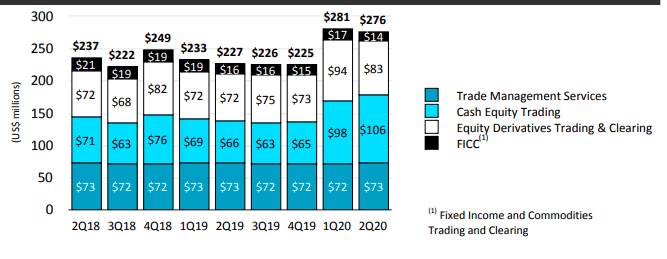

Nasdaq reported that combined U.S. equities and options markets set a quarterly record for trading volume, boosting revenue in Market Services by 22% from a year ago.

The exchange group said electronically operated equities, options and fixed income markets operated at high performance levels during the surge of trading volume related to the COVID-19 pandemic.

Adena Friedman, president and chief executive of Nasdaq, said in a statement: “Our foundational markets are demonstrating their resilience and the power of a distributed, electronic market model, handling record volumes through multiple periods of extreme volatility.”

(2/3) “I am extremely proud of the Nasdaq team and how we are serving our clients as we continue to navigate the pandemic,” said @AdenaTFriedman, President and CEO, @Nasdaq. pic.twitter.com/WZ6B0ZPmFt

— Nasdaq (@Nasdaq) July 22, 2020

Net revenues in cash equity trading were $106m, up $40m from a year ago. Nasdaq said the increase primarily reflects higher U.S. and European industry trading volumes and a higher U.S. capture rate, partially offset by lower overall U.S. matched market share.

Friedman said on the results call: “The current backdrop of the pandemic, the economy and the election should support elevated volumes in the second half of this year.”

Remote working

Friedman said the vast majority of staff are working remotely but there are long-term social and creativity benefits in having them in the office.

“We are taking a measured approach to re-opening and returning will be voluntary until at least the end of 2020,” she added.

Market Technology

The chief executive highlighted the launch of the Marketplace Services Platform, a software-as-a-service platform which provides modular cloud-based technology across the transaction lifecycle from execution to settlement and post-trade.

Friedman said: “The pandemic highlighted the important of having a flexible and scalable technology architecture.”

She explained that the Marketplace Services Platform can be used to deploy new markets in the cloud. For example, the new platform is being used by LEX as the underlying technology for an alternative trading system for commercial real estate securities.

In addition Nasdaq said new order intake totaled $38m during the second quarter, driven by the market and trade surveillance business and the signing of five new SaaS marketplace customers, including surveillance deals with Tradeweb and the National Futures Association. Robinhood, the U.S. retail brokerage, has also selected Nasdaq Trade Surveillance technology to monitor their markets.

Friedman continued that SaaS products benefited from firms needing to meet compliance and surveillance requirements while employees work from home.

Indexes

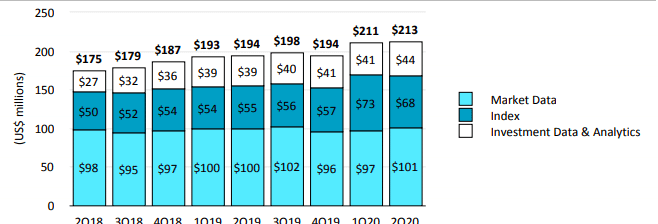

Friedman added that the index business is benefiting from favorable thematic exposure to the digital economy as assets under management tracking the Nasdaq-100 index and Nasdaq indexes overall reached new quarterly records.

Overall assets under management in exchange-traded products benchmarked to Nasdaq’s proprietary indexes rode by a third to $272bn which includes $96bn, or 35%, tracking smart beta indexes. There was a 54% rise year-over-year in the assets linked to the Nasdaq-100 index.

“Investors have a new appreciation of our thematic approach to indexes, especially in technology and healthcare,” added Friedman.“The pandemic has elevated social responsibility so we are going to expand our environmental, social and governance offerings.”

Friedman said: “We are a pretty good at selecting themes in our selected niches. They play into the next generation economy.”

She also highlighted the increased demand for alternative data through the firm’s Quandl subsidiary as users try to gauge how demand is shifting ahead of official statistics.

IPOs

"So far this year @Nasdaq has had 87 IPOs," says @adenatfriedman. "I would not have expected that in March, but I would say investors are looking to put risk capital to work particularly for companies that are leaning into the trends that are going to be coming out of COVID." pic.twitter.com/9Zi6PI1W0i

— Squawk Box (@SquawkCNBC) July 22, 2020