Marc Rowan, chairman and chief executive at Apollo Global Management, said on the results call on 5 August 2025 that the numbers for the second quarter were “nothing short of extraordinary.”

Rowan said Apollo was launched to serve the smallest bucket of institutional clients, alternatives, but now has a significant number of other sources of demand.

One is individuals, which Apollo expects to be as large as the institutional business over time. A second source of new demand is insurance companies, where Apollo can harness the illiquidity of its liabilities to provide long term capital and strategies.

“A third new source of demand is that institutions are looking at private assets, not just in their alternatives bucket, but in their fixed income bucket for fixed income replacement,” he added. “We expect, over time, this will also happen in their equity bucket for equity replacement.”

Traditional asset managers, who have struggled with the rise of passive and the decline of active management, are the fourth new source of demand.

“We are watching traditional managers begin to redefine what active management is,” said Rowan. “Rather than buying and selling stocks, they are adding private assets to previously solely public portfolios.”

As a result, Apollo is collaborating with traditional asset managers. Rowan added that Apollo is in the beginning stages of these partnerships, but this has the potential to be a very large market.

“Finally, I believe we are on the cusp of being able to serve the 401K and the defined contribution marketplace,” he said. “I expect significant proposed changes to the regulatory landscape to make this easier.”

U.S. retirement plans are among the largest pools of savings in the world, with $12 to $13 trillion of money mostly invested in daily liquid index products for 50 years. Rowan argued that a small change in the rate of return available to these investors over their retirement period could lead to 50% or 100% better outcomes.

Rowan said: “Part of our vision is a return to defined benefit in the form of guaranteed income, not provided by the employers themselves, but providing people options within their existing retirement structure for guaranteed lifetime income.”

Europe

In June this year Apollo committed £4.5bn financing for Électricité de France, which was the largest ever sterling-denominated private credit transaction. Apollo invested in EDF’s €50bn Euro Medium Term Note program, which will be used primarily to finance EDF projects in the United Kingdom, notably the Hinkley Point C nuclear power station.

Jim Zelter, president of Apollo Global Management, said on the call that Apollo sees a broad pipeline of these type of transactions.

“More broadly, Europe is an area where we are investing significant time and resources to expand our dominant presence over the coming years,” he added.

There is substantial origination opportunity as the region commits to infrastructure investments, defense, reindustrialization and power generation.

For example, Zelter visited Germany three times during the second quarter and Apollo has made a significant commitment to support the country’s growth initiatives, and committed to deploy over $100bn over the next decade. The firm sees a large direct lending opportunity, as over 90% of the firms with revenue greater than $100m are still private and in asset-based finance strategy, particularly if meaningful securitization reform takes place.

“The U.S. is a $30 trillion economy with a $15 trillion securitization market, compared to Europe’s $24 trillion economy with just a $500bn total securitization market,” said Zelter.

Rowan added that over the coming quarters Apollo significantly build its requirements for Euro-denominated liabilities

In Europe Apollo is a strategic investor in Athora, a savings and retirement services business with €76bn of assets under management and administration, serving approximately 2.8 million policyholders.

In July this year Athora agreed to acquire Pension Insurance Corporation Group, the ultimate parent company of the specialist insurer of UK defined benefit pension schemes Pension Insurance Corporation (PIC), for £5.7bn. Athora said the acquisition will create a pan-European savings and retirement services “champion,” and the UK pensions market will complement its existing operations in the Netherlands, Belgium, Italy and Germany.

Rowan said the deal is an “incredibly attractive” way for Athora to enter a “very interesting” UK marketplace. He continued that the UK has many of the same demographic, corporate and pension trends and needs as the US, but it does not have the same amount of capital.

“The UK regulatory mood is one of encouraging private capital into its marketplace, particularly investment grade private capital that supports the long-term projects that the UK and other European governments want to do,” he added. “We are very excited about what this could lead to, and excited to enter the UK market in real size and scale.”

Financials

The firm reported record quarterly fee related earnings of $627m, up 22% year-on-year, which it said demonstrated Apollo’s differentiated capabilities to provide flexible capital solutions through dynamic market environments.

Apollo had record quarterly origination activity of $81bn, representing nearly 50% growth year-over-year, which it said was driven by significant contributions from debt origination platforms and core credit.

“Buying something or originating something is not the secret, buying something that has excess return per unit of risk is what creates value in our business, ” added Rowan. “The flywheel of origination, raising capital and deployment was in full force for the quarter.”

He expects this to continue in the third quarter and said the pipeline looks equally as good.

Zelter said the firm’s North Star is to be an all weather equal opportunity investor in private and public, primary and secondary, combined with speed and scale across the entirety of the investment grade and non-investment grade ecosystem.

“In the aftermath of Liberation Day, we deployed $25bn in a condensed timeframe, and were well regarded as the market leader in that period,” Zelter said. “As the quarter progressed, confidence returned, markets reopened and risk assets recovered.”

Zelter highlighted the performance of Apollo’s high-grade capital solutions business, where the firm originated more than $8bn across four transactions.

He also highlighted that Apollo has worked collaboratively with many banks to drive capital formation and unlock differentiated sourcing. Apollo has a global network of 12 bank partnerships and Zelter anticipates adding a handful of new partnerships by year end.

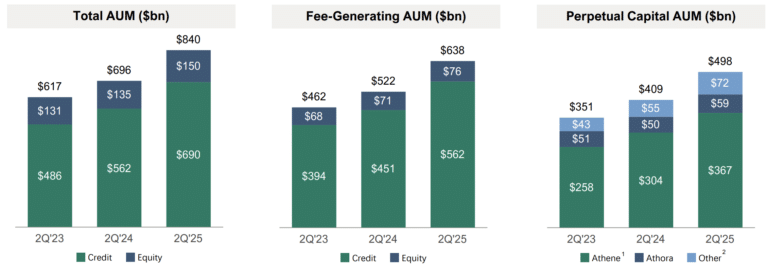

Total assets under management reached a record $840bn. There were inflows of $61bn in the second quarter and $179bn over the last twelve months, leading to a 21% increase year-over-year. All buckets of the credit business, the largest segment of the asset management business, performed the way they should according to Rowan.

Apollo Debt Solutions BDC (ADS) launched in January 2022 with more than $1bn in assets under management. The fund invests primarily in directly originated assets, including debt securities, and in particular focuses on large-cap origination and is managed by an affiliate of Apollo. Rowan said ADS returned more than 9% annually since inception now exceeds $20bn in size.

“It shows that you can grow and scale a business while adhering to the principles that we espouse in our investment business,” added Rowan.

Private equity is expected to be Apollo’s fastest growing business segment. Rowan said fund 10 continues to perform well and he expects the firm’s flagship vehicle to surpass $25bn at year end. He added: “We continue to remain very well positioned with $72bn of dry powder.”