Average daily volume of CME Group’s suite of cryptocurrency contracts have surged to a record since the launch of spot bitcoin exchange-traded funds in the US, as the new ETFs have also affected derivatives trading patterns.

The US Securities and Exchange Commission approved spot bitcoin ETFs on 10 January this year. Giovanni Vicioso, global head of cryptocurrency products at CME Group, told Markets Media that CME’s bitcoin futures hit record open interest on that day.

Subsequently, CME reported that its cryptocurrency futures exceeded $10bn in notional value and traded more than $10.6bn on 28 February 2024, which was the highest notional volume to date. Then CME’s cryptocurrency futures and options reached a record average daily volume for the week ending 8 March 2024.

Cryptocurrency futures and options offer reliable liquidity when it matters. ADV surged to a record 137.6K contracts for the week ending Mar. 8, making it the highest volume week to date.

— CME Group (@CMEGroup) March 13, 2024

Vicioso highlighted that following the launch of the bitcoin ETFs, there has been a sharp increase in volume in the one-hour window before the calculation of the pricing reference rate in New York at 4pm EST.

“Nearly 20% of daily volume is being traded between 3pm and 4pm EST, which is approximately $600m based on bitcoin’s average price,” Vicioso added. “Institutions have been using our products for price discovery and to hedge risk around the net asset value calculation for the ETFs.”

In addition, this year CME has also seen an increase in trading volume beginning around 9am EST, 30 minutes before the US equity market opens.

Six of the 10 new spot bitcoin ETFs that launched in January are fixed to CME CF Bitcoin Reference Rate New York. As a result, market participants are using CME’s Basis Trade at Index Close (BTIC) mechanism that allows them to automatically trade the futures contract relative to an underlying index price and Vicioso said consistent volume is developing both on screen and for blocks.

“BTIC adoption is a great development because it helps liquidity providers and authorised participants manage positions around the NAV (net asset value) calculation,” he added.

CME is also seeing interest in its exchange for physical (EFP) mechanism, which allows market participants to trade a futures position versus a similar position in an ETF or bitcoin. There is also interest in CME’s trading at settlement (TAS) mechanism for trading futures relative to the settlement price of the futures contract.

Vicioso said: “We still maintain our pole position, relative to competing regulated and unregulated venues, of about 28% to 29% of overall participation.”

In July last year CME introduced ether/bitcoin ratio futures that gives market participants the ability to trade a cash settled product that represents the relationship between ether and bitcoin. Last year that ratio trended down but it has begun to trend the other way and there was one day in January when the ratio moved over 12% according to Vicioso.

“Last year was all about bitcoin and anticipation of the spot ETFs but in January this year ether outperformed bitcoin and some ETF providers have filed for spot ether ETFs,” he said.

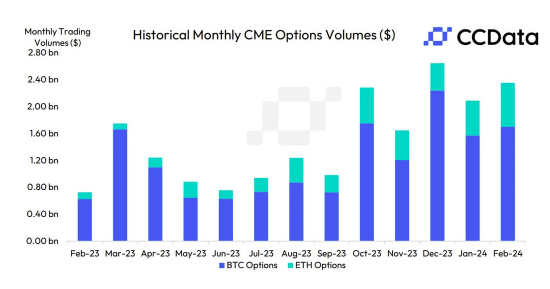

Data provider CCData said in a report that bitcoin options volume traded on CME rose 8.21% to $1.7bn in February, while ether options volume recorded an all-time high, rising 26.4% to $655m.

CCData said: “This could suggest that institutional participants are turning their attention to ethereum ahead of the upcoming catalysts including the Dencun upgrade and a potential spot ethereum ETF later in the year.”

Euro-denominated crypto contracts

In February this year CME said it plans to further expand its crypto derivatives by offering Micro Bitcoin Euro and Micro Ether Euro futures on March 18, pending regulatory review. Vicioso said the European market is well positioned for growth this year given recent regulatory developments and rising institutional interest in bitcoin and ether.

“There has been a fourfold increase in our US micro bitcoin contracts which was driven by some of the price action last year,” he added.

With increased market volatility, micro bitcoin futures trading volume at CME rose to a record on 5 March 2024.

With increased market volatility, Micro Bitcoin futures (MBT) trading volume soared to an all-time high on March 5, surpassing 135K contracts ($850M+ in notional value).https://t.co/rMCyHkyxL2 pic.twitter.com/30tJeVAKXC

— CME Group (@CMEGroup) March 6, 2024

Vicioso said it is important to note that the micro euro contracts for bitcoin and ether will settle to a price that is calculated using euro transactions, and not by converting the dollar rates.

Designed to match their U.S. dollar-denominated counterparts, the micro euro futures will be sized at one-tenth of their respective underlying cryptocurrencies.

Sam Newman, digital assets head of broking at TP ICAP, said in a statement: “TP ICAP will support this market-defining crypto derivative from CME Group by providing block facilitation services to this product. Interest in crypto derivatives has seen huge worldwide growth in recent years and these new euro-denominated micro futures contracts will help further expand the accessibility and utility of crypto derivatives, particularly within Europe.”

Smaller contract sizes make it easier for market participants to manage positions and hedge risk given the recent price rallies, as well as test new trading strategies, according to Vicioso.

“We will have micro bitcoin and ether futures in both US dollars and euros, so this may provide additional foreign exchange trading opportunities for participants,” he added. “The contracts could also be traded relative to our micro euro FX options.”

In March this year Kaiko, the cryptocurrency market data provider, received authorization to redistribute CME’s crypto futures and options real-time market data covering all bitcoin and ether futures, options, and spread contracts.

Ambre Soubrian, chief executive of Kaiko, said in a statement: “CME Group occupies a central role as a top derivatives marketplace, rendering its data essential to our comprehensive offering.”

Regional growth

Approximately 10% to 15% of CME’s crypto trading volume is from Asia Pacific, between 20% and 25% from Europe, Middle East and Africa and the rest in North America, according to Vicioso who said the firm is focused on growing the business regionally.

In November last year Wintermute Asia, the digital asset derivatives trading arm of liquidity provider Wintermute Group, said it executed its first options block trade through CME Group. The bitcoin/US dollar block was traded between Wintermute Asia and TP ICAP and was cleared by ABN AMRO Clearing Bank.

Evgeny Gaevoy, chief executive of the Wintermute Group, said in a statement: “An increasing number of institutional leaders are actively broadening their portfolios by extending their presence within the digital asset sector and Wintermute is well positioned to play an active role in facilitating trading activity. Our integration with CME reflects the growing importance of established exchanges in digital markets, and we are excited to partner with them.“

Vicioso highlighted that CME integrated half a dozen firms into its markets last year, which makes the business “super excited” because they provide additional access to its contracts.

“Wintermute Asia is just one example, but they will allow us to grow regionally and we are looking to develop our options suite so they can help us grow the ecosystem,” he said. “There is growing interest, particularly out of Hong Kong, for additional products.”

In order to meet this demand the Basis Trade at Index Close (BTIC) mechanism will be going live on March 18 using the reference rate which publishes at 4pm Hong Kong/Singapore time.

–