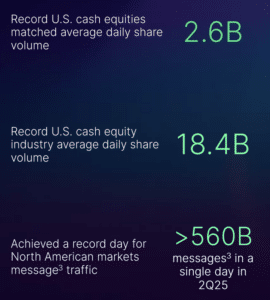

Nasdaq Market Services net revenue was $306m in the second quarter of 2025, up 22% versus the prior year period. This was boosted by Nasdaq’s U.S. exchanges achieving record cash equities volumes.

During the Russell reconstitution, Nasdaq’s Closing Cross successfully executed 2.5 billion shares in 0.871 seconds across Nasdaq-listed securities that represented a record $102.5bn dollars in notional value.

Adena Friedman, chair and chief executive of Nasdaq, said on the second quarter results call on 24 July 2025 that Nasdaq delivered an excellent second quarter performance amid a dynamic market environment. The group’s second quarter net revenue was $1.3bn, an increase of 13% over the same period last year.

Innovation

Investment in technology transformation continues as companies focus on achieving benefits from AI, which is driving momentum across infrastructure modernization, accelerated cloud readiness and enhanced data management, according to Friedman.

She said: “These dynamics are evident across the banking and capital market sectors, where clients are focused on technology investments to modernize their infrastructure, improve their risk management and regulatory compliance and fight financial crimes, although uncertainty remains as to the longer term impact of trade and economic policies.”

Financial technology revenue of $464m in the second quarter increased 10% over the same quarter last year.

In July this year, Nasdaq Verafin announced the launch of its Agentic AI workforce, a suite of digital workers, now in beta testing, which has the potential to address the most resource intensive anti-money laundering workflows. For example, when onboarded into a bank’s alert triage workflow, the Digital Sanctions Analyst automates the screening, documentation and acknowledgement processes, reducing alert review workload requiring human intervention by more than 80%.

Friedman said: “Beyond AI, digital assets represent another key theme driving innovation as we focus on the maturation of the ecosystem and supporting institutional adoption.”

Calypso, the Nasdaq platform which provides front-to-back trade management solutions to manage risk, margin, and collateral needs, has also announced a digital assets proof of concept with Digital Asset, QCP, one of the first digital asset trading firms in Singapore and a global market maker in digital asset derivatives, and Primrose Capital Management.

“This use case demonstrates our ability to integrate onchain capabilities to help financial institutions manage collateral across asset classes and markets in a more dynamic and efficient manner,” added Friedman.”We continue to work with our partners and clients to finalize the product build and we are targeting launch in early to mid-2026.”

She continued that regulatory winds are favorable towards the institutionalization of digital assets as the U.S has passed a federal framework for stablecoins, which make payment rails more efficient. Nasdaq can benefit as it provides technology to traditional markets in helping them digitize assets from creation to settlement, custody and collateral management.

“We can use onchain capabilities to move collateral more dynamically, which will free up a lot of excess liquidity trapped inside clearinghouses,” Friedman added.

Nasdaq is heavily engaged with U.S regulators and legislators as they put together a market structure bill for digital assets.

“We feel like the institutionalization of crypto is positive for the industry,” she added. “So we’re very excited about the direction of travel.

In private markets, Nasdaq has also became the exclusive distributor of Nasdaq Private Market’s Tape D(R) API in the second quarter to deliver real-time data and valuation insights to investors.

“Since launch, we have already signed two clients and the pipeline is building for asset managers and asset owners,” added Friedman. “Our platform provides a wealth of private markets intelligence which has become an increasingly powerful for new sales and client retention.”

Index business

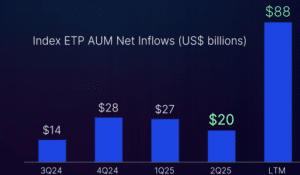

Index revenue of $196m grew 17% in the second quarter, with $88bn of net inflows over the trailing twelve months and $20bn in the second quarter of this year. Index exchange-traded product assets under management was a record $745bn at quarter-end.

Nasdaq launched 33 new index products in the second quarter, including 21 international products and 12 products in partnership with new index clients.

“We continue to focus on growing our exposure to institutional clients with the launch of seven products within the insurance annuity space,” said Friedman.

In addition, Nasdaq signed an extension through 2039 of CME Group’s exclusive license contract to offer futures and options on futures based on the Nasdaq-100 and other Nasdaq indexes.

Listings

Nasdaq saw the highest level of new issuances in the first six months of this year since the first half of 2021, according to Friedman.

She continued that 83 operating companies listed in the first half including three of the top five largest IPOs.

“Importantly, the strong performance of recent listings, especially of large cap companies, has raised optimism on the IPO outlook for the remainder of this year,” said Friedman.

Nasdaq exchanges in Europe had 10 new listings which raised five times more capital than the first half of last year.

“We’re particularly excited to see our Stockholm exchange continue to lead as Europe’s premier destination for new listings underpinned by the relative valuation of its market and the strength of the local ecosystem,” she added.

Sarah Youngwood, chief financial officer, said on the call that Nasdaq is executing well on its capital allocation priorities, including repaying debt, and has surpassed gross leverage milestone 16 months ahead of schedule.