Gareth Coltman, global head of trading automation at MarketAxess, the operator of an electronic fixed income trading platform, said the market is on the cusp of the next wave of electronification in credit as the firm looks to further develop its block trading solutions.

MarketAxess went live with targeted blocks in the U.S. in May this year, after launching in Europe in the fourth quarter of last year. The firm reported that in May there were strong increases in block trading average daily volume across U.S. credit of 41%, in emerging markets of 24 % and 116% in eurobonds.

For the second quarter of this year, Marketaxess reported that emerging markets and eurobonds both benefited from the launch of targeted block solutions in late 2024, which has generated cumulative trading volume of approximately $2bn and $3.8bn, respectively, since launch.

Coltman told Markets Media that the firm’s block trading solutions are underpinned by a dataset that helps clients make decisions around who to go to, and what the likely outcomes will be. MarketAxess has built out some counterparty selection tools which include an AI model that can identify which counterparts might be able to offer liquidity. He said clients love getting all the data in one place and connecting that data to their workflow.

“We are still innovating around our block trading solution, and we will be coming out with new features and extensions to support clients,” added Coltman. “Historically, blocks of credit have been resistant to electronic trading, but we are on the cusp of the next wave” of trading workflows moving to screens.

Chris Concannon, chief executive of MarketAxess, said on the first quarter results call in May this year that the firm’s block trading market share had increased, with a record for block trading volume in emerging markets. He continued that clients want to be able to trade larger size electronically without information leakage, so a targeted solution allows them to maximize price improvement by marketing to a few dealers, rather than all dealers.

“So when it comes to competition, being able to click to trade your workflow for blocks is quite powerful,” Concannon added.

Adaptive Auto-X

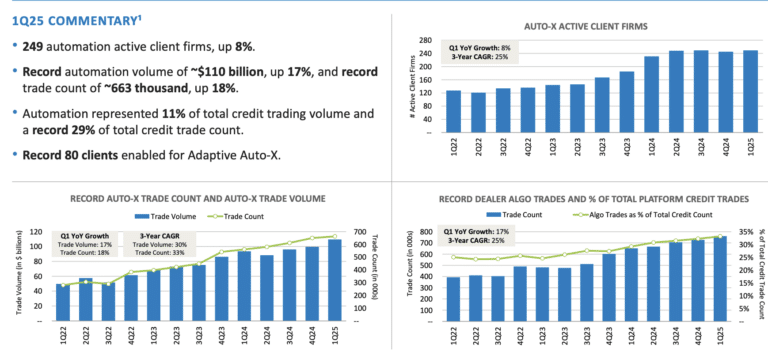

Coltman also highlighted that automation activity in the first quarter remained very high and resilient despite the increase in volatility.

“A consistent theme is that every time we’ve gone through a significant period of market volatility, clients have continued to use automation more actively or return to it more quickly,” he added.

In addition, access to a range of tools has become increasingly important to clients. Coltman said MarketAxess’s focus over the past 24 months has been building out a set of tools so that whatever the objective and market conditions, clients have both the data and execution tools to get trades done on the platform, including automated RFQs (request for quotes), portfolio trading, and block trading.

MarketAxess sees Adaptive Auto-X, its multi-protocol automated execution solution, as the “future of automation.”

“More clients are now willing to place very large orders into Adaptive Auto-X and are effectively using the platform to help them execute those blocks throughout the day as an alternative to trying to trade all in one go,” added Coltman.

At the end of last year Marketaxess launched its Take algorithm, which it has been piloting with about 40 U.S. clients. Coltman said: “The feedback we’ve had so far from clients has been excellent.”

The Take Strategy in Adaptive Auto-X is focused on helping clients who want to trade with some urgency. It allows clients to aggregate available liquidity from multiple sources, including open trading, MarketAxess’ all-to-all protocol, traditional dealer liquidity on MarketAxess, and third-party liquidity, such as ICE Bonds.

Last year MarketAxess and ICE Bonds, part of Intercontinental Exchange, said they would connect their respective protocols and liquidity pools. This enables ICE Bonds’ automated trading system (ATS), ICE TMC, and MarketAxess’ Open Trading network to communicate with each other, expanding the depth and reach for their respective global user bases.

Coltman explained that the Take Strategy has a more sophisticated pricing model than Auto-X to help clients get better results in terms of execution, performance, efficiency, and a more sophisticated pricing model. It is built on CP+, the firm’s proprietary algorithmic pricing engine for corporate bonds, but offers a more granular approach to provide clients with a customised target.

This workflow allows clients to explore workflows that extend beyond sending an RFQ. Coltman gave the example of clients being able to rest an order in the tool for a period of time and send out their RFQ at the close, or sweep up any natural liquidity available prior to that.

“A huge focus has been building out a dataset that we can provide to clients, either when they are trading blocks directly using our solutions such as Adaptive Auto-X, leveraging pricing models like CP+ or liquidity models like Tradability,” added Coltman. “We are working with dealers to get real-time content from banks which helps clients identify natural liquidity.”

MarketAxess is also integrating a number of other data points into Adaptive Auto-X, including machine learning liquidity models and ETF data. Coltman said the rise in passive investment, particularly ETFs, has been a massive catalyst in transforming fixed income secondary market trading over the last few years, including the rise of portfolio trading.

In addition, he highlighted that a number of banks and alternative liquidity providers are offering a centralised risk book around both their ETF and cash bond activity, which has created velocity in the market that supports automated trading.

MarketAxess reported that in the second quarter it surpassed $1 trillion in total credit quarterly trading volume for the first time and achieved record $2 trillion in total rates volume.

“The platform’s strong year-over-year volume growth continued in June as volatility moderated through the quarter,” reported MarketAxess. “We delivered strong progress with our new initiatives across the client-initiated, portfolio trading and dealer-initiated channels that contributed to the record level of trading volumes across most products in the second quarter of 2025.”