The ability of Nasdaq Marketplace Services Platform to spin up environments for digital asset markets and help reduce the time for new venues to come to market means that this is one of the business’ fastest growing areas.

Johan Toll, Nasdaq

Johan Toll, head of digital assets at Nasdaq Market Technology, told Markets Media that Nasdaq Marketplace Services Platform can spin up environments for clients and reduce the time to market from a year to weeks or months from an operational standpoint.

“In addition to trading and surveillance technology, Nasdaq can provide additional support across the trade lifecycle as well as data and analytics needed to value and verify assets to support issuance and settlement of digital assets,” he added. “We are delivering more and more Software-as-a-Service functions using the cloud.”

For example Sporttrade, a Philadelphia-based fintech announced it will use Nasdaq technology for surveillance of its sports betting and trading platform.

Alex Kane, founder and chief executive of Sporttrade, said in a statement: “Adopting Nasdaq’s industry-leading market surveillance technology is essential in Sporttrade’s promise to our participants – to advance fair, transparent, and efficient open sports betting markets.”

Recently, @Nasdaq announced a technology agreement with sports betting company, @Sporttrade_app. Sporttrade will leverage @NasdaqTech for surveillance of its sports betting and trading platform.

Learn more: https://t.co/fl5hKqwUDg pic.twitter.com/JmtjWAeUoC

— Nasdaq (@Nasdaq) September 19, 2021

Sporttrade said that using Nasdaq’s SaaS-deployed market surveillance technology will allow it to monitor trading patterns and protect its user base by identifying irregularities and unusual trading behavior. Through interactive visualization, complex data can be distilled into a single snapshot and provide a full view of the order book, enabling Sporttrade to transparently and continuously collaborate with regulators.

Real estate

Scott Shechtman, head of new markets at at Nasdaq Market Technology told Markets Media that volumes of fractionalized real estate trading have been increasing.

Scott Shechtman, Nasdaq

He said: “We are seeing an uptick in interest in trading fractionalized real estate, with Lex and IPSX as two great examples.”

Lex, the commercial real estate securities marketplace, said in June last year that it would use Nasdaq’s Marketplace Services Platform as the underlying technology for its alternative trading system (ATS).

Craig Hatkoff, LEX’s chairman and chief strategy officer, said in a statement at the time: “While others have tried variations, until now no one has cracked the code on how to partner with a recognized national securities exchange. The LEX/Nasdaq tie-up should be a game-changer opening up access to an untapped market for the accredited and unaccredited investor and dramatically lowering the cost of capital for the real estate industry.”

International Property Securities Exchange (IPSX) is regulated by the UK Financial Conduct Authority and said in May this year that it is the world’s first such exchange dedicated to the initial public offering and secondary market trading of institutional grade commercial real estate assets. The IPSX platform has been established with technology partners including Nasdaq, GoldenSource, Quant House and Scila.

Although many individuals & institutions see real estate as an attractive investment alternative, the initial cost can be a significant barrier to entry for the average investor.

Creating a real estate marketplace can address this challenge.

Learn more: https://t.co/Qlbyw1mDny pic.twitter.com/GO9Z7oSlkR

— Nasdaq Tech (@NasdaqTech) August 4, 2021

Shechtman continued that real estate is the largest asset class in the world but what proportion of will trade on exchanges in the future is unclear.

He said: “We see a large opportunity in supporting new markets for digital assets, cryptocurrencies and NFTs and allowing start-ups to scale with the confidence that our technology is robust.”

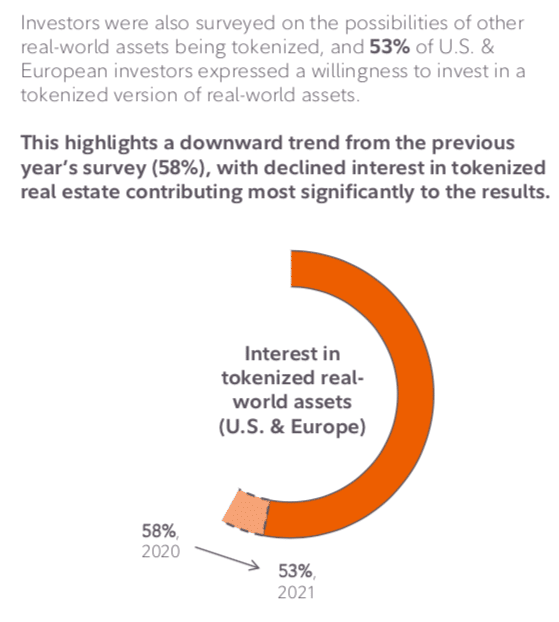

Fidelity Digital Asset’s 2021 Institutional Investor Digital Assets Study found that 27% of U.S. and European investors surveyed felt that real estate had the greatest potential for tokenization, down from 39% last year.

Source: Fidelity Digital Assets

Th report said: “Although this downward trend is significant, we hypothesize that it may have more to do with trends in the housing market than tokenization. In 2021, home prices in the U.S. increased by 13% and in Europe by more than 6%, signaling an increase in demand. During a banner year for the housing market, investors may have struggled to determine what benefits tokenization would provide.”

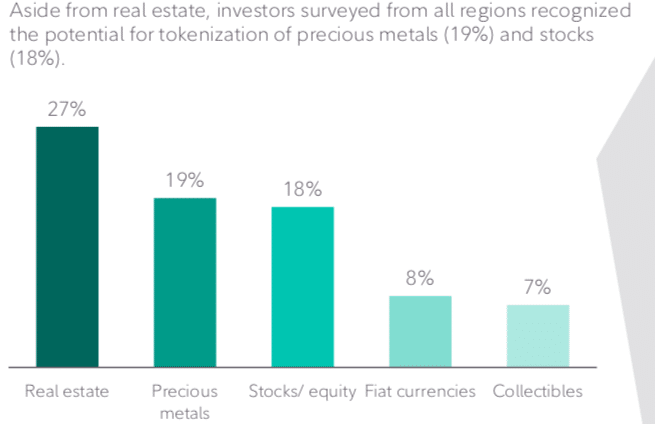

Investors surveyed also recognized the potential for tokenization of other real world assets.

Source: Fidelity Digital Assets

Half of investors agreed that fractional ownership and lower investment minimums were the leading advantages for tokenized assets and 47% of investors in the survey saw advantages in the increased market liquidity.

Fidelity surveyed 1,100 institutional investors across the U.S., Europe, and Asia on their perceptions of digital assets and investment behaviors.