Nelson Chu, founder and chief executive of private credit platform Percent, has compared private credit to the high yield market of the 1980s.

“The high yield market was historically super opaque but participants agreed to standards and the market took off,” Chu said. “Private credit is having its high yield moment.”

The majority of wealth and asset managers expect to increase their allocations to private credit in the next year according to research from Percent and consultancy Coalition Greenwich.

Their survey, Wealth and Asset Managers Focus on Private Credit, said 63% of respondents. expect to increase their allocations to private credit in the year ahead, compared to the 7% who expect their allocations to decline and the 50% who increased allocations in the past year. The private credit market grew to $1.3 trillion at the end of last year and it has been estimated to more than double to $2.7 trillion by 2026 according to the report.

Coalition Greenwich interviewed 77 investors in the US familiar with private credit markets in the summer of this year. The majority manage $250m or less with an average allocation to private credit of 10%, above the 3% average allocation of U.S. pension funds according to Coalition Greenwich data.

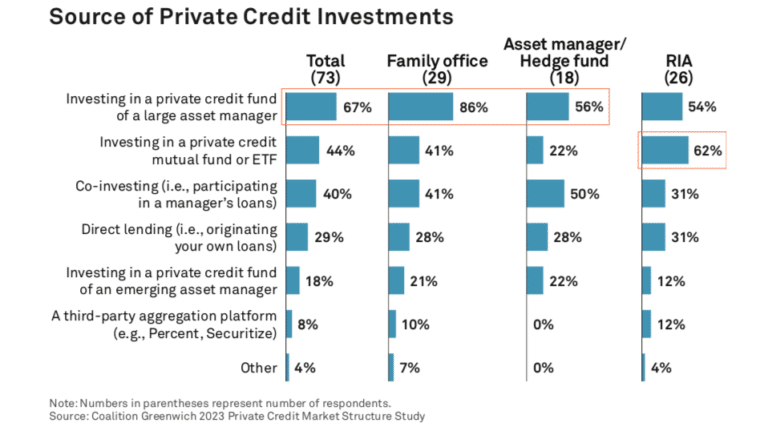

The majority acquire their private credit exposure through funds offered by large asset managers, and as result large asset managers such as Apollo, KKR and Blackstone account for the majority of private credit assets under management.

In the third quarter of this year BlackRock closed its acquisition of private debt manager Kreos Capital, which provides growth and venture debt financing to companies in the technology and healthcare industries. BlackRock has been building private markets capabilities and generated nearly $3bn of net inflows in the third quarter, driven by infrastructure and private credit.

Martin Small, chief financial officer, said on the third quarter results call that the asset manager was seeing bigger and better private markets opportunities for BlackRock and its clients.

“It is the long tail of investors – boutique asset managers, wealth managers and family offices -that are increasingly entering the market and acting as the source of funds for small and medium-sized businesses around the world,” added Coalition Greenwich.

Public liquid alternatives such as exchange-traded funds and mutual funds are also common, particularly with wealth managers whose clients often prefer investments through traditional investment vehicles according to the survey. Co- investing, or direct participation in loans originated and subsequently syndicated by a manager, is also popular, particularly with asset managers who have sophisticated expertise and due diligence capabilities.

Challenges

Colm Kelleher, chair of UBS, has warned that the next financial crisis is likely to be in the non-bank lending sector and that the growth of private markets is a cause for concern. The study also highlighted challenges to the growth of private credit.

“A lack of liquidity, particularly when investors are looking to sell, and high fees are seen as the biggest impediments to further investment in the asset class,” said the report.

In addition, high fees present a bigger roadblock for asset managers as private credit/alternative fund managers typically charge a 2% fee on assets under management and a 20% carried interest fee on profits.

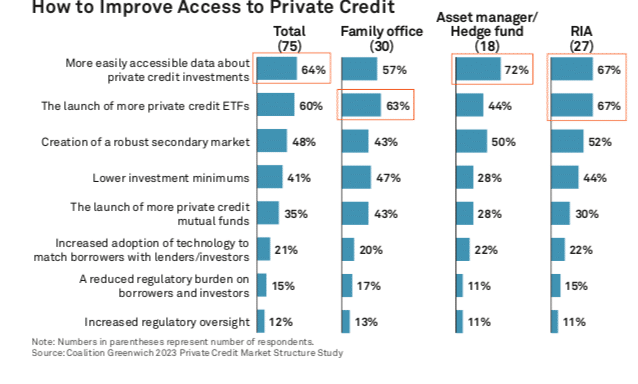

Kevin McPartland, head of research for market structure and technology at Coalition Greenwich, told Markets Media there is a desire for more transparency and better access to data.

“There are always calls for more information, but this is a market that clearly is attractive to many investors,” said McPartland.

Coalition Greenwich suggested that a more impactful long-term approach to improved market access would be to focus standardized company information to foster the creation of a robust and standardized secondary market for individual loans as the history of capital markets has displayed many examples of robust and accurate data leading to increased liquidity and secondary market trading.

For example, public reporting of trading data for corporate bonds was mandated in 2002, which Coalition Greenwich said paved the way for more investors to enter the market, increased electronic trading and improved market liquidity.

McPartland continued there are incentives for asset managers to provide more data and be more transparent because that is what investors are demanding.

“If that is the case, then the big data providers start to collect and aggregate information in one tool which then allows investors to make the most informed decisions,” he added. “It is a virtuous cycle.’

The report added that more robust “exchanges,” operational efficiency in the form of interconnected trading and investment platforms, and standardized, easy-to-consume data will go a long way toward opening up the private credit market even further.

Chu said Percent’s technology can provide a standard private placement memorandum and expose risks. Percent can also provide weekly and monthly reporting for nearly all its issuers to provide transparency that has historically been hard to get, but that investors are demanding.

“We have also tried to create a standardised structure so we can compare deals without scanning through term sheets and company data,” he added.

Performance

Nearly three quarters, over 70%, of study participants expect private credit to outperform U.S. government bonds and U.S. corporate bonds in the coming year.

The report cited private equity firm KKR who has estimated that private credit is expected to return 11% annually over the next five years. Private credit instruments based on loans to lower middle market companies offer even higher returns, topping 18% in September 2023 according to data from Percent.

“This sheds light on the two-thirds of respondents who demand returns over 11% to make private credit attractive over other alternatives,” said the report.

Chu added that private credit is fairly uncorrelated to the broader public markets and that the sector tends to do well in times of increased regulatory scrutiny.

He acknowledged that a tailwind could be maturities that are coming up for some larger private credit opportunity funds, and if defaults increase or there is a cascade of restructurings.

Chu added: “Having said that, a lot of things are being priced in the market right now.”