Morgan Stanley has filed to launch bitcoin and solana exchange-traded funds as it has been predicted that more than 100 crypto-linked ETFs will launch this year.

The U.S bank filed with the U.S Securities and Exchange Commission on 6 January 2026 to launch Bitcoin and Solana ETFs.

Nate Geraci, president of NovaDius Wealth Management, said:

Back in October, Morgan Stanley dropped restrictions on financial advisors recommending crypto ETFs…

Now launching their own.

Makes sense given Morgan’s massive distribution.

Clearly they were seeing meaningful demand from clients for crypto ETFs. https://t.co/9vIroWf8y9

— Nate Geraci (@NateGeraci) January 6, 2026

In next few months, *Charles Schwab* will offer direct spot crypto trading to clients while *Morgan Stanley* will launch spot btc & sol ETFs…

Meanwhile, *Vanguard* now allows clients to trade spot crypto ETFs.

You see what’s happening here yet?

“Crypto is all just a scam.”

— Nate Geraci (@NateGeraci) January 7, 2026

Eric Balchunas, senior ETF analyst at Bloomberg, said:

I like this move by them. It's smart. They have like $8T in advisory assets and they already OK'd those advisors to allocate so might as well be in their own branded fund vs paying BlackRock or someone else. Further, they could use kickstart to their mostly BYOA ETF biz. This…

— Eric Balchunas (@EricBalchunas) January 6, 2026

Morgan Stanley Investment Management’s ETF platform reached more than $10bn in assets under management according to a statement on December 18 2025, which the firm said reflects strong investor appetite for MSIM’s active and systematic ETFs.

The ETF business launched in 2023 with six strategies and last December it comprised 18 products, including 10 Eaton Vance active fixed income ETFs, five Calvert responsible investing ETFs and three Parametric derivative income and hedged equity ETFs.

Ally Wallace, global head of capital markets and ETF strategy for Morgan Stanley Investment Management, said in a statement: “Our rigorous vetting process includes exploring new market trends, listening to clients and considering investment insights from portfolio managers. This empowers us to create what we believe are compelling ETFs for today’s market environment that address investors’ distinct investment objectives.”

Blockworks Research said in a newsletter: “This move signals growing institutional confidence in regulated crypto products, and it reflects a strategic shift from distributing third-party offerings to vertically integrating digital assets across Morgan Stanley’s vast wealth management platform, allowing the bank to keep ETF fee revenue in-house as demand for crypto exposure continues to rise.”

Matt Hougan, chief investment officer at Bitwise, the crypto fund manager, said:

Morgan Stanley manages 20 ETFs, but mostly under the Calvert/Parametric/Eaton Vance brands. These will be the 3rd and 4th ETFs to bear the "Morgan Stanley" brand. Pretty remarkable. https://t.co/oL1sX0LCcO

— Matt Hougan (@Matt_Hougan) January 6, 2026

Growth of crypto ETFs

Bitwise predicted in a report that more than 100 crypto-linked ETFs will launch in 2026 including spot crypto ETFs, crypto plus staking ETFs, crypto equities ETFs, and crypto index ETFs. The report said that a clear regulatory roadmap and a market hungry for crypto ETFs will set the stage for an “ETF-palooza.”

The regulatory roadmap includes the SEC publishing generic listing standards in October 2025 allowing ETF issuers to launch crypto ETFs under a general set of rules.

“More importantly, we believe the wave of institutional capital that began entering the space with the approval of spot bitcoin ETFs in 2024 will accelerate in 2026, as platforms like Morgan Stanley, Wells Fargo, and Merrill Lynch begin allocating,” added Bitwise.

The spot bitcoin ETFs are coming into 2026 like a lion, +$1.2 in flows in first two days of year w/ everyone eating. That's a $150b/yr pace. Told ya'll if they can take in $22b when it's raining, imagine when the sun is shining. pic.twitter.com/YdRaLN0Op7

— Eric Balchunas (@EricBalchunas) January 6, 2026

Jianing Wu, institutional research at digital asset investment manager Galaxy, also predicted in a report that a major asset-allocation platform will add bitcoin to its standard model portfolios.

“After three of the four wirehouses (Wells Fargo, Morgan Stanley, and Bank of America) lifted restrictions for advisors to recommend bitcoin to investors and endorsed a 1% to 4% allocation, the next step is getting bitcoin products onto their recommended lists and into formal research coverage, which would meaningfully increase visibility to their clients,” she added.

The final step is inclusion in model portfolios, which typically requires higher fund assets under management and sustained liquidity, but she expects bitcoin funds to clear those thresholds.

Following the SEC’s approval of generic listing standards, Wu expects the pace of spot altcoin ETF launches to accelerate in 2026. She forecast that more than 50 spot altcoin ETFs, and another 50 crypto ETFs (excluding spot single-coin products), will launch in the U.S. this year.

“In 2025, we’ve seen more than 15 Solana, XRP, Hedera, Dogecoin, Litecoin, and Chainlink spot ETFs come to market,” added Wu. “We expect the remaining major assets we’ve identified to follow with their own spot ETF filings.”

In addition to single-asset products, Wu anticipates that multi-asset crypto ETFs and leveraged crypto ETFs will launch. She also predicted that U.S. spot crypto ETF net inflows will exceed $50bn in 2026, following $23bn of net inflows last year.

Matthew Kimmell, digital asset analyst at fund manager Coinshares, said in a report that he expects the four major U.S. wirehouses to formally open solicited Bitcoin ETF allocations within discretionary portfolios (Morgan Stanley, Merrill, UBS, Wells Fargo) in 2026. In addition, he predicted that at least one major 401(k) retirement plan provider will allow bitcoin allocations via ETFs (Fidelity, Empower, Vanguard, Principal).

Kimmell said the theme for 2026 is the continued mainstreaming of Bitcoin into the U.S. financial industry.

“A slow-moving industry continues to absorb the structural events that have already taken place, with each section making incremental changes that bring bitcoin closer to the ordinary,” he added. “The implication is that bitcoin increasingly resembles other established asset classes in distribution, regulation, and perception.”

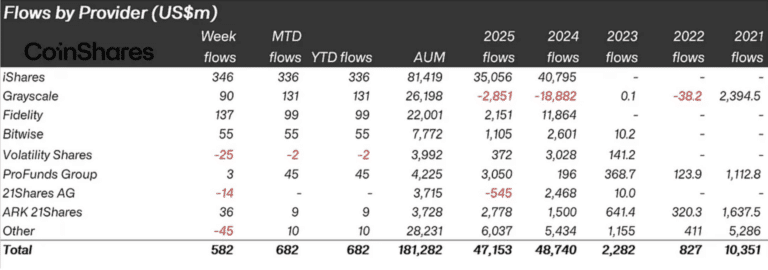

Inflows into crypto ETPs in 2025 were $47.2bn according to CoinShares, 3% below 2024’s record.