Adena Friedman, chair and chief executive of Nasdaq, described the $10.5bn acquisition of Adenza, which provides risk management and regulatory software to the financial industry, as a milestone in Nasdaq’s transformational journey which will “supercharge” the group’s capabilities across critical functions, asset classes and geographies.

Friedman said on an investor call on 12 June 2023 Nasdaq’s strategy since 2017 have been to become a leading technology provider and decisions have been made through the lens of allocating capital to the highest growth opportunities around delivering trusted platforms that improve the liquidity, transparency and integrity of the global economy.

“We are operating in a dynamic environment, but in times of economic uncertainty companies have unique opportunities to play offence,” she added.

As Nasdaq evaluated ways to grow and scale its business Adenza stood out as a company with a tremendous financial profile and technology solutions that fit squarely into Nasdaq’s strategic focus areas according to Friedman. In 2021 Nasdaq completed the acquisition of Verafin, which provides anti-financial crime detection, and has been looking to expand into adjacent areas due to the fast growth of the business.

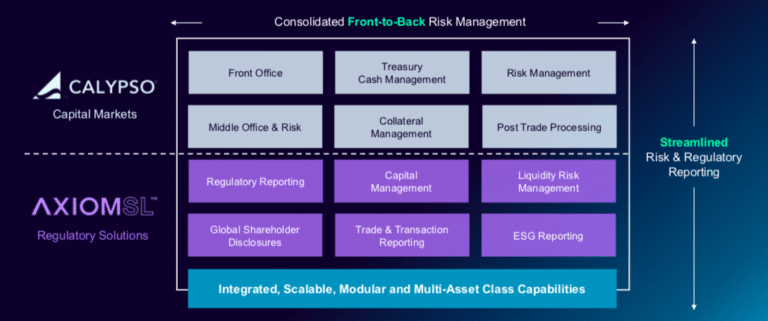

Private equity firm Thoma Bravo formed Adenza in 2021 from the combination of Calypso, which provides risk management from the front to back office and collateral management workflows across asset classes and geographies, with AxiomSL, which provides regulatory reporting.

“Financial institutions are sitting at the intersection of a powerful set of external forces, ever-changing regulatory requirements and increasingly sophisticated criminal threats,” said Friedman. “Our clients are also integrating emerging technology into their businesses, particularly artificial intelligence and cloud, and we believe these trends will only intensify in the future.”

Nasdaq's Adenza deal brings more capabilities to each of our clients, Nasdaq CEO Adena Friedman tells @JoeSquawk. Watch the full video: https://t.co/4OjL1VLrbt pic.twitter.com/A5K1Kc9yH3

— CNBC (@CNBC) June 12, 2023

Adenza’s client base includes banks, brokerage firms, asset managers and financial market infrastructure firms across 70 countries. As a result, Nasdaq approached Thoma Bravo to discuss a deal. Friedman said Adenza has a very effective operating model that has been a critical driver behind their growth in client retention.

“There’s a lot about the way that they go to market that we’d like to adopt at Nasdaq to make our processes even more efficient and effective in serving our clients,” she added.

In addition, Adenza’s technology capabilities are highly modular and in 2023 it is expected to earn revenues of approximately $590m, with a 15% organic growth rate and an adjusted EBITDA margin of 58%.

Tal Cohen, president of the market platforms business at Nasdaq, said on the call that Calypso’s core clients are Tier 2 and Tier 3 banks and brokers across a broad set of asset classes, while Axiom offers global regulatory compliance platform that covers 55 jurisdictions and 110 regulators to a core client base of Tier 1 banks.

“Adenza’s risk management solution excels at covering over-the-counter instruments, whereas Nasdaq excels in exchange-traded assets,” he added. “We envision integrating capabilities and offering a module upgrade.”

The ability to seamlessly expand the range of asset classes is a powerful differentiator according to Cohen, especially when Nasdaq can add collateral management and OTC capabilities as a complement to its existing post-trade offer.

In addition the acquisition allows Nasdaq to pull forward Verafin’s global expansion into the European banking sector given Adenza’s presence in that market.

Financials

Cohen continued that Adenza has a $16bn total addressable market growing at 6% per year and a $10bn serviceable addressable market growing at 8% per year.

“Growth is driven by the fact that financial institutions are operating in a very complex and dynamic environment,” he added. “The cost of regulatory compliance is estimated to be nearly 10% of a bank’s revenue.”

He said that since the implementation of the Dodd-Frank Act in the US in 2010, banks have increased their compliance costs by more than $50bn per year.

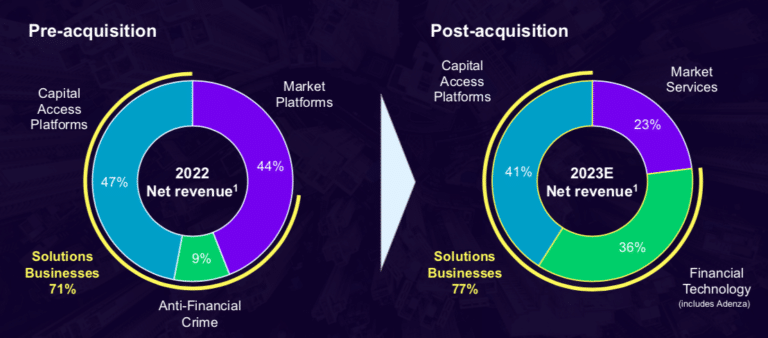

Friedman said Adenza has predominantly recurring revenues which will increase Nasdaq’s annualized recurring revenue (ARR) to 60% of total revenue to support sustainable growth over the long term.

She added: “Adenza accelerates our strategy as a leading technology partner to clients and ultimately enhances Nasdaq’s overall financial profile across a number of key metrics including growth, quality of revenue, margins and cash flow.”

Following the completion of the deal Nasdaq will be reorganised into three divisions – Capital Access; Market Services and Financial Technology, which will include Adenza.

“The creation of the Financial Technology division represents a continuation of our transformation and will allow us to bring highly relevant software solutions to our clients even more effectively and efficiently,” said Friedman.

After the acquisition, Financial Technology will represent approximately one third, 36%, of 2023 estimated net revenue and is is expected to grow at between 10% to 14%.

Ann Dennison, chief financial officer, said on the call that the purchase price is $10.5bn in cash and shares.

Nasdaq has obtained fully committed bridge financing for the cash portion of the deal and expects to issue approximately $5.9bn of debt between signing and closing to replace the bridge.

The group will also issue stock to Thoma Bravo, who will become a 14.9% shareholder in Nasdaq with the right to appoint a nominee to the board of directors. Holden Spaht, a managing partner at Thoma Bravo, is expected to be appointed to Nasdaq’s board, which will be expanded to twelve members once the deal closes.

Dennison said the acquisition is consistent with Nasdaq’s financial requirements as it creates attractive expense and revenue synergies and delivers earnings-per-share accretion by the end of year two. Nasdaq’s enterprise-wide return on invested capital is expected to return to greater than 10% by year five.

She argued that Nasdaq is an inexperienced acquirer with the purchases of ISE, Evestment and Verafin all exceeding the deal objectives.

“Nasdaq has delivered total shareholder returns of more than 400% since 2014,” Dennison added.

Advisors

Goldman Sachs is lead advisor and J.P. Morgan is financial advisor to Nasdaq. The two banks provided bridge financing for the transaction. Wachtell, Lipton, Rosen & Katz is legal advisor to Nasdaq.

Qatalyst Partners is lead financial advisor to Thoma Bravo and Adenza, along with Barclays, Citi, Evercore, HSBC, Jefferies and Piper Sandler. Kirkland & Ellis is legal advisor to Thoma Bravo and Adenza.

US stocks rise, but Nasdaq, Inc. falls 10.9% after announcing Adenza acquisition, and Methanex drops 7.9% due to Scotiabank downgrade. #stockmarket #Nasdaq #negative pic.twitter.com/YBxzepBzfh

— Streetbeat Nasdaq (@SBNasdaqTracker) June 12, 2023