Pershing Trading Services expects to double the number of clients using its equity trading services in Europe, Middle East and Africa which provides integrated execution to custody as an arm of BNY Mellon.

Michael Horan, head of trading at Pershing EMEA, told Markets Media: “We are not an agency broker in disguise as we get in the room with the client. We consult with them on execution which may be voice, electronic or in esoteric markets.”

There are 20 staff in the team with trading desks in New York, Australia and Canada, as well as London. Global equity trading services are being expanded to firms who do not hold custody on the Pershing platform and beyond UK and Ireland.

“We have been very successful in the UK so clients in EMEA then contacted us,” Horan added. “A year from now we would expect to have double the number of clients.”

Pershing Trading Services had more than 50 clients in October last year and has since signed up another 17 clients.

Horan explained that asset managers want to outsource trading because of the high fixed costs of paying for a team of traders and the investment in necessary technology, especially with the increase in regulation. For example, the MIFID II regulations in the European Union have given more responsibility to the buy side for both regulatory reporting and evidencing best execution. In addition, fund managers are under pressure on fees as passive funds are gaining increasing inflows.

“We have integrated processes from execution to custody all in one place. Our sweet spot is medium-sized asset managers with two to five traders,” he added.

Horan continued that Pershing also has a team of experienced traders, with many contacts, which became important when volatility increased due to the Covid-19 pandemic.

“During the height of the Covid-19 pandemic clients could not find liquidity on screen and trading became very high-touch,” he said. “Volumes rose to between three and four times our average.”

Geoff Towers, chief executive of Pershing Limited, said in a statement: “Over the past few years we have made our services increasingly modular so that clients can switch on or off the parts they need as their business model evolves. Extending our trading services as a stand-alone offer, as well as offering it as an integrated execution, clearing, settlement and custody service, was a natural extension of this.”

Growth in outsourcing

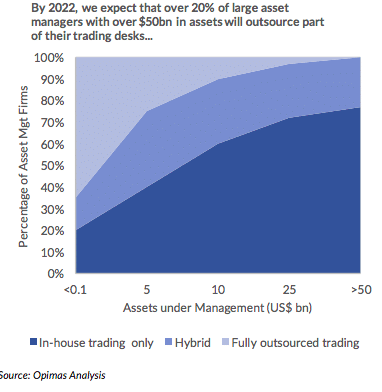

One fifth of investment managers with assets under management greater than $50bn (€44.5bn) will outsource some portion of their trading desks by 2022 according to a report last year from consultancy Opimas.

The report said the future for outsourced trading desks looks bright as an increasing number of large asset managers will outsource some of their trading activities.

“Most frequently, this will involve foreign equities in different time zones, where staffing becomes problematic,” added the study. “On the smaller end of the scale, asset managers with more limited assets under management will continue to rely on third parties for their trade execution, but they will be more reluctant to add full-time staff, even as their assets grow.”

As a result, Opimas predicted that revenues for providers of outsourced trading services will grow between 20% to 30% annually.

“The headwinds the asset management industry is facing now will continue for the foreseeable future, which is a boon for these providers,” said the study.