Nasdaq has changed its opening auction to give institutional investors the opportunity to interact with retail flow as there has been a rise in retail participation in US equity markets.

Chuck Mack, Nasdaq

Chuck Mack, head of US equities at Nasdaq, told Market Media: “Asset managers want more access to retail liquidity and we are helping to solve that problem in the opening auction. Increasing the diversity in the ecosystem participating in the opening auction improves the quality of the market so it is a win-win for everyone.”

He explained that the composition of Nasdaq’s opening auction is different from the close as a significant portion of the open is from individual retail investors. The amendments include establishing an early order imbalance indicator (EOII) for the opening cross; extending the time period for accepting certain limit on open orders and changing cutoff times for on-open orders entered for the opening cross.

“Prior to the change data was disseminated at 9.28 ET and institutions could only interact passively,” he added. “Now data is disseminated at 9.25 and managers have much more flexibility to interact with retail liquidity.”

Mack continued that the changes launched in May this year and asset managers have been dipping their toe in the water. The exchange expects slow but steady growth over time.

Retail participation

In the US retail trades are not executed on exchanges but most are sold by brokers to market makers under “payment for order flow” agreements, allowing the brokers to offer no-commission trading to retail. The market makers internalize the flow and capture the majority of the spread, in return for offering retail investors a slight improvement on the exchange price.

Trade Reporting Facilities (TRFs) run by Nasdaq and NYSE capture trading off-exchange such as in alternative trading systems, internalizers, internal matching by central risk books and single-dealer platforms. Ray Ross, co-head of electronic trading at BMO Capital Markets, told Markets Media in May 2021 that TRF volume is now larger than any one single exchange and also larger than any exchange family – so significant liquidity is absent from exchanges.

More innovation is expected to attract more volumes onto exchanges.

Curious about the proposed updates to our Retail Program? Read more in the latest blog post from IEX President Ronan Ryan: https://t.co/sZVKM5lHiJ

— IEX (@IEX) May 10, 2021

For example, IEX Exchange has filed with the US Securities and Exchange Commission to change its retail price improvement programme to enhance performance for retail investors. The changes provide the retail community with the ability to execute at the midpoint as detailed in this blog.

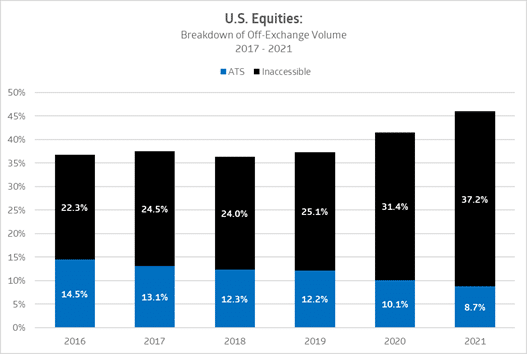

Cowen has developed an “Inaccessible Liquidity Adjustment” which allows clients to automatically adjust algos for the share of inaccessible liquidity, which includes off-exchange trading, in individual stocks for the first time. The broker has estimated that “inaccessible liquidity” in the market has made up more than 37% of total volume so far this year.

Source: Cowen

Nasdaq expects to continue to see new products and solutions that solve specific problems and adds value both on- and off-exchange.

“For example, our M-ELO order decreases market impact while PureStream ATS adds a different way of trading blocks,” Mack added.

PureStream Trading Technologies is aiming to launch the first US equity trading venue that allows institutions to trade blocks algorithmically with orders being matched in a stream of liquidity. The ATS has created a streaming block which allows institutions to trade blocks algorithmically by naturally matching a specified percentage of the parent order which is called the ‘liquidity transfer rate’. Therefore, crosses are not constrained to one moment in time and can consist of a number of trades.

Mack said: “Risk and resiliency had been a very hot topic since last spring so we are reviewing changes to our risk controls in order to protect clients.”