Pyth Network, alongside Chainlink, was chosen by the U.S. Department of Commerce as one of the oracles to post real gross domestic product (GDP) data on the blockchain and the decentralized blockchain-based distribution platform aims to further scale its data business.

On a blockchain, trust or verification from the user is not needed because data is stored on a decentralised ledger with global consensus. However, blockchains need a way to securely access some off-chain data, such as asset prices which are constantly changing. Oracles were designed to provide secure access from blockchains to off-chain data using smart contracts to connect to external data providers.

The Department of Commerce said it will begin with publishing the July 2025 GDP data and this will be the first time a U.S. federal agency has published economic statistical data onchain.

Mike Cahill, chief executive of digital asset infrastructure provider Douro Labs and initial contributor to Pyth, told Markets Media this is significant because it is the first time that the U.S government has embraced permissionless chains. He highlighted that benefits of putting economic data onchain include the ability to use the information in smart contracts and to modernize the collection of the data by the government.

Pyth took two months to develop the mechanism for publishing the economic data. Cahill said: “We will continue to build out the capabilities and start publishing an ever expanding set of economic data.”

3/

New feeds include:

• Employment: Nonfarm Payrolls, Unemployment, Wage Growth

• Inflation: CPI, PPI, PCE

• Growth: GDP Index, Current Account Balance

• Business Activity: PMIThese indicators form the backbone of global analysis.

— Pyth Network 🔮 (@PythNetwork) September 5, 2025

5/

Big moves start with better data.

More categories, benchmarks, and geographies are on the horizon.

Developers can integrate these new feeds today and begin building the next generation of financial applications.

Learn more on this macro data unlock:https://t.co/NcUKGAT3E2

— Pyth Network 🔮 (@PythNetwork) September 5, 2025

Security Token Group agreed in a newsletter making economic data immutable and accessible on multiple chains will allow smart contracts to reference offchain information and act on that information for real world assets. The newsletter said this level of data could create a variety of tools or new assets including inflation-linked products, perpetual futures and real-time prediction markets.

Sergey Nazarov, co-founder of Chainlink, said in a statement: “Bringing this high-quality government data to blockchains through Chainlink catalyzes a wave of new onchain financial instruments, all built on this new foundation of cryptographic truth.”

Cahill continued that embracing this new technology could lead to modernization of data collection by the government. He gave the example of payment firm Stripe producing lots of datasets that can be collated on blockchain so statistics on consumer spending could be produced that are updated in real time.

He has been spending a lot of time in Washington D.C. and continuing to meet with other government agencies.

“The SEC has tried countless times to update Reg NMS and add a framework for competing consolidators and that is something we are working on,” Cahill added. “The Treasury Department has things like the OFAC list and putting that onchain is a great opportunity.”

The OFAC list is a collection of sanctioned individuals, entities, regimes, organisations and countries.

Growth strategy

The Pyth network was founded in 2021 to “bring the price of everything, everywhere.” Cahill said: “Pyth effectively puts data on more than 100 blockchains and that is something we want to encourage.”

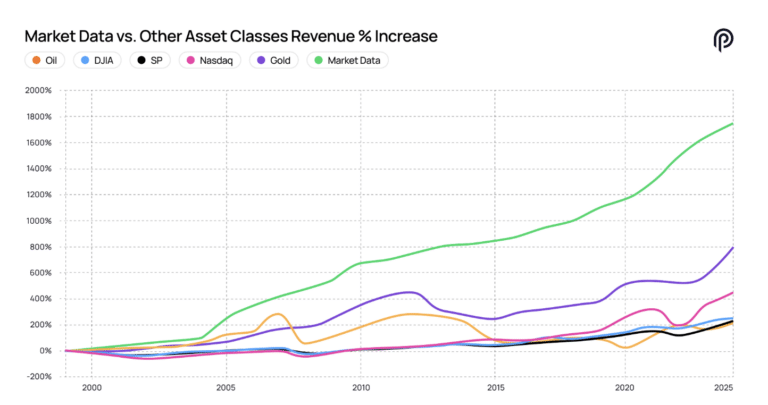

The financial industry has to pay $50bn for licenses for financial market data from exchanges and aggregators, which has led to returns from market data outperforming oil, gold, the S&P 500 index in the last 25 years, according to Cahill.

Pyth said in a blog: “If Pyth can capture just 1% of that market, that’s $500m in annual recurring revenue. But Pyth isn’t just here for that $500m. It’s here to win the market and return sustainable value to the entire network.”

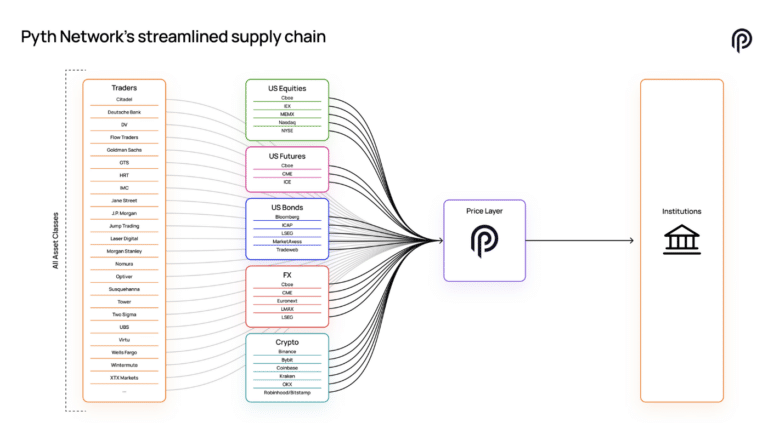

“We had to go upstream and figure out our own sources to create a universal source for the price of everything,” Cahill said.

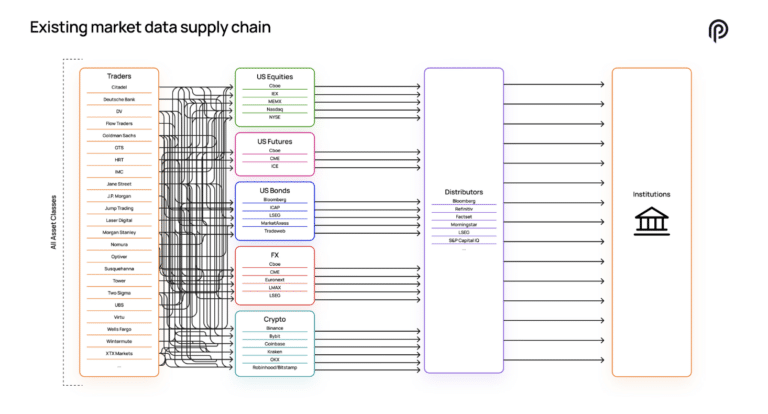

For example, Pyth uses a wide array of contributors including trading firms who use multiple exchanges. Cahill said Pyth has 120 publishers including five banks, DRW, Jump, Jane Street, Optiver, HRT, SIG, IMC, Virtu, GTS, Flow Traders and exchanges Cboe, LMAX, MEMX, MIAX, and IEX. Pyth said it has integrated more than 600 protocols across more than 100 blockchains and delivered more than 1,800 price feeds across asset classes.

The network adds about 200 instruments each month including crypto, U.S. equities and international equities and Cahill argued that originating data is a differentiator for Pyth.

The blog said Pyth has had more than $1.6 trillion in cumulative transaction volume, a 60%+ market share in decentralised finance derivatives and over 600 integrations.

“Another differentiator for Pyth is scale as we distribute data on over 100 blockchains,” said Cahill. “Scale is the name of the game and the end goal is to have 10,000 instruments by the end of next year.”

Pyth covers the majority of crypto instruments, according to Cahill, so a lot of growth will come from adding data from traditional markets. For example, in February this year Pyth contributors launched Pyth Rates Feeds, rolling out US Treasury rates across various maturities directly onchain. In July this year Pyth began publishing onchain prices for 85 stocks listed in Hong Kong.

The strategy is that each new data source will attract more builders and institutions, driving adoption and subscription revenue. That revenue strengthens the Pyth DAO and expands incentives for contributors, which draw in more data sources.

Cahill compared Pyth to Spotify, the digital music firm.

“We are the one subscription that just keeps getting better,” he added. “We need to keep adding the Beatles collection or Coldplay music.”

.