The US elections is closer than polls & betting markets predicted. Investors should expect some flight-to-safety response in areas like US Treasury bonds & the dollar, and tech may perform well if President Trump secures victory again. https://t.co/kCYPOrvv7x#elections2020 pic.twitter.com/OrG5zqYJKs

— AllianzGl (@AllianzGI_view) November 4, 2020

The BlackRock Investment Institute (BII) said the US election is too early to call:

- A delayed result could bring uncertainty and volatility. We prefer to look past this and stay with high-conviction positions.

- We see government bond yields capped in a Biden divided government or Trump win amid modest fiscal stimulus.

- We see EM assets outperforming in a Biden win; cyclicals underperforming in a Trump re-election.

The U.S. election result was too early to call on Nov. 4, raising the prospect of a period of uncertainty as vote counting of absentee and mail-in ballots continues in several battleground states. A conclusive result could take a few days or more, potentially spurring market volatility and leaving open the possibility of a contested result. We prefer to look through any volatility and stay with high-conviction positions amid any sell-offs in risk assets. Likely low trading volumes in this period could magnify market moves.

Both President Donald Trump and Democratic nominee Joe Biden had a potential path to victory as of 2 a.m. EST, with the outcome likely coming down to a few states such as Michigan, Pennsylvania and Wisconsin that may not announce results for several days. The race for control of the U.S. Senate was close, but the odds of a Democratic sweep – with Democrats winning both the White House and the Senate – looked low.

A win by former Vice President Joe Biden could bring a heightened focus on sustainability through regulatory actions and would likely signify a return to more predictable foreign policy. A re-elected Trump would likely double down on the “America First” approach to immigration and trade, and usher in more deregulation. A Democratic sweep could bring large-scale fiscal spending and higher taxes for companies and the wealthy.

We see fiscal policy as a critical area, as it is needed to prevent permanent economic damage from the virus shock. A Biden win with a divided Congress would constrain Democrats’ ability to implement key policy priorities and launch large-scale fiscal stimulus. Stimulus in a second Trump term could be bit larger, in our view, with negotiations on a fiscal package to cushion the virus shock restarting. We expect little public investment in either case.

We see the election outcome’s implications playing out in fixed income and leadership in equity markets. We expect long-term yields to be capped under a Biden divided government or Trump re-election – and could see U.S. Treasury yields falling further after a pre-election run-up in yields on expectations of a Democratic sweep. Longer term, however, we see government bonds challenged amid a higher inflation regime. We expect tech companies the quality factor and large caps to perform strongly under a divided government – as they have done in the past. We believe emerging market (EM) assets would likely outperform on improved trade sentiment in case of a Biden win, especially Asia ex-Japan assets. Many countries in that region have managed to contain the virus and are further ahead in the economic restart. We see challenges for EM assets and global cyclicals in a second Trump term due to a possible resurgence in trade tensions.

? [Instit.Invest.]

— Amundi (@Amundi_ENG) November 4, 2020

?? US election: no winner yet, but markets moving from a Blue Wave to a possible Trump trade.

Discover the latest analysis of our experts on the U.S. elections in our #ResearchCenter ⤵https://t.co/57KiZaPxD3

Sunil Krishnan, head of multi-asset funds at Aviva Investors, said in an email:

What we don’t know:

With large swing states including Michigan, Wisconsin and especially Pennsylvania highly unlikely to call for either candidate, we may well go into tomorrow not knowing who the President will be, or who will control the Senate. Pennsylvania is particularly difficult because it has provision for the longest counting period (up to 14 days in theory).

What we do know:

While results so far are consistent with polling margins of error, undoubtedly both Presidential and Senate races have seen stronger Republican showings than in the base case, which makes a delay in final results an inevitability. It is worth noting though that Biden has put in a much stronger showing in suburban counties than Clinton did in 2016. As a result, he still has a number of open paths to the White House.

However, the same cannot be said for the Democrats in the Senate. Their path to a majority now runs through a handful of states, specifically North Carolina (currently too close to call) and Georgia (which has a special election for one of its Senate seats in January). This reduces the chances of a large stimulus programme, which had been seen as a potential near-term consequence of a ‘Blue Wave’. Arguably the biggest market reaction to this has been seen in Treasuries, where sharp pre-election rises in yields have abruptly reversed. A return to higher yields may now be more a function of the path of the pandemic than stimulus.

We also know that President Trump is likely to throw his weight behind a number of court challenges to state-level vote counting. This does not guarantee success in any of those challenges but can be expected to draw out the waiting game – especially if the court challenges affect Pennsylvania as seems likely. It was noticeable than Trump’s speech to this effect sent equity markets and other risk assets briefly but sharply lower – a sign of investors’ hunger for a quick resolution. The resilience of the US dollar is another indicator that lingering uncertainty will act as a dragging anchor on risk appetite.

Finally, the election result does not change some key features of the investing landscape. We know that economic momentum, which rebounded strongly in Q3, will be challenged by second-wave pandemic restrictions in Q4 – but on balance we expect these to be much less severe than in the spring, even where countries enter apparent ‘national lockdown’. We also know that a number of key global vaccine candidates are likely to reveal efficacy data in coming weeks – and while this is not the same as regulatory approval or mass distribution, we believe markets would see the light at the end of the tunnel.

Why the removal of #election uncertainty could support markets – regardless of the outcome.https://t.co/wPv0WIIjtA

— Janus Henderson U.S. (@JHIAdvisorsUS) November 4, 2020

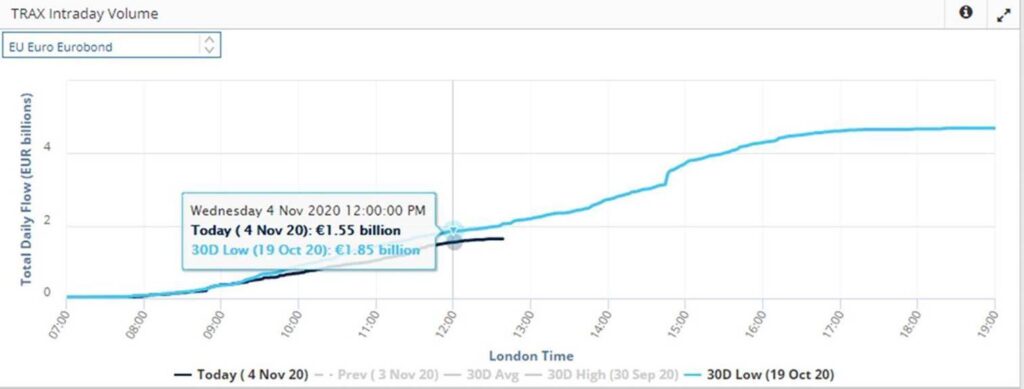

MarketAxess, the bond trading technology provider, said in an email that credit volumes are flat today and are tracking lower than the 30 day low across EU credit, US Treasuries and US credit.

Snapshot for EU credit at midday in the region is shown below: