Asset managers updated their fillings with the US Securities and Exchange Commission for approval to launch spot bitcoin exchange-traded funds at the end of 2023

BlackRock VanEck, Valkyrie Investments, Invesco, Fidelity and WisdomTree Investments were amongst the group of fund managers that had updated their SEC filings for spot bitcoin ETFs by 29 December 2023. Reuter reported that the US regulator may approve issuers on 2 or 3 January 2024.

Link… https://t.co/ORCjSHAGte

— Nate Geraci (@NateGeraci) December 30, 2023

The SEC has only permitted bitcoin futures ETFs, and has so far rejected all the applications for spot bitcoin ETFs. However, in July this year five bitcoin ETF applications from BlackRock, Fidelity, Invesco Galaxy, VanEck and WisdomTree were published in the Federal Register, which sets a timeline for the SEC to review the proposals.

Eric Balchunas, senior ETF analyst for Bloomberg, highlighted that the updated filings included details of authorised participants (APs) and fees. Authorised participants have an agreement with the ETF issuer that it can manage the creation and redemption of ETF shares in the primary market so that the ETF accurately tracks the value of its underlying index.

For example, Balchunas noted that BlackRock was the first to name APs for its proposed bitcoin ETFs on 29 December – Jane Street Capital and JP Morgan Securities. Subsequently, WisdomTree and Fidelity both named Jane Street as an AP and Valkyrie Digital Assets also named Jane Street as an AP, alongside Cantor Fitzgerald.

Just to be clear: the AP names weren't due in S-1s, so BlackRock adding them in there is a bit of a flex in that regard. So if we see other S-1s not naming AP doesn't mean they don't have one lined up. But this does make BlackRock the first horse officially ready imo.

— Eric Balchunas (@EricBalchunas) December 29, 2023

Fidelity's S-1 in as wow, it included its fee which will be 0.39%, by far lowest so far, also names Jane Street as AP. Fidelity is officially ready to party. pic.twitter.com/Taq32IGB0L

— Eric Balchunas (@EricBalchunas) December 29, 2023

Balchunas found that Invesco named Virtu and JPMorgan as APs and the fund manager waiving fees for first six months and for first $5bn in assets:

Invesco/Galaxy is in and here's a whopper: it will be waiving fee for first six months AND for first $5b in assets, APs named as well, Virtu and JPMorgan (again lol). Another horse in. Are we having fun yet? pic.twitter.com/mDUOOSnA29

— Eric Balchunas (@EricBalchunas) December 29, 2023

All or almost all of these filers have their AP's lined up and they know what their fees are going to be (at least roughly). These N/A's will have to be filled in before launch and before SEC signs off on the S-1's but are not needed for 19b-4 approvals as far as i'm aware

— James Seyffart (@JSeyff) January 2, 2024

Data provider CCData said in a report in December that the pending approval of a spot Bitcoin ETF contributed to the performance of bitcoin in 2023.

Bitcoin rose 156% in 2023 which CCData said was more than traditional financial benchmarks such as Nasdaq, S&P500, and Gold, and will remain a catalyst this year. The approval of BlackRock’s ETF could propel Bitcoin’s price to “new, extraordinary heights” according to CCData.

“BlackRock’s spot bitcoin ETF application sent waves through the market, as the world’s largest asset manager signalled keen interest in the digital asset industry,” said the report. “Institutionally, we have observed key signs of positive sentiment following the rebirth of the industry post-FTX, with participation by sophisticated players rising at a consistent pace.”

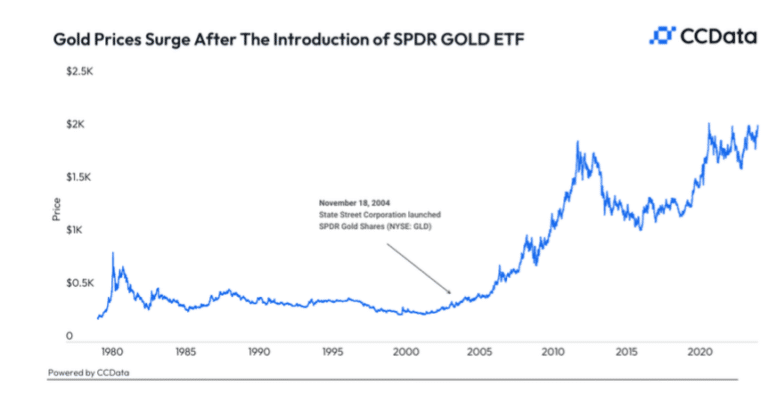

CCData highlighted the performance of gold following the launch of the first SPDR ETF and said bitcoin may be entering a new period of accessibility and adoption.

Blockworks Research said in a daily newsletter that 2024 is starting with bitcoin pumping at over $45k, a new local high

“The CME BTC Futures are trading at a ~2.5% premium to spot, showing that TradFi is certainly getting ahead of the announcement,” added Blockworks. “BTC miners are also rallying after a large sell-off across the board on 29 December.”

Grayscale Investments, the digital currency fund manager, said in a blog that if the SEC approves trading of spot Bitcoin ETFs, this may broaden the number of investors with regulated access to digital asset investment products, and potentially result in new net demand for Bitcoin.

“In light of a relatively “tight” supply backdrop, as well as the halving of Bitcoin issuance scheduled for April 2024, new net inflows into the asset should have positive implications for Bitcoin’s valuation, in our view,” added Grayscale.

In August 2023 Grayscale won a lawsuit against the SEC, challenging the regulator’s decision to deny conversion of Grayscale Bitcoin Trust to an ETF.

Michael Sonnenshein, chief executive of Grayscale, said in a statement at the time that the win brought the market one step closer to making a US spot Bitcoin ETF a reality.

“This is a historic milestone for American investors, the Bitcoin ecosystem, and all those who have been advocating for Bitcoin exposure through the added protections of the ETF wrapper,” added Sonnenshein. “Grayscale has adhered to US financial rules and regulations in building our product suite since our founding in 2013, underpinned by one fundamental belief: investors deserve transparent, regulated access to crypto.”