In March this year Lazard and Deutsche Bank both announced partnerships to expand in private credit, highlighting investor demand and their need for support from fund administrators in this space.

DWS and Deutsche Bank announced a strategic cooperation to develop private credit origination and investment opportunities for the asset manager’s clients across the private credit space. As part of the cooperation, DWS will have preferred access to certain asset-based finance, direct lending and other private credit asset opportunities originated by the bank.

Stefan Hoops, chief executive at DWS, said in a statement: “Private credit is a key offering for our clients who are looking for exposure to real-economy investments.”

Lazard, the financial advisory and asset management firm, also said in a statement that it IS partnering with Arini Capital Management, an alternative credit manager, for direct lending across Europe, Middle East and Africa. Jean-Louis Girodolle, Lazard’s co-head of European investment banking, said in a statement that the growth of private capital is deeply relevant to the firm’s European clients.

Hamza Lemssouguer, founder & chief investment officer of Arini, said in a statement: “Arini has deep roots across European and global credit markets where we have been seeing significant convergence between public and private credit.”

Charly Guyot, global head of loan solutions, Securities Services at BNP Paribas, told Markets Media: “Major financial institutions are making strategic acquisitions to bolster their presence in private credit. As the market continues to expand, the demand for scalable and efficient solutions has driven the success of our offerings.”

Data challenges

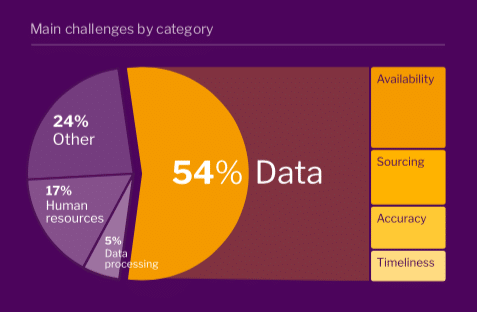

In private markets the majority, 55%, of fund administrators consider data acquisition and data governance their primary operational challenge, with significant concerns expressed about data availability, accuracy, and timeliness according to a survey from Pascal Hernalsteen for Accelex and FactSet. The survey covered 16 private capital asset servicing firms who oversee more than $13 trillion in assets under administration.

Data challenges have intensified due to the increasing complexity of fund structures and growing regulatory demands. For example, private credit structures can include covenants, multi-tiered loan tranches, floating interest rates, and bespoke repayment schedules, all of which require tracking and reporting. Loan-level data must also be frequently updated for changes in interest rates, borrower creditworthiness and covenant compliance.

In addition, the push to give retail investors more access to private markets is reshaping the industry’s scale and operational requirements according to the survey. For example, BlackRock has launched the first customizable model portfolio that includes access to both private and public market assets through a a Unified Managed Account (UMA). Retail typically invests in smaller ticket sizes but greater numbers, which significantly increases the volume and complexity of data that fund administrators must handle.

The report said: “The private capital asset servicing industry stands at a pivotal crossroads, where the need to balance operational efficiency with exceptional service quality is more critical than ever.”

Securities Services at BNP Paribas pulls data from various sources to allow clients to gain an aggregated view across the private debt markets to manage investments more efficiently. BNP Paribas Caplink Private, the client digital platform, has been designed to streamline operations, provide advanced analytics and insights from data aggregation, according to Guyot.

Guyot added: “Investors can find it challenging to navigate private markets due to the fragmented nature of data, and the need for near real-time data and actionable insights.”

He said the bank has been consistently investing to build the best technology stack available for private debt solutions dedicated to alternative investors, by marrying up internal solutions and external fintechs. For example, BNP Paribas Group has formed a strategic partnership with Mistral AI, a French fintech.

In July 2024 BNP Paribas said in a statement it had signed a multi-year partnership to provide access to current and future Mistral AI commercial models across all the bank’s business lines. The fintech’s large language models can process and analyse unstructured data from diverse sources according Guyot and the bank consolidates and normalised data in a unified system.

“Integrating these technologies into our operating model analysis increases data accessibility, accuracy and it facilitates more informed decision making for clients,” Guyot added. “Infrastructure requires substantial long-term investments and that is what we have been doing.”

The survey said AI offers a transformative opportunity to overcome the inherent complexities of managing and leveraging private market data by automating data acquisition from diverse and unstructured sources, while ensuring consistency and accuracy at scale. AI also facilitates real- time validation and anomaly detection capabilities which reduces errors and risks associated with manual data processing.

Scalability

“There has been a pivot to data-driven solutions and this strategic shift has been essential to manage complexity and ensure business resiliency,” said Guyot. “This proactive approach to operational risk management has been crucial and is critical to scaling our operations in the private debt area efficiently.”

In BNP Paribas Group’s fourth quarter results, the bank said securities services signed new mandates and had a “very strong” increase in revenues, which included continued “robust” development in private capital.

Guyot said drivers behind recent success in winning mandates with alternative investors has been a commitment to innovation and technology, as well as continuous investment in human capital. He highlighted that the skills required for a career in finance, and more specifically private assets, are changing rapidly and increasingly include proficiency in coding and data science.

“These profiles are becoming the front line to build systems that automate interactions, and turn data into valuable information which provides a competitive edge,” he added.

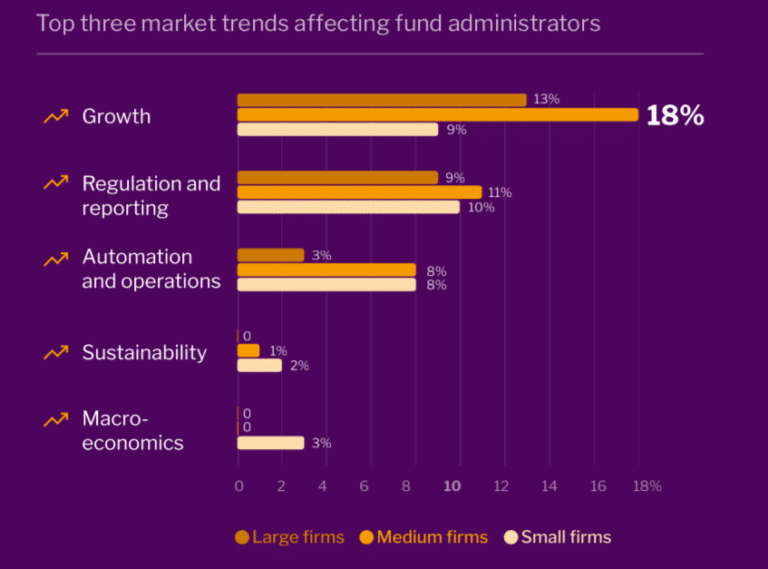

The survey found that scalability has become a critical objective for fund administrators as private markets grow sector and the client base becomes increasingly diverse Scaling operations often highlights talent shortages, especially for skilled client-facing roles and the report recommended that firms invest in training and retention strategies to ensure that their workforce can grow in parallel with operational demands.

Guyot said: ”We are looking forward to driving sustainable growth in an increasingly competitive landscape. General Partners expect us to partner with them in the long term to co-create platforms which combine specialised asset servicing, financing and distribution.”