This month JPMorgan Chase and technology company Infleqtion released a new open source quantum software library designed to improve the efficiency of potential applications and use cases. This reinforces the belief of Brad Levy, chief executive of Symphony, which provides four interconnected platforms for messaging, voice, directory and analytics (MVDA), that quantum computing will destabilize, and may invalidate, many foundations of business, including current encryption methods.

Infleqtion said the new library addresses one of the biggest current barriers in quantum computing, which is the scale of hardware typically needed to achieve practical fault tolerance. The library allows between 10 and 100 times reductions in the number of physical qubits required to run quantum programs. Qubits enable computing exponentially faster than the classical systems based on binary logic.

Pranav Gokhale, general manager of computing at Infleqtion, said in a statement: “Through our work with JPMorgan, we’re showing how software and hardware innovation, especially the flexibility of our Sqale quantum processor, can work together to move the financial industry toward commercial use of quantum computing faster.”

The Symphony Innovate conference in London on 21 May 2025 included a panel on cybersecurity and quantum panel. Levy told Markets Media: “The undercurrent is that if we can’t figure out how to protect ourselves in a world of basic speed and binary technology, then we have to really be concerned about security and encryption.”

In January last year the World Economic Forum (WEF) and the FCA, the UK regulator, published a white paper on a roadmap to inform global regulatory and industry approaches for a quantum secure financial sector. The paper said the financial sector “stands on the brink of a transformation from a digital economy to a quantum economy.”

In a blog in April 2025, Markets To Mars: How Quantum Will Change the Fabric of Finance Forever, Levy and Dietmar Fauser, chief information officer at Symphony, said quantum computing will destabilize and may invalidate current encryption methods, and will also accelerate artificial intelligence to unimaginable speeds.

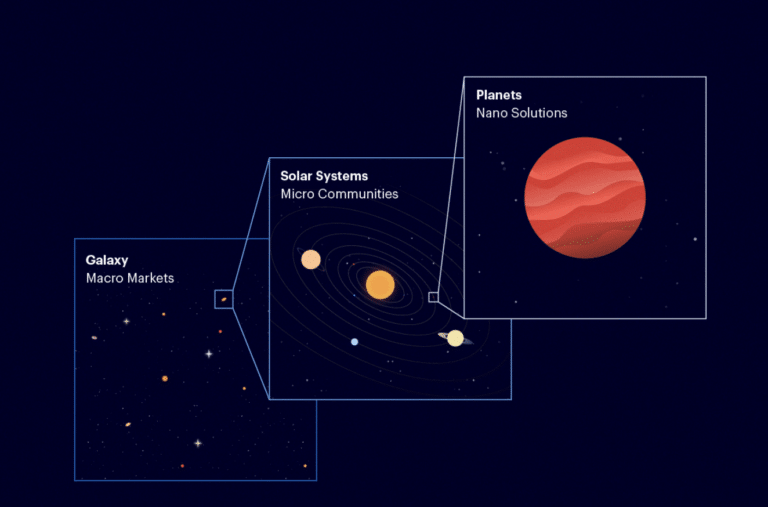

Scientists are still searching for the Theory of Everything, a single equation that can define both the large-scale cosmological structure of the universe and the quantum world. Levy and Fauser compared the entirety of interconnected global markets to the galaxy and said this global whole will undergo a revolutionary transformation with the advent of quantum computing.

The galaxy is made up of solar systems, the equivalent of individual companies in this analogy, who will have to adapt all their financial workflows due to quantum technology. Further down, at the nano-market level, Symphony’s technology addresses granular details to ensure market liquidity and security.

Levy argued that Symphony’s strength is its detailed understanding of market dynamics such as how collateral and margin is structured, and how repo and stock loan markets works. As a result, the firm is developing secure quantum-secure workflows that encrypt daily financial workflows at this nano-level to protect financial stability.

Voice and messaging

In addition to preparing for the development of quantum technology, voice and messaging is still important to Symphony.

Levy said: “Voice is a big deal for us and we are pushing that product hard. It is still a massive opportunity in terms of people want to be secure and compliant”

Symphony has combined its AI and domain expertise with Google Cloud’s transcription and generative artificial intelligence capabilities to enhance its Cloud9 voice product with speech-to-text fine-tuning and natural language processing (NLP) capabilities. Many banks have embedded Symphony’s Federation, which unifies popular mobile communication channels such as WhatsApp, SMS and WeChat in a secure and compliance-enabling interface, in their own platforms according to Levy. The Symphony Innovate London conference included presentations from banks including Wells Fargo, Natwest Markets, HSBC and Bank of America.

Contain, converge and collaborate

Federation is an example of Symphony always putting security first as the firm looks to “contain, converge and collaborate”, according to Levy.

Symphony has also been rolling out confidential cloud which allow firms to securely manage keys that decrypt messages in the cloud, rather than on premise. Levy compared moving data between the cloud and the edge, devices at or near the physical location of either the user or the source of the data, to yoga – people don’t get hurt in position but when they move to the next position.

In terms of convergence, Symphony has made acquisitions such as Cloud9 which securely brings voice and messaging together.

“People are also looking at being in multiple asset classes, at being public and private investors and investing in both Europe and the US,” said Levy. “Convergence is real.”

Symphony also co-operates with relevant firms and Levy said the firm will be looking at more post-trade partnerships. In April 2025 Euroclear Bank said the collateral management services business is using Taskize, an investment operations collaboration platform, as well as its integrations with email and Symphony Messaging, to make query resolution faster and easier to manage.

Levy said: “We want to make sure that we are in the settlement flow for the buy side, the sell side and custody, which is not easy.”