OneChronos ATS, a periodic auction dark pool, has received regulatory approval and is aiming to launch before the end of this year.

Jesse Greif, chief operating officer at OneChronos Markets, the broker-dealer subsidiary of Silicon Valley funded start-up OCX Group, told Markets Media that the platform has satisfied all of its regulatory obligations. The venue is expected to go live in the fourth quarter of this year.

Greif said the firm has about 19 subscriber agreements and is performing user testing.

Jesse Greif, OneChronos Markets

“We will flip the switch when we feel we have enough algo-providing banks that have completed FIX and testing certification,” he added.

The venue’s Form ATS-N is available on its website.

“ATS-N is a pretty cool piece of regulation because anyone can look online and find the form for any US equities dark pool which details how it operates,” Greif said.

He explained that this type of standardized transparency will allow dark pool market share to scale.

“We are very excited and that was a big milestone for us,” he added.

OneChronos’ matching engine initiates auctions throughout the trading day, every tenth of a second. As a result predatory trading strategies will be rendered ineffective in the venue according to Greif. He continued that one of the values of periodic auctions is that they offer unique liquidity.

The US Securities and Exchange Commission has also approved the introduction of periodic auctions in the US by Cboe Global Markets.

The exchange has been using the mechanism in Europe where periodic auctions last for very short periods of time during the trading day to help market participants find liquidity quickly with low market impact, while prioritizing size and price.

“We differ from other auctions because we do not prioritize orders based on a race for speed,” added Greif. “We are using modern engineering techniques to optimize for price improvement as much as possible.”

This allows OneChronos to help brokers strengthen and differentiate their equities trading algorithms, and enhance execution quality for their clients.

OneChronos also allows for expressive bidding i.e the specification of constraints by trading algorithms or their users, For example, only trade when an imbalance is above a certain magnitude or only buy a certain stock if they can sell some other shares, which may appeal to some traders.

Greif estimated that in the US there are only a few periodic auctions in dark pools with a market share of between 40 to 45 basis points.

“We are pretty confident that the equilibrium is much higher” added Greif. “We hope that dark pool market share will rise and that we will be a catalyst for that growth.”

Off-exchange volume

The launch of another dark pool in the US comes as there have been discussions in the US about the volume of trading that takes place off exchanges.

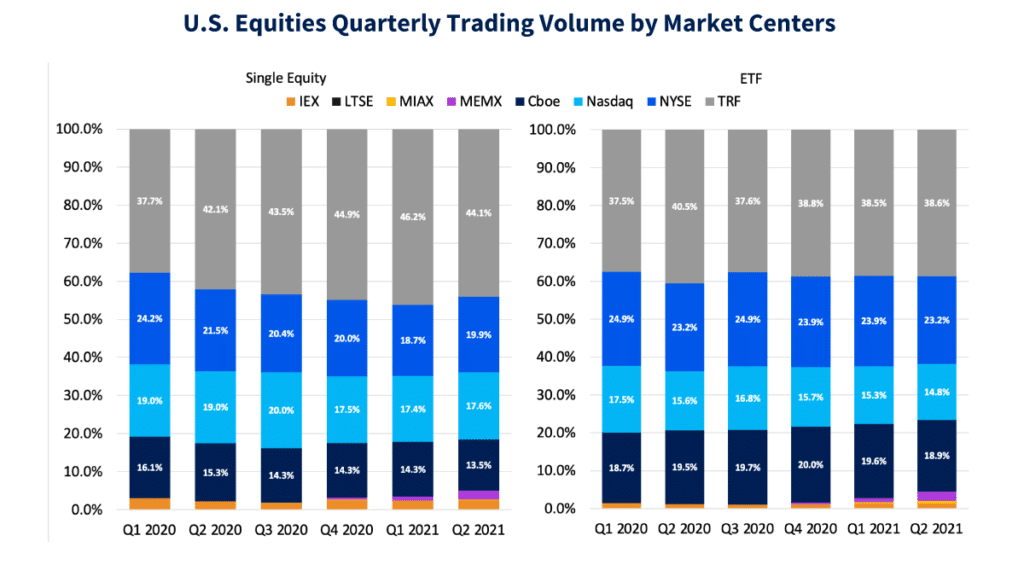

Shane Swanson, equities and financial technology expert in consultancy Coalition Greenwich’s market structure and technology practice, said in a blog that off-exchange trading volume has grown from 34.49% of overall average daily volume in 2017 to 44.29% in the first half of this year according to data from Trade Reporting Facilities (TRFs).

*New Blog* Maneuvers in the Dark – Examining the Equity Markets Renewed Dark Pool Obsession https://t.co/ZhdNxzmuja via @CoalitionGrnwch by @GreenwichShane

— Coalition Greenwich (a division of CRISIL) (@CoalitionGrnwch) August 10, 2021

Swanson continued that the vast majority of trading off-exchange occurs with market makers, as in the US retail trades are not executed on exchanges but most are sold to market makers under “payment for order flow” agreements.

“That said, we do see an anticipated increase in [dark pool] usage over the next three years across all sizes of institution participants,” he added. “We also see a relatively large increase in the use of low touch/algorithmic access.”

Greif estimated that dark pools contribute to between 10% to 11% of TRF volume.

Gary Gensler, chair of the SEC, has said in speeches that he has asked the regulator’s staff to consider the impact of payment for order flow.

Gary Gensler, SEC

“Significant trading interest on these platforms is not necessarily being reflected in the commonly cited National Best Bid and Offer quote,” said Gensler. “I’ve asked staff to consider whether this equity market structure, as currently composed, best promotes efficiency and competition.”

Market makers internalize retail flow and capture the majority of the spread, in return for offering retail investors a slight improvement on the exchange price.

“We’ve seen a notable rise in payment for order flow in the U.S., something that you’ve banned in the United Kingdom,” Gensler added. “Canada and Australia also don’t allow broker-dealers to route retail orders to wholesalers in return for payments.

Cboe’s Equities Execution Consulting has seen growth in retail trading activities in the past year and a half. Cboe said in a report that principal broker-dealers have been the largest beneficiary of this growth among non-displayed market centers.

Before the Covid-19 pandemic, ATSs and principal broker-dealers had similar market share, with each holding 50.9% of non-displayed trading volume, according to an analysis by Jeff Nguyen, an intern at Cboe.

Source: Cboe.

“By July 2020, principal broker-dealers’ market share climbed significantly, outpacing ATSs by 4,975 basis points,” the report added. “At its peak in January 2021, the difference in market share between the two groups was 5,680 bps, likely driven by the “meme” stock trading phenomenon.”

Cboe said this significant shift in off-exchange execution introduces price transparency risks that Regulation National Market System (RegNMS) was created to address.

US market structure

There have been changes in US market structure this year with exchanges buying alternative trading systems.

In August Nasdaq announced it had acquired a significant minority stake in LeveL ATS, an independently operated US equity dark pool, joining Bank of America, Citi, and Fidelity as owners.

Nasdaq’s deal follows Cboe Global Markets’ purchase of BIDS Trading, the largest independent block trading alternative trading system in the US. TP ICAP also completed its acquisition of dark pool Liquidnet in March this year.

Brad Bailey, Celent

Brad Bailey, research director in the capital markets division of consultancy Celent, told Markets Media in August that there are significant reasons why firms are rethinking their venue ownership and the products they can offer to different segments of the market.

“There’s a lot of potential for change,” Bailey added. “We are seeing a new wave of innovation in marketplaces and people are placing bets.”