MarketAxess is going to pilot Adaptive Auto-X, its multi-protocol automated execution solution, in Europe in the fourth quarter of this year and the operator of an electronic fixed income trading platform is also launching a new algorithm called Take.

Gareth Coltman, global head of trading automation at MarketAxess, told Markets Media that Adaptive Auto-X is fully live for US credit and the firm will begin pilots with European clients in the fourth quarter of this year. He added that MarketAxess is also launching its latest algo, Take, a next generation request-for-quote (RFQ) focused Auto-X style algo in October.

Adaptive Auto-X was launched in 2023 and is an algo and smart order router that allows clients to use MarketAxess’ predictive AI-driven analytics, like CP+, and automatically direct their order to the best workflow – such as RFQ, order book and other matching protocols to create better quality execution outcomes. Clients can specify a protocol or use data-driven, smart-order-routing to maximize the potential liquidity sources across multiple MarketAxess trading protocols and liquidity pools.

Coltman said: “We expect all clients will ultimately migrate onto the Adaptive framework because of the benefits that it offers versus traditional automation.”

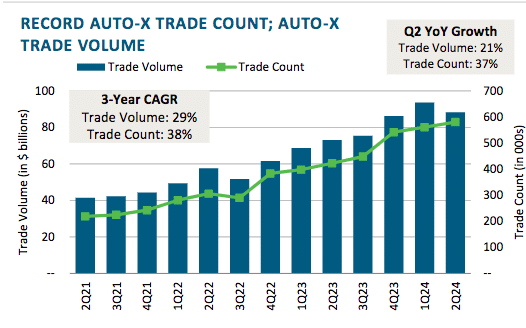

MarketAxess said in its second quarter results that active automation client firms rose 70% to a record 248, which Coltman said was due to automation broadening out to smaller clients. Automation volume rose 21% to $88bn and there was a record trade count of 580,000, up 37%.

Automation represented 10% of total credit trading volume and a record 27% of total credit trade count according to MarketAxess. In addition, 65 clients were enabled for Adaptive Auto-X.

Coltman added that over the last three or four years, automation usage on the platform has grown in excess of 30% each year.

“We are only just starting to see wholesale adoption, so lots of growth is still to come,” he added. “We are building a suite of workflows with Adaptive so depending on what clients trade, there is probably some help that we can provide with our hybrid approach.”

Nearly all, 97% , of respondents in The Finance Hive’s latest Pulse report, developed in partnership with Tradeweb, anticipate a rise in automated trading capabilities, and said automation is a key driver of efficiency. Two thirds. 63%, expect trading flow to increase over the next 12 to 18 months, emphasising the need for advanced technology and operational strategies to manage growing volumes.

Shaun Copeman, senior trader at Federated Hermes, said in the report: “During seasonal illiquid periods, we shifted from a high-touch to a low-touch strategy, reducing our risk appetite as market-makers became more cautious. We also moved towards the all-to-all space to enhance liquidity, focusing on liquidity at the right price.”

The report also highlighted that while automation is on the rise, over 50% of trading still relies on manual processes.

New algo, Take

Coltman described MarketAxess’ algos as being designed for fixed income market structure so that clients can choose between their appetite for price improvement against their urgency to transfer risk.

“They can dial those things up or down and the algo determines how quickly, and how much of the order, to execute aggressively versus interacting with more passive liquidity over time,” he added.

An existing MarketAxess algo, Provide, is passive and liquidity-seeking to offer price improvement. Clients can rest orders and opportunistically take advantage of natural liquidity, for example, in an order book or from a response to an Open Trading RFQ. Open Trading is MarketAxess’ all-to-all model.

MarketAxess has also rolled out an algo called Seek. Coltman said that if clients are not getting matches to their resting orders which satisfy their time horizon, the algo allows them to start being aggressive in the market over time.

A new algo, Take, is designed for clients where urgency is paramount and aggregates all available liquidity, so they can aggress the market based on their rules. MarketAxess has sophisticated pricing and liquidity models that adjust to the profile of individual clients to tell them at what level they should be trading, according to Coltman. Clients can allow an order to rest until the market has moved in their favour so that it can be executed within their price target.

“Take offers the next level of efficiency, making sure clients are not missing out on any liquidity,” Coltman added. “Clients have the ability to always have an order working rather than switching from an automated workflow that fails and then reverting to manual intervention.”

MarketAxess provides an artificial intelligence model that predicts the likely level of depth that is available in the market, which the firm calls ”Tradability,” which Coltman said gives clients a preview of the likely success of a given workflow.

“We are trying to push the boundaries and make sure that the profile of automation is as broad as possible, and as close as possible to what a human trader would do if they were in control, whilst still able to have oversight,” he added.

BlackRock partnership

In September this year MarketAxess announced an expansion of its partnership with BlackRock, that began in 2013, to seamlessly integrate MarketAxess credit trading protocols, pricing and data into BlackRock’s Aladdin order execution management system (OEMS).

The new connectivity will provide common clients of Aladdin and MarketAxess with an enhanced trading experience through integration of select MarketAxess credit protocols natively within the Aladdin platform.

Rich Schiffman, global head of trading solutions at MarketAxess, said in a statement that as the market evolves there is increased adoption of automation protocols, with many MarketAxess clients turning to the firm’s automation strategies for over 90% of their trading volumes.

“We look forward to bringing the latest of our automation protocols, Adaptive Auto-X, as well as our market leading RFQ solutions, Open Trading, and Live Markets central limit order book directly to Aladdin clients through this partnership,” Schiffman added.

Coltman continued that some of the largest asset managers have automated order routing into MarketAxess without any human intervention by setting rules inside their order or execution management system. He said approximately 40% of all MarketAxess’ automation is completely no-touch and that has been growing.

“BlackRock wanted to allow their Aladdin clients to get more out of automated workflows by integrating Adaptive Auto-X, which is the next step in automation,” Coltman said. “We are very excited to have BlackRock as a partner as we push the boundaries of what is possible in fixed income automation.”

Municipal bonds

In. August this year ICE Bonds, part of Intercontinental Exchange, and MarketAxess announced plans to connect their respective liquidity networks.

Pete Borstelmann, president of ICE Bonds, said in a statement: “By combining our complementary strengths, we aim to offer users expanded opportunities to access liquidity in corporate and municipal bonds, enhancing market efficiency and benefiting participants across both platforms.”

Coltman said some clients are automating municipal bonds, but it is still early days. The partnership with ICE Bonds has gone Iive with municipal binds and high-grade corporate bonds.

“It is really exciting to be partnering with ICE Bonds to bring their liquidity into our ecosystem,” Coltman added. “It speaks to MarketAxess’s intent and vision in simplifying how clients access fixed income markets, and being able to offer data, connectivity, liquidity and a very easy to use workflow.”