The following is an excerpt from a 2017 review written by Billy Hult, president of Tradeweb, and first appeared on Tradeweb’s website.

Repurchase agreements, or repo, have long played an important role in supporting capital markets liquidity, but the marketplace has remained relatively static technology-wise in contrast to other asset classes, such as fixed income and derivatives.

Repo traders may have already streamlined their manual trading experience, where electronic trading would have historically been perceived as having less of an impact on their workflow. That changed in both the institutional and wholesale repo markets in 2017, as innovation began to streamline execution, and demand for operational efficiency increased alongside regulatory reform.

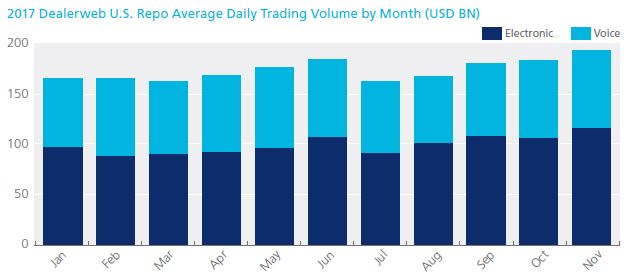

In the wholesale market, Dealerweb paired electronic execution with traditional voice brokerage this year to help reduce costs, while enabling traders to leverage relationships when necessary. Participants are clearly taking advantage of new electronic efficiencies, with repo activity on Dealerweb growing to more than USD190 billion in average daily trading volume – up 17% since January, and representing approximately 20% market share in the U.S.

Institutional dealer-to-client trading through electronic markets is also on the rise, both in Europe and the U.S. Reduced balance sheets, new risk limits, and resource constraints are driving demand for greater operational efficiency and enabling a resurgence of bilateral repo trading.

Tradeweb integrated request-for-quote trading with straight-through-processing on its global repo platform, and market participants are beginning to optimize their workflows and better demonstrate best execution.

Traders can now access real-time pricing from multiple sources, quickly and easily execute bulk lists, and benefit from a fully-electronic post-trade workflow. And as clients realize the benefits of electronic repo in their overall trading performance, we expect to see continued growth on our institutional platform.