MarketAxess is considering adding emerging market bond trading in local currency to Open Trading, the electronic platform’s all-to-all trading model, due to client demand.

For full-year 2022 MarketAxess reported record emerging markets annual daily volume of $2.8bn, up 7% year-on-year. MarketAxess also said it had a record 29% estimated market share of FINRA TRACE-reportable emerging markets trading volume, up 220 basis points over 2021.

Max Callaghan, head of hedge fund, ETF (EMEA) & CEEMEA sales at MarketAxess, told Markets Media: “In 2022 Open Trading was 41% of emerging market trading in hard currency. We are thinking about Open Trading in local currency as we definitely have demand from clients.”

For the first quarter of 2023, MarketAxess said emerging markets annual daily volume rose to an all-time high of $3.1bn, up 1% from the same period in the previous year.

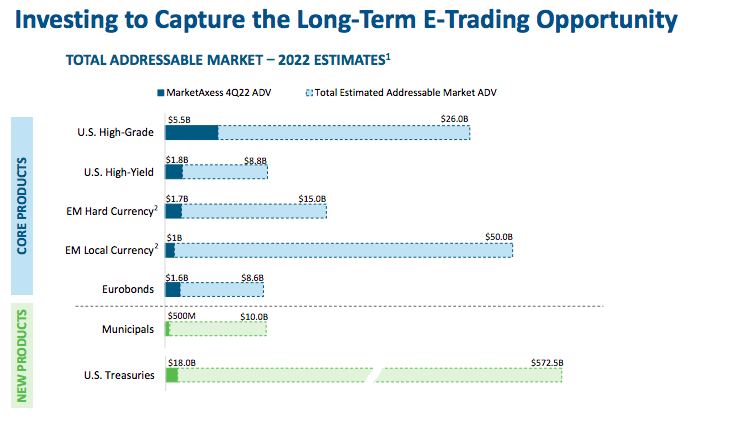

Callaghan said: “I am very optimistic as emerging markets are a huge opportunity.”

The opportunity comes from growing adoption of electronic trading in emerging markets and of high-touch and low-touch tools on the buy side. There is also accelerated adoption of dealer algos on the sell side according to Callaghan.

He described emerging markets as still in their infancy with respect to algo adoption so there is lots of runway.

“There is also the potential of new entrants as there are regional dealers, and regional pockets of liquidity, that are very specific in emerging markets,” Callaghan added.

For example, the United Arab Emirates is starting a local currency operation. In addition Callaghan said growth could potentially be boosted by the inclusion of countries in indices and the growing theme of ESG in emerging markets.

MarketxAxess has most recently entered Serbia and Egypt and Callaghan said the firm is speaking with clients around other markets, namely India where there are ongoing discussions around index inclusion, and the Middle East, which is a big opportunity.

“In the high-touch space, we are looking at protocols that facilitate block trading in larger size,” Callaghan added. “This could involve better data or products that allow workups in terms of sizes or in terms of automation.”

Jared Model, senior trader and portfolio analyst for fixed income ETFs at VanEck, said electronification has profound effects on emerging markets very quickly. The New York-based asset manager has used MarketAxess in emerging markets and took part in a case study.

Model said in the report: “Initially, we see wider bid/ask and more spread out RFQ (request for quote) levels. After trading electronically for some time, we see cover levels that are much closer.”