Lynq was formed in April this year and will be integrating Fireblocks, the digital asset infrastructure provider, to make it easier for institutions to access the real-time yield-bearing settlement network for digital assets which is due to go live in 2025.

The new platform was developed over 18 months by digital asset firm Arca Labs, technology provider Tassat Group and tZERO Group, a regulated special purpose broker-dealer, to allow users to earn yield in the network which settles transactions using a tokenized treasury fund.

A month after being formed, Lynq named Jerald David as chief executive. David had previously been president of Arca Labs since 2019, when the firm launched the Arca US Treasury Fund, the first registered fund under the U.S. Investment Company Act of 1940 to issue shares as digital asset securities. The fund invests a minimum of 80% of its assets in U.S. Treasuries and issues its shares as a token, ArCoin, on the ethereum blockchain.

David told Markets Media that Lynq is the natural evolution of Arca’s work as it was developing use cases for its tokenized fund. During this process, Arca formed a strong relationship with Tassat Group.

“Tassat created and operated one of the most important pieces of infrastructure in digital assets to date, which was Signature Bank’s Signet,” he added. “This was an industry standard for tokenized deposits and a blockchain-based, real-time payments platform .”

Signet was introduced in 2019 to allow instantaneous peer-to-peer payments among Signature Bank clients and was the first platform of its kind to be approved by the New York State Department of Financial Services. At its peak Signet had $25bn of tokenized bank deposits that could travel on a private permissioned blockchain but in March 2023 the bank failed and was closed by U.S regulators.

“The market had a huge void so we partnered with Tassat to create a settlement system that operates outside the US banking system,” said David.

He argued that the technology will help Lynq achieve its mission to provide a settlement solution for digital assets that solves for market fragmentation, mitigates counterparty credit risk, and, critically, delivers yield to users. Instead of being powered by tokenized bank deposits, Tassat’s platform for Lynq uses shares in a new Arca tokenized fund for settlement – the Arca Institutional U.S. Treasury Fund (TFND) on the Avalanche blockchain – which has been created with independent board governance.

David said: “The beauty of these shares is that they are interest bearing, which increases capital efficiency.”

Lynq’s patent-pending Yield-in-Transit functionality ensures clients continually accrue and receive interest on their intraday holdings, calculated in five-second increments using an algorithm created by Tassat to allocate the yield, even during settlement operations.

Currently, only TFND can be used for settlement on Lynq, but David said the platform has been built for scalability so it is possible to add other forms of digital cash in the future

David continued that another leg of the stool is tZERO Group, who operates one of two special purpose broker-dealers in the U.S. Cash is deposited with tZERO Securities and shares of the Arca U.S. Treasury Fund are held in custody with tZERO Digital Asset Securities. U.S. Bank is the custodian for underlying assets held in the Arca U.S. Treasury Fund, safeguarding the U.S. Treasuries and cash of the trust.

In addition, all Lynq users will have to be onboarded by tZERO’s broker-dealer after being subject to their know your customer (KYC)/anti-money laundering (AML) processes and procedures. Users can onboard at the broker dealer from any jurisdiction and settle trades 24/7, even when traditional banks are closed.

“The beauty is that we have created a regulatory compliant solution for the market from a patchwork of licenses,” said David.

He believes that the network’s regulatory compliance and ability to pay yield are differentiators.

Fireblocks

In May 2025 Lynq added Fireblocks as a launch partner. Other launch partners include liquidity providers B2C2 and Wintermute, and Galaxy, the digital asset financial services firm which recently listed on Nasdaq. Additional partners include U.S. Bank to provide treasury management services and blockchain network Avalanche.

Katryna Hanush, managing director at Wintermute, said in a statement: “We’re seeing a clear shift toward greater institutional participation, and Lynq is designed to support this evolution.”

Fireblocks provides infrastructure for custody, tokenization, payments, settlement, and trading operations across the digital asset ecosystem. The firm said in a statement it has secured over $10 trillion in transactions with more than 2,000 organizations, across more than 100 blockchains and 300 million wallets.

David said Fireblocks’ institutional clients will be able to use the firm’s interface to connect to Lynq. In a blog Lynq said Fireblocks’s infrastructure and robust API stack have made them the “go-to provider” for banks, funds, fintechs, and exchanges.

In addition, Fireblocks’ API-driven workflows make it easy for institutions to embed Lynq into existing treasury operations, supporting automated liquidity management, netting, and settlement and David said potential clients have already expressed an interest in using the platform for treasury management. For example, Fireblocks will be available on Lynq when it launches. Over the longer term, they will explore capabilities such as delivery-vs-payment (DvP) functionality, giving institutions more confidence when moving assets simultaneously.

David said: “One of our core objectives is to solve for market fragmentation and to bring the industry together in one place whereby they can settle, on-amp to exchanges, create stable tokens, manage their treasury, create and redeem ETFs. We are actively talking to the market about building out a host of other use cases.”

More than 30 clients are in the process of onboarding to Lynq according to David, including several that are traditional financial (tradFi) participants who are looking for regulatory compliant ways to settle with their counterparties. David said: “I think this is a very attractive value proposition for tradFi.”

He expects testing to begin in the coming weeks, with the intention of launching the platform over the next couple of months. Lynq has four important objectives before launching – to continue to acquire customers so there is a network of trusted counterparts on the platform; finalizing API connections between clients; finalizing other strategic initiatives with technology providers and ensuring full testing is complete.

“The possibilities are limitless and we have a pipeline of clients and product requirements that are really deep,” David added.

Tokenized funds

Since Arca launched its tokenized treasury fund in 2019 other asset managers have offered similar products. For example, traditional asset manager BlackRock introduced its first tokenized fund in March 2024 through the Securitize platform and it gathered more than $500m in record time.

A year later in March 2025 Securitize said in a statement that the BlackRock USD Institutional Digital Liquidity Fund, BUIDL, had exceeded $1bn in assets under management, which marked a significant milestone in the growth of the tokenization ecosystem.

Joseph Chalom, head of strategic ecosystem partnerships at BlackRock, said in a statement: “BUIDL showcases the viability of real-world assets on-chain, offering institutional investors enhanced liquidity, flexibility, and yield opportunities.”

Consultancy McKinsey has estimated that the market capitalization of tokenized assets (excluding cryptocurrencies and stablecoins) could reach $2 trillion by 2030, with tokenized funds contributing $0.4 trillion. Taurus, a blockchain infrastructure provider, said in a report that fund tokenization is a high-potential area that could represent a $1 trillion market opportunity by 2030.

The report said the benefits of tokenizing funds include transfers, settlement, and clearing being able to occur at any time, worldwide, with lower costs, higher speed, and greater transparency.

“Smart contracts enable the automation of many administrative tasks, in particular transfer agency tasks (e.g., via a Digital Transfer Agent smart contract),” said the report. “Streamlining fund operations through smart contract-based automation reduces operational costs and errors infund management and enhances transparency and real-time processing.”

Other benefits include increased liquidity, fractionalization, increased collateral mobility and financial inclusion.

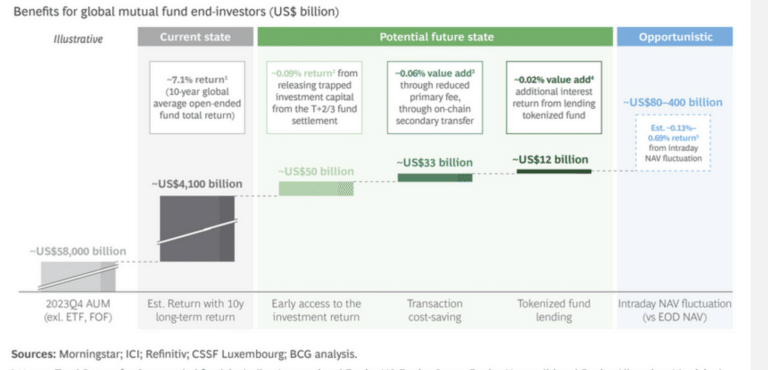

“Mutual funds manage about $58 trillion in assets, but today’s settlement process is inefficient, with a T+2/3 settlement period locking up funds,” said the report.” Boston Consulting Group estimates that by solving these problems,fund tokenization could produce approximately +17 basis points in annual returns for investors,representing a gain of $100bn, plus an additional additional $80–400bn in value if investors can capture extra return from intraday net asset value (NAV) fluctuation.”