.

“It reminds me of showing RFQ to the market years ago and everybody said that is really natural and intuitive and I can’t believe nobody’s done that before,” he added. “That’s what people say when they see this.”

The latest LTX whitepaper explains how we are using AI to effectively discover liquidity in the US corporate bond market and help our clients #TradeSmarter. #CapitalMarkets https://t.co/DsCQt3gGQZ pic.twitter.com/Yefcz8g4Lg

— LTX, A Broadridge Company (@LTXtrading) December 10, 2021

Toffey said more than 20 dealers and 50 asset managers have joined the LTX platform and he expects this number to double. The number of RFX sessions has steadily increased since January 2021 and the total amount of bonds offered on the platform is more than $4bn.

“The buy side made it loud and clear that they didn’t want to create another platform which disintermediated dealers and Broadridge is uniquely positioned as we are the back office for many of the banks and can build on top of the role we already have,” added Toffey. “Our theme is to trade smarter.”

AI allows dealers to find natural counterparties for a trade by providing a ranking and a profile in seconds. Dealers can give permission to let Broadridge use their data for AI to provide those recommendations back to their salespeople and traders. The technology also provides a real-time liquidity score to help participants assess the probability of competing a trade.

“The innovation that got the buy side excited is that we are creating an anonymous cloud which provides signalling if there is natural counterparty interest in a bond,” added Toffey. “It’s about understanding liquidity, helping dealers find and identify natural counterparties and then creating a much more flexible protocol to allow the parties to transact together and we are rolling that out now.”

For example, in March this year LTX was integrated with the Charles River order and execution management system (OEMS).

“Empowering the buy and the sell side to trade smarter is a really important endeavour and building out the network requires a lot of time, effort and investment,” said Toffey. “You need a significant liquidity pool which we have been building out and investing in.”

Automation

In credit markets features allowing for workflow automation were second most important after order management functionality according to a survey from Coalition Greenwich.

The consultancy said in a report: “Whereas considerable focus was put on electronifying the actual execution of fixed-income products over the past decade, the 2020s are showing a strong focus on digitization more broadly. This means that even products that are customized and illiquid have a path toward automation—a stark contract to electronic trading expectations, where many wrote off such products as ‘impossible’ to electronify.”

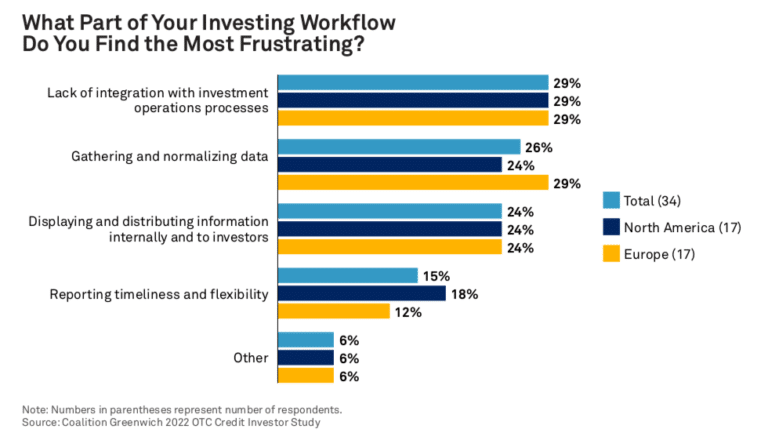

Lack of integration with downstream operational processes, and data aggregation and normalization, cause the most frustration among the study respondents.