Just over a year ago the U.S., Canada, and Mexico had cut their securities settlement price to T+1, one day after a trade, by 28 May 2024. This had repercussions across global capital markets, especially for overseas investors, and other regions are now aiming to coordinate with this shorter settlement cycle. For example, both the UK and the European Union are aiming to move to T+1 in October 2027.

Vermiculus, the financial technology provider, collaborated with capital market research firm GreySpark Partners on a report, Key Insights on T+1 Settlement Transition. Lars-Göran Larsson, business developer at Vermiculus, said in a statement that the shift to shorter settlement cycles is a “game-changer,” forcing the industry to rethink operations and upgrade systems at speed.

The report highlights an analysis from Bloomberg which estimated that the total industry-wide cost of the US transition to T+1 was $30bn, which included system upgrades, operational restructuring and staff training programmes. The investment appears to have paid off as trade fail rates did not spike despite widespread concerns that the shorter settlement would cause an increase. The report argued this was extensive adoption of automation and straight through processing (STP).

Asset managers achieved a same-day affirmation rate of 97.5% in the immediate days following T+1 implementation, up from 92% in January 2024 according to the report. Prime brokers improved even more dramatically, reaching an affirmation rate of 98.6%, up from 81% in January.

The most critical vulnerability in the T+1 settlement process for custodians, broker-dealers and asset managers has been exception management according to the report. T+1 has reduced the available time to identify and resolve trade discrepancies from about 12 hours to just two hours, so firms need real-time alerting systems.

An additional effect T+1 implementation is the widening technology gap between sophisticated market participants and those with less advanced infrastructure.

“Firms that have invested heavily in state-of-the-art settlement technology now enjoy a substantial settlement advantage, while those who lack robust post-trade automation face significantly higher operational costs and settlement risk,” said Vermiculus.

The report also highlighted some benefits from T+1. There was a 28% decrease in clearing fund requirements in the quarter following the implementation of T+1 according to DTCC data, and a 25% reduction in capital required for National Securities Clearing Corporation (NSCC) margin deposit.

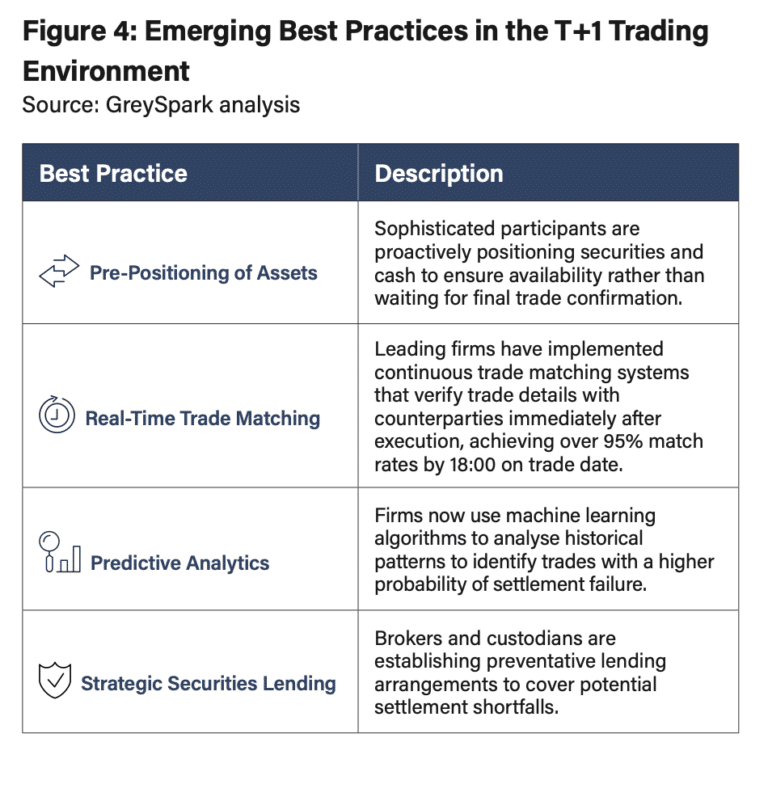

Some best practices have also emerged under T+1, according to the report, including pre-positioning of securities and cash, real-time trade matching and advanced predictive analytics of potential settlement issues.

“The transition to T+1 settlement in North America has fundamentally transformed post-trade operations, making automation and STP an operational necessity rather than a desirable competitive advantage,” added Vermiculus. “The compressed settlement timeframe has widened the technology gap between market leaders and laggards, potentially driving industry consolidation as smaller firms struggle with implementation costs.”

Simon Vincent, head of product management at Meritsoft, a Cognizant company, which provides post-trade automation, argued that the US move to T+1 has been a “resounding” success.

“Automation was a key enabler, and as Europe looks to move to T+1, it will need to embrace the recommendations of the relevant taskforces set up to analyse the impacts,” Vincent said in an email. “Coordination across jurisdictions will be key to success due to the complexities which exist in the various markets.”

European transition to T+1

Andrew Douglas, chair of the UK Accelerated Settlements Taskforce, said firms should use the UK’s transition to a T+1 as an opportunity to reassess how their post-trade systems are configured during a webinar hosted by DTCC, the US post-trade infrastructure.

“Transition to next-day settlement will not mean just losing one day from the settlement cycle,” Douglas added. “Rather, settlement counterparties will lose up to 83% of the time previously available for transaction processing and for managing any exceptions that they may encounter.”

The Investment Association (IA), Personal Investment Management and Financial Advice Association (PIMFA) and Alternative Investment Management Association (AIMA) have issued a recommendation encouraging firms to alter their fund settlement timings to T+2 on or before 11 October 2027.

Chris Cummings, chief executive of the Investment Association, said in a statement that it’s extremely important that the funds industry keeps pace with broader changes in financial services infrastructure.

“The move to T+2 for funds will encourage greater global alignment on settlement cycles, enabling better services for investors, fostering a more robust financial ecosystem and improving the competitiveness of UK and European funds,” said Cummings.

Sabine Farhat, Head of securities financing, lending and repo product management at Murex, the capital markets technology provider, said in an email to Markets Media that there are several challenges in Europe. For example, a centralized inventory is needed to locate the appropriate security to use in a repo transaction to meet the shortened settlement timeframe.

Jesus Benito, head of domestic custody & TR Ops at SIX, the Swiss and Spanish financial market infrastructure, said in an email to Markets Media that Europe can learn from the US playbook but faces its own unique challenges.

“Addressing these early – and doing so collaboratively – is essential, given the added complexity of the UK, EU and Swiss markets moving together,” added Benito.

James Pike, chief revenue officer at Taskize, which provides pre- and post-trade automation, said in man email to Markets Media that the UK and Europe face communications challenge in resolving settlement issues due to the number of asset managers, broker-dealers, custodians and sub-custodians.

“Market participants must streamline the way trades are settled and exceptions resolved – from agreeing more of the post trade components at the point of trade, to enabling much faster dispute resolution mechanisms which ensure clearer communication between broker-dealers, asset managers and custodians,” said Pike.