David Newns, head of SIX Digital Exchange (SDX), said the digital asset arm of SIX Swiss Exchange has benefitted from a flight to quality and is excited about taking part in a test with the Swiss National Bank to settle transactions with a central bank digital currency.

SDX formally received regulatory authorisation from FINMA to operate a stock exchange and a central securities depository for digital assets in Switzerland in September 2021 allowing the exchange to go live with a fully regulated, integrated trading, settlement, and custody infrastructure based on distributed ledger technology for digital securities.

Newns highlighted that SDX has benefited from a flight to quality since the collapse of FTX and the alleged fraud at the crypto exchange. He stressed it was important to differentiate between transactions on public blockchains and the underlying distributed ledger technology for digital assets.

“FTX has, without a shadow of a doubt, driven a conversation around counterparty risk and the need to have a trusted service provider in a jurisdiction that is effective in terms of oversight under regulations that are comprehensive, transparent and make sense,” he added. “We have seen empirical evidence that institutions are moving towards licenced service providers, especially for custody.”

Newns said a number of members have joined SDX and are issuing, trading and settling securities on blockchain technology in a fully regulated environment.

For example, in November last year UBS sold a CHF 375m bond that was issued on SDX’s DLT-based central securities depository. Investors have been concerned about the lack of liquidity in digital bonds and so the UBS issue was the first native digital bond with intended dual listing and trading on SDX and SIX Swiss Exchange.

“In 2022 we built a bridge to enable dual bonds or equities to be issued on SIX and also on digital infrastructure,” added Newns. ”That helps with liquidity and any concerns that an issuer has around reaching the entire investor community.”

In January this year the city of Lugano in Switzerland sold a CHF 100m bond that was the first municipal digital bond ever to be issued on regulated financial market infrastructure according to SDX. Lugano’s bond became the first digital native asset accepted as eligible collateral for repos at SNB, the Swiss central bank based on the double listing on SDX Trading and SIX Swiss Exchange.

The Lugano Digital Bond has been approved for the @SNB_BNS General Collateral Basket! This represents a major milestone in the adoption of #digitalbonds & another world first. Read more: https://t.co/9OvRK1koM1#SDX #digitalassets #digitalexchange #stockexchange #DLT #blockchain pic.twitter.com/2kn5AYTH5b

— SIX Digital Exchange (@SDX_global) February 15, 2023

Ratings agency Moodys also said there is no difference in the risk factor analysis of a digital issuance on SDX compared to a traditional bond.

Alexandre Kech, head digital securities at SDX, said in a statement at the time: “I see this as an important signal to market participants that digital bonds have not only arrived in the domestic CHF bond market but have established themselves as an integral part of the capital market value chain in Switzerland.”

Settlement

Newns said that in addition to concerns about the liquidity of digital bonds, investors have expressed concerns about cash settlement. SDX has an account with the SNB and issues tokens on a one-to-one basis but Newns explained this is not equivalent to a central bank digital currency (CBDC). He added: “It is technically commercial bank money and that comes with a balance sheet charge.”

However, in March this year the SNB presented its Swiss Payments Vision, an ecosystem for future-proof payments, at its annual Money Market Event. The central bank said it would conduct a test for issuing digital issuances during a specified time period which will be settled with a CBDC.

“This will be the first time there has been wholesale CBDC settlements on regulated financial markets infrastructure anywhere in the world,” said Newns.

During its presentation, the central bank highlighted that in 2021 Switzerland became one of the first countries to adopt a comprehensive legal framework for the application of DLT and has also created a new licence category for DLT trading facilities under the Financial Market Infrastructure Act.

“This has created the basis in Switzerland for a regulated token ecosystem,” added the SNB. “The SNB is open to DLT and the token ecosystem and its potential for efficiency gains and risk reduction.”

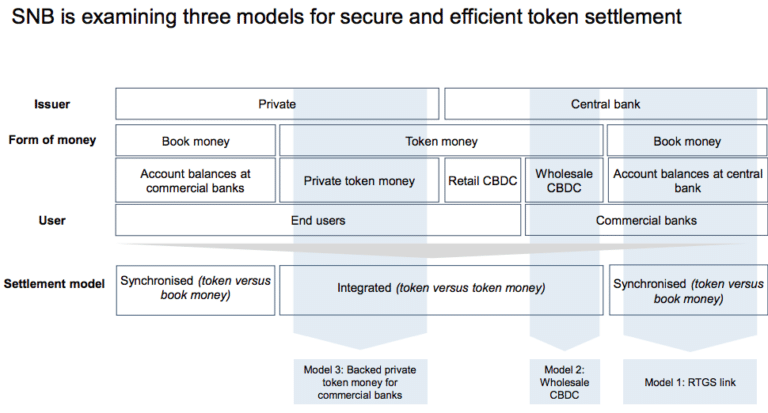

The central bank also acknowledged that, at the same time, DLT can introduce new risks into the system and could fundamentally change the role of financial intermediaries, and the architecture of the current financial system. Therefore, the SNB launched a project to test three models in payment and settlement with regulated financial market infrastructures and market participants.

One model involves integrated settlement using a Swiss franc wholesale central bank digital currency. In Phases I and II of Project Helvetia, tests of the issuance of a Swiss franc wholesale CBDC were conducted on the test environment of SDX.

The SNB said: “Building on the insights gained, we intend in particular to further explore the operational basis that would enable the SNB to issue wholesale CBDC for settlement purposes if necessary in the future. As part of the project, we will issue real wholesale CBDC on SDX for a limited time and test selected transactions with market participants.”

Newns said this test will start soon and will run over a few quarters. He added: “This turbocharges the whole situation.”

SDX is also building out a private markets ecosystem to tokenize private equity and increase the efficiency of the market.

SDX Web3 Services

In addition to SDX operating a regulated trading, settlement, and custody infrastructure, the group launched SDX Web3 Services in June last year. Newns described SDX Web3 Services as satisfying newly emergent demand for facilitating services within the Web3 ecosystem while it will take a longer period of time for securities to migrate onto new digital asset infrastructure.

SDX Web3 Services offers services to institutional clients based on blockchain technology and decentralized applications including, initially, digital assets custody and non-custodial staking. SDX said it considers the provision of industrial-strength, institutional-grade foundational infrastructure delivered by an efficient, secure and stable provider such as SIX as an essential step towards establishing the levels of trust needed for the further adoption of this evolving technology.

The business subsequently announced a strategic collaboration with Fireblocks, the digital asset and crypto technology platform, to provide institutions with infrastructure services for the distributed economy.

Newns said: “We are beginning to see the adoption of SDX Web3 Services as we leverage our Fireblocks custody platform.”

#News! InCore Bank can now offer #ETH #staking to their clients using #SDXweb3 services! InCore Bank also signed its first client – Maerki Baumann. This collaboration between established #digitalasset institutions is the first of its kind in Switzerland https://t.co/Zvjn5cr987 pic.twitter.com/rHrWKXVIMT

— SIX Digital Exchange (@SDX_global) April 5, 2023

In April this year InCore Bank said it will offer Ethereum staking capabilities to their clients using SDX Web3 services that are fully compliant with know your client and anti-money laundering regulations. Switzerland’s InCore was the first B2B bank to receive FINMA approval for banking services with digital assets, back in 2020.

Staking is pledging crypto-assets to a cryptocurrency protocol to earn rewards in exchange. InCore Bank provides crypto brokerage, banking operations and custody services, while SDX Web3 provides crypto custody and non-custodial-staking services.

Mark Dambacher, chief executive of InCore Bank, said in a statement: “We perceive an increasing interest in staking and ways to participate in the decentralized economy. InCore Bank’s fully integrated and future-oriented staking services via segregated wallets, enable us to offer staking to our clients within a convenient, secure, regulated and tax compliant setting.”

SDX also has international ambitions. At the end of 2020 SDX and SBI Digital Asset Holdings announced plans for a Singapore-based digital issuance platform, exchange and CSD venue for institutional clients, subject to regulatory approvals from the Monetary Authority of Singapore.