Jeffrey Sprecher, chair and chief executive of ICE, said one of the attractions of investing in Polymarket was the prediction market’s use of smart contracts to take advantage of the new blockchain banking infrastructure, which will help ICE adapt to using tokens as collateral 24/7 in the future.

In October this year ICE announced a strategic investment of up to $2bn in Polymarket, a prediction market platform.

Sprecher said on the third quarter results call on 20 October 2025 that ICE was an early investor in the crypto space, in Baakt and Coinbase, in order to stay close to the evolution of the market’s use of blockchain.

“Polymarket expands our footprint into decentralized prediction markets, which is aligned with our commitment to providing innovation and data-driven insights to our customers,” he added.

Traditional regulated financial firms were slow or unwilling to adopt tokens during a period of regulatory uncertainty. However, a more favourable US administration has led to ICE more actively leaning into the knowledge about blockchain that it has accumulated over the past decade, according to Sprecher.

“One of the significant macro trends of the past decade of blockchain investment is a rewiring of the rails of the banking system,” he added.

For example, ICE operates six clearing houses around the world, all of which are highly regulated in their local jurisdiction and have operate within the limitations of local banking hours. Therefore customers place excess collateral at clearing houses to meet these requirements. However, onchain banking allows for instantaneous margin calls and trade liquidations 24/7.

Sprecher said: “ICE decided to invest in Polymarket as we’re impressed with the design of its underlying architecture of smart contracts that take advantage of this new banking infrastructure.”

Alongside its investment, ICE has also formed a strategic data agreement with Polymarket to become a global distributor of the firm’s event-driven data as the leader in non-sports prediction markets. Polymarket provides real time probabilities on events such as elections, economic indicators and cultural trends which Sprecher said offer a “powerful” new layer of insight, supporting more informed decision making.

“We believe that we can accelerate Polymarket’s acceptance into the traditional financial system by virtue of our distribution and long-term customer relationships,” Sprecher added.

In addition, Polymarket’s engineering team can help ICE better understand its adoption of evolving banking technology, which is already paying dividends, according to Sprecher. For example, ICE is in the process of rolling out an advanced clearing model for its global clearing houses, called ICE Risk Model II, and the regulatory environment may eventually allow tokenized assets to be used as collateral 24/7.

Sprecher said: “We believe Polymarket has done something particularly innovative and special in the way they have historically settled their contracts. It’s a true blockchain non-intermediated settlement between two parties sending tokens on a second layer that gives them some performance capabilities.”

As ICE needs to have six clearing houses around the globe, clients tend to keep excess collateral at all six due to the need to move capital around when they are open in local hours. Having 24/7 collateral mobility will allow the exchange to minimize overall margin requirements for customers, which Sprecher said will feed its way into higher trading volumes.

In addition, Polymarket has been educating ICE on how the prediction market went to market with retail customers and created brand awareness with a small balance sheet.

“We’re trying to educate them on traditional finance while they educate us on consumer finance, and hopefully that’ll pay dividends for both of us down the road,” added Specher. “It just made sense that the teams work together to educate one another, in the hope that ‘one on one makes three.’”

Polymarket has also pioneered the rapid listing of new markets driven by real-time consumer demand, according to Sprecher. In contrast, traditional exchanges need regualtory approvals for new product launches, which take 30 days at a minimum and usually much longer.

“Polymarket is forcing a dialog in the U.S. on how to minimize government regulatory burdens so as to not impede innovators,” said Sprecher. “We think this dialog will ultimately benefit new product innovation for all markets and certainly for ICE.”

Warren Gardiner, chief financial officer of ICE, said on the call that the initial $1bn investment in Polymarket was funded through commercial paper issuance in early October. The remaining $1bn is also expected to be funded from existing capacity in ICE’s commercial paper program.

Sprecher said: “We are not a venture firm and you guys won’t reward us if we make money on that investment. I think we’ll be rewarded if we can bring the underlying technology into our workflow, increase our sales revenue and manage our costs.”

ICE Aurora

Ben Jackson, president of ICE and chair of ICE Mortgage Technology, said on the call that technology and innovation have been foundational to ICE since its inception and the firm’s approach to AI is a natural extension of that legacy.

“We are now taking the next step by combining our pursuit of workflow automation across our business processes with the solutions we provide to our clients through generative and agentic AI under the name of ICE Aurora,” added Jackson.

ICE conducted a risk assessment of how much automation can be applied to every workflow based on the impact, technical maturity, accuracy and model explainability in the AI tools from a scale of zero for fully manual to five for fully automated.

For example, within the reference data business ICE processes approximately 40,000 documents per month using AI, achieving over 95% accuracy in extracting reference data from fixed income prospectuses.

“We have clear visibility of where we can go and are executing on this in many areas,” said Jackson. “That is our strategy and what our ICE Aurora platform is about.”

Jackson said ICE is already seeing results in streamlining and automating workflows across systems, accelerating product development and dramatically accelerating the speed of modernizing multiple tech stacks within the group. He claimed that ICE’s proprietary data is the cornerstone of its business and a “key differentiator” in the evolving AI landscape.

ICE is using AI with its new sentiment indicator datasets, including Reddit, Dow Jones and soon, Polymarket, according to Jackson.

Can confirm this is true.

Polymarket is now a widely used institutional data source, alongside Bloomberg. https://t.co/w6FaqfCB62

— Matt Hougan (@Matt_Hougan) October 30, 2025

“Google and Meta AI models help process these data sets and identify patterns,” he added. “While still in the development phase, these data sets are particularly attractive to market participants seeking an edge through differentiated data inputs.”

As AI becomes embedded in trading strategies across all areas of investing, Jackson expects ICE’s proprietary data to grow in strategic importance and providing a competitive edge to users of AI models that depend on precision, depth and large quantities of historical data.

AI has accelerated the speed to market for certain ICE products. For example, the time to convert code for index qualification, calculation and reporting has been reduced by approximately 60%.

ICE is also using machine learning to power key components of its evaluated pricing model to predict bond prices. Additional ICE models use historical data to determine bid-ask spreads across the bond universe.

“Machine learning capabilities significantly improve evaluation quality when measured against actual trades in the market,” said Jackson.

Sprecher said ICE sees the jagged intelligence phenomena at play for both its own AI adoption and for its customers. Jagged intelligence refers to performing AI very well at certain tasks but becoming unreliable across enterprise functions.

He gave the example of ICE engineers using AI copilots to help write code more effectively, particularly for modernizing legacy technology. However, to fully deploy production code at scale and at the latency precision which ICE operates, the firm requires unique skill sets that are not available in AI.

“Our current experience is that AI has become a good assistant for our teams, but not a replacement,” adde Sprecher. “The current state of AI is helping us to control costs and new hiring and driving sales and transaction growth at the margin.”

Financials

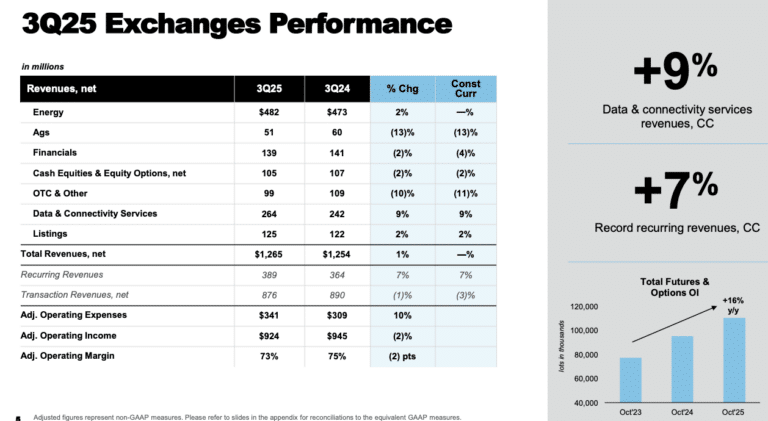

Gardiner said the group had record third quarter results and has generated all-time high revenues and operating income during the first nine months of this year.

Third quarter net revenue increased 3% year-on-year to $2.4bn. Operating income rose 6% over the same period to $1.2bn.

Net revenues were underpinned by 5% increase in recurring revenue according to Gardiner. Recurring revenue growth was fuelled by a 9% rise in exchange data and a 7% increase in fixed income and data services, which reflected sustained demand for ICE’s “high value” proprietary data offerings.

“Strategic investments in data center infrastructure are paying off,” Gardiner added. “This is driven by increasing demand for data and increased capacity, as well as clients preparing to integrate AI into workflows.”

Exchange net revenues in the third quarter were $1.3bn, which Gardiner said built on strong double-digit growth in the prior two years.

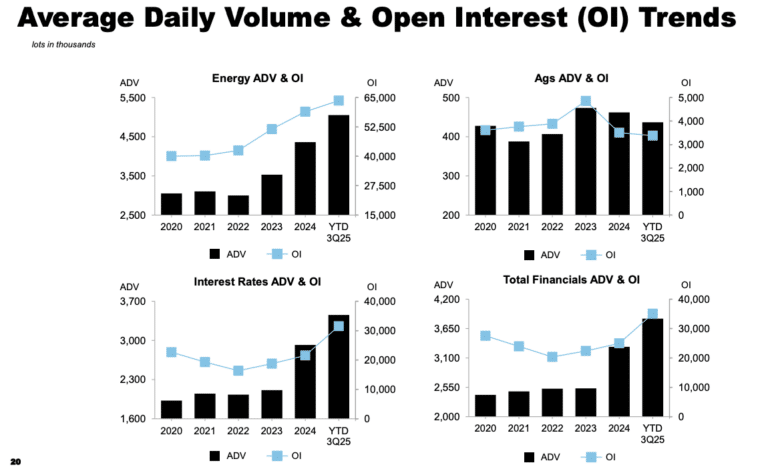

Transaction revenue was $876m in the third quarter. Towards the end of October, open interest across the futures and options complex surged 16% year-over-year, energy futures open interest rose 14% and interest rate futures open interest climbed 37%.

Jackson said the macro trend of AI and data center expansion is expected to drive significant energy demand over the next decade, which will boost trading and clearing across ICE’s energy complex. He argued: “ICE is uniquely positioned to support customers despite lower overall market volatility.”

Third quarter volumes in ICE’s global gas and power markets were up 8% and 18% year-over-year respectively. Open interest, a leading indicator of future growth, in energy futures reached a record in October, up 14% year-over-year.

In the index business, ETF assets under management tracking ICE indices reached a record $754bn at the end of the third quarter.