On 28 April this year TMX Group, the Canadian financial market infrastructure, went live with its modernization of CDS, the country’s equities and fixed income clearinghouse, which had begun back in 2019.

The project involved replacing some legacy systems at CDS including those related to clearing and settlement, and entitlement payment systems.

Kevin Sampson, president at CDS, told Markets Media: “This is the largest single platform financial market infrastructure (FMI) transformation and migration that has been successfully accomplished in terms of transitioning the full suite of post-trade services.”

He continued that the group has spent numerous years building and customizing for the Canadian market to ensure the needs of market participants were met, and to have a high level of confidence in success. The project was initially launched with CDS participants, key service providers and vendors in 2019 in order to future CDS’ technology capabilities and modernize the infrastructure for the Canadian market. This allows CDS to meet the needs of regulators, the expectations of clients and to be well positioned to support increased global investment into the Canadian market according to Sampson.

The technology was provided by TCS BaNCSTM for Market Infrastructure, a clearing and settlement solution provided by Tata Consultancy Services (TCS), CDS’ previous technology partner. Sampson said TMX had a “very thorough” process to assess future needs and it was clear that TCS could offer the capabilities and best-of-breed technology that was needed.

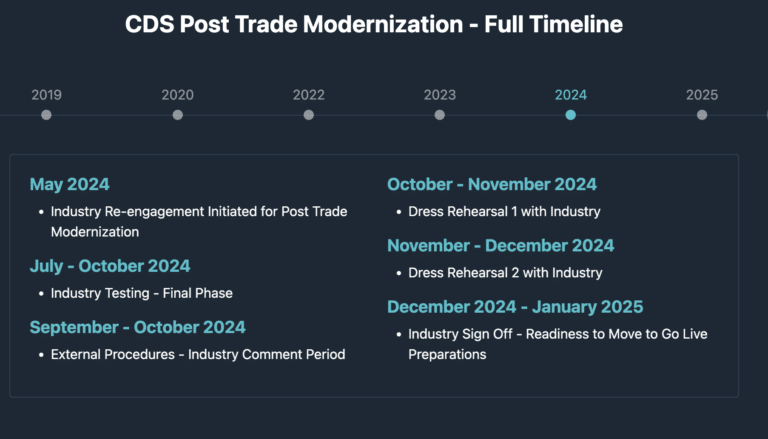

Sampson said TMX undertook “very robust and extensive” testing with industry participants and other stakeholders.

There were multiple dress rehearsals around the conversion weekend because leaving anybody behind was not an option, Sampson added.

“We completely advanced our core technology capabilities that underpin our post-trade services in CDS,” argued Sampson. “This was a game changer for the Canadian market in terms of having best of breed, efficient, resilient, and adaptive post-trade infrastructure.”

He explained that the new technology gives CDS a foundation to invoke change management and enhance systems and services in a more efficient, agile and robust fashion. The upgrade also positions CDS well in terms of managing through volatility and adapting to increasing demands from a capacity and resiliency perspective.

In addition, a new front-end system allows participants to access information in a more efficient manner. There is also more information and transparency from some of CDS’ risk modelling and components related to collateral margin requirements.

“We are very excited to put this foundational technology in place to amplify and advance our existing suite of solutions and services, and accelerate the development of new market solutions such as our Canadian Collateral Management Service (CCMS),” said Sampson.

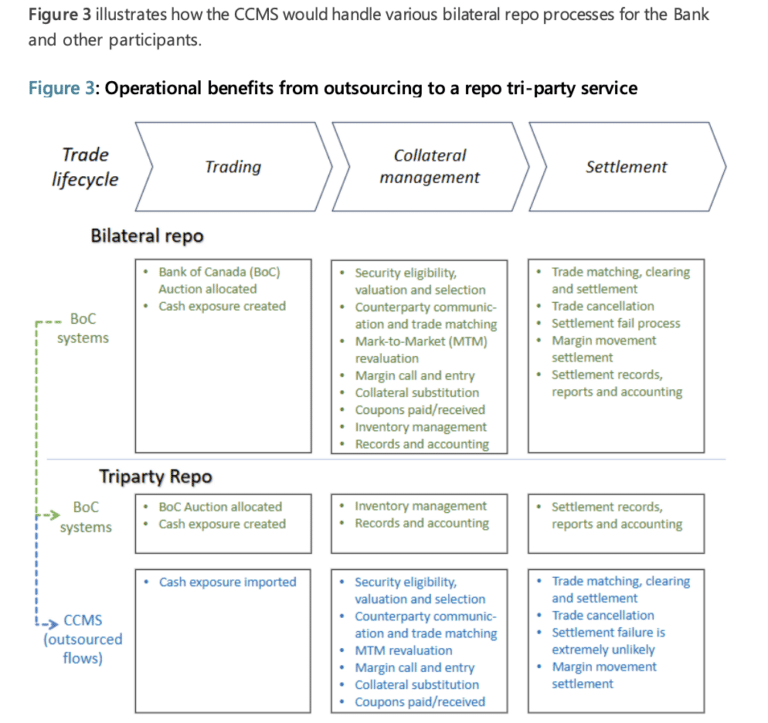

The CCMS was launched in 2024 in partnership with Clearstream Banking, the international central securities depository of Germany’s Deutsche Börse Group. It introduced domestic tri-party repo capabilities for the first time in the Canadian market to increase repo market liquidity, as well as increasing automation ahead of the move to T+1. The platform streamlines and simplifies end-to-end domestic collateral management activities, which decreases capital requirements.

In February this year the Bank of Canada, the central bank, decided to use CCMS which TMX said is a significant step because the participation of the central bank in domestic tri-party operations is a key facilitator for the broader market.

Marton Szigeti, head of collateral, lending & liquidity solutions at Clearstream, said in a statement: “The Bank of Canada deciding to join the service underlines its strategic significance for the stability, efficiency and innovative power of the country’s capital markets.”

The Bank of Canada said in a staff analytical note that before CCMS the Canadian repo market relied heavily on bilateral transactions because of the absence of a tri-party infrastructure. This led to operational inefficiencies due to manual procedures and high operational costs for new market participants, including corporate treasuries and foreign investors.

“Critically, the CCMS will enhance the Bank’s ability to rapidly scale up its operations during a crisis, accommodating increases in transaction volumes, in the types of eligible collateral and in counterparty participation,” said the Bank of Canada. “This scalability will empower the Bank to provide emergency liquidity more quickly and efficiently than previously possible, should severe market stress warrant such intervention.”

Financials

After a period of stabilization for the new CDS platform, Sampson said the group will start investing in the suite of core services from depository, issuer services, clearing, settlement and asset servicing to enhance and broaden their scope.

In the first quarter of this year, TMX Group reported record revenue of C$419.1m, up 21% from the first three months of 2024.

John McKenzie, chief executive of TMX Group, said in a statement: “The first quarter marked important progress in key enterprise initiatives, including the successful implementation of major upgrades to CDS’s foundational clearing technology, designed to boost Canada’s ability to compete for global investment flows.”

The results report said early feedback on the post-trade modernization project, has been “very positive.”

“The launch of the modernized systems enables faster, more cost-effective updates to adapt to evolving market needs, and provides new opportunities and capabilities in TMX’s post-trade businesses,” said the report.

Following the launch of the project, TMX expects amortization and depreciation expenses of approximately C$2.5m per quarter, partially offset by savings beginning in 2H/25 reaching full run-rate in 2026. Since the start of the modernization project, TMX has capitalized a total of C$147.4m to 31 March 2025, including C$16.7m in 2024, and C$3.3m in Q1/25.

The group said the the launch of the post-trade modernization project, and organizational changes are “designed to advance the evolution of the enterprise, creating stronger alignment across corporate functions, and enable TMX to scale efficiently as it executes a client-centric strategy to diversify, innovate, and globalize.”