Octaura Holding’s electronic syndicated loan trading platform has traded more volume in the first six months of this year than in the whole of 2024 and the firm completed a $46.5m fundraising.

Brian Bejile, chief executive of Octaura, told Markets Media that Octaura traded about $14bn during the whole of 2024. In the first half of this year trading volume has increased to close to $19bn which he said speaks to continuing adoption.

Volatility increased after 2 April 2025 when President Trump announced a series of tariffs which also led to fears of a potential recession.

“There was a collective ‘aha moment’ as participants found that Octaura was an effective outlet to source liquidity in volatile markets,” Bejile added.

In the midst of the spike in volatility, auctions of between $200m and $500m took place on the platform, and only took about an hour to complete.

“This never used to happen,” said Bejile. “When you had such monumental moves, the market used to freeze.”

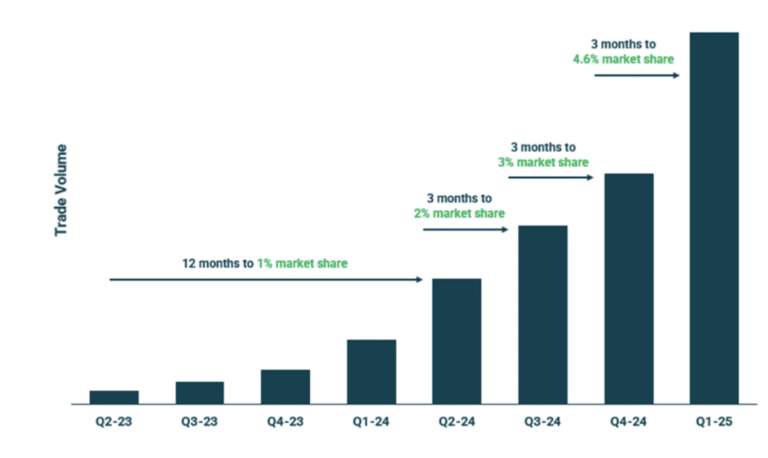

In contrast, Bejile said Octaura had record logins and a lot of follow-on trades. Octaura said in a blog that since the beginning of March this year, an average of $1bn is being traded each week on the platform. This gives Octaura about 4.6% of total trading in the secondary market, based on figures published by the LSTA, a trade body for the North American syndicated loan market.

Bejile highlighted that approximately 40% of trading volume is related to Market Lists, a protocol which Octaura only introduced in September last year. Market Lists makes the liquidations of collateralized loan obligations (CLOs) more efficient and reduces the time taken from days to less than four hours.

CLOs are securities backed by a bundle of loans. Managers consolidate hundreds of loans and then sell portions of a CLO, or tranches, to outside investors. When a CLO reaches maturity and is redeemed, the CLO manager has to liquidate the portfolio and sell hundreds of loans. This process was manually intensive with the selling manager sending out a giant spreadsheet of the individual loans and asking for bids.

“This is the first protocol that we have released where the loan market can see what’s going on as lists on Octaura go to both dealers and the buy side,” said Bejile. “The platform has demonstrated what is possible and Market Lists has more than paid for itself.”

Bejile continued that Market Lists has grown to be a significant driver of volume, and it has been interesting to watch market participants using the protocol in areas beyond liquidations, including for exchange-traded funds and mutual funds.

“ETFs have accelerated electronification of the credit markets, helped increase liquidity and bought in new retail investors,” added Bejile.

April 2025 marked the two-year anniversary of the launch of Octaura’s platform, which aimed to electronify loan trading and make the process far more efficient. In the first quarter of 2024 Octaura reached 1% of secondary loan trading volume, which increased to 4.6% of total market volume this year.

Between April 2023 and April 2025, Octaura also said it grew its dealer network from three to 25 and expanded its buy-side participation from 34 to 146 firms.

Funds raised

Octaura is also planning to launch an electronic trading platform for CLOs in the summer of this year according to Bejile.

The new platform will be partly funded by Octaura raising $46.5m in June this year. The round was backed by Octaura’s founding investors, including Bank of America, Citi, Goldman Sachs, J.P. Morgan, Morgan Stanley, Wells Fargo and Moody’s. There were also new investors – Barclays, Deutsche Bank, BNP Paribas, Apollo and Motive Partners, MassMutual Ventures and OMERS Venture.

Alex Stromberg, co-head of U.S. credit trading at Barclays, said in a statement: “We have seen firsthand the impact that the Octaura platform is having on the leveraged loan trading market and as such we are excited to be a part of it.”

The funding will also be used to develop critical data and analytics, for example, by providing information on the market or specific instruments. For example, Octaura has developed liquidity metrics for loans that give an indication of how many bids could be received, trading costs or dealer profitability

“It’s a little bit like using GPS to plan a journey” said Bejile. “Data and analytics facilitate people getting a sense of what could happen.”

Integration

Another part of the growth strategy is to integrate Octaura in the buy-side workflow through their order management systems.

In June this year ICG, a global alternative fund manager with $112bn in assets under management, implemented a joint solution from technology provider Allvue Systems and Octaura. ICG gains a seamless workflow for bulk loan trading, portfolio management, and operational efficiencies.

Michael Kovacs, head of product – credit at Allvue Systems, said in a statement: “Leveraged loan trading has traditionally been a highly manual, labor-intensive process – hand reconciling 500 trades previously took days. Allvue and Octaura’s combined technology, enables firms to complete these reconciliations in hours or even minutes.”

Bejile said that between 15 to 20 buy-side firms have also connected to Octaura in a similar way with technology providers including Allvue, Charles River and Aladdin.