Superstate reached two landmarks in September this year as the financial technology firm for crypto capital markets surpassed $1bn in its tokenized funds and it partnered with Galaxy Digital, to tokenize the digital asset and data center infrastructure firm’s public shares onchain.

Jim Hiltner, head of business development at Superstate, told Markets Media that tokenized money market funds have reached more than $8bn in total assets under management, so Superstate reaching more than $1bn for its two funds is definitely a “good landmark.” He described tokenized money market funds, which hold Treasuries amongst their portfolio, as a proving ground for tokenization.

“With the safest asset on the planet being the guinea pig, this was a really good place to launch before moving into other types of funds,” he added.

Hiltner compared the impact of tokenization to the impact of the internet on physical stores. If stores did not go online, they became less competitive.

“If you are an asset manager or a securities issuer and you are not compatible with blockchains then you are going to be behind the curve,” he said. “This is the next platform for capital markets.”

Asset managers in traditional finance (TradFi), including BlackRock and Franklin Templeton, have also tokenized money market funds, but Hiltner argued Superstate’s differentiator is that it is not a TradFi firm and has built its own technology.

“It is easier to learn about traditional securities and launch a fund than to become a really good, fast, nimble engineering shop,”he added. “We merge those two worlds together, which is why we have been successful.”

He gave the example of Superstate building and introducing a feature called continuous net asset value. A fund traditionally reports a daily or monthly net asset value. However, an onchain fund means income can be streamed in real time, 24/7, including weekends and bank holidays. As a result, many stablecoin issuers use Superstate funds as reserves, especially since the U.S. Administration passed the GENIUS Act, which established the first federal framework for stablecoins.

Onchain equities

When SupersState first launched, the firm focused on being an asset manager to demonstrate the benefits of tokenization. This also allowed the firm to build the required infrastructure such as for client onboarding and asset servicing, and it can now provide this infrastructure to third parties.

“We will launch funds on our platform that will be managed by other people,” said Hiltner. “We will be their technology partner to allow them to access the digital assets ecosystem.”

In March this year Superstate further extended its digital asset infrastructure by registering its transfer agent, Superstate Services, with the U.S. Securities and Exchange Commission. Transfer agents provide a core service to issuers by tracking track ownership of their equities , issuing and redeeming shares and distributing dividends. Superstate Services’s blockchain-integrated record keeping system tracks and monitors onchain ownership and activity in real time, while its smart contract Allowlist creates a permissioned environment ensuring only eligible individuals or institutions may acquire shares.

“We are a regulated technology provider for publicly traded companies that want to bring their stock onchain,” Hiltner added. “”We couldn’t have got that license if we did not have products in production.”

He explained that the firm had to show the SEC how it operated the millions of dollars in its funds and how its technology worked before the regulator would grant it a licence to offer services to third parties. The authorisation of the transfer agent allowed Superstate to launch Opening Bell in May this year. Opening Bell nables companies to issue publicly registered equity directly onto blockchain networks like Solana and Ethereum with Superstate Services recording the ownership of shares and tokenizing them onchain.

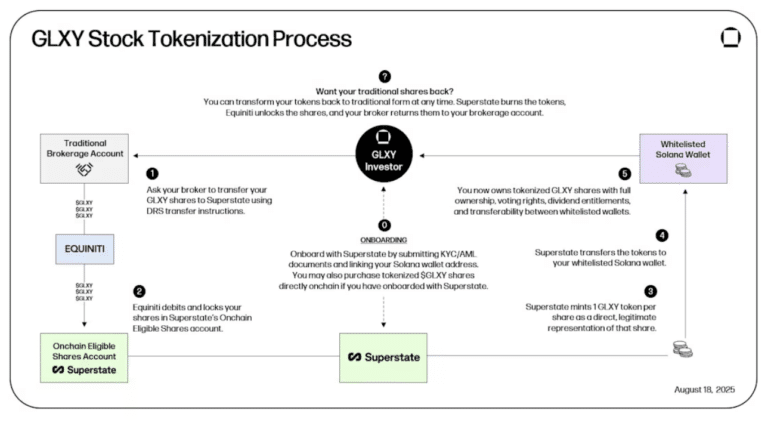

In September this year Galaxy Digital, the digital asset firm and data center infrastructure provider, partnered with Superstate to tokenize its Nasdaq-listed shares on the Solana blockchain.

Mike Novogratz, founder and chief executive of Galaxy, said in a statement: “Our goal is a tokenized equity that brings the best of crypto – transparency, programmability, and composability – into the traditional world. And we’re taking part in building a model that can scale, not just for Galaxy, but for the market more broadly.”

The Opening Bell platform ensures the shares remain fully compliant and legally equivalent to traditional equity while maintaining Galaxy’s official shareholder records in real time. By tokenizing on Solana, Galaxy’s equity gains 24/7 market potential and near-instant settlement.

Robert Leshner, chief executive of Superstate, said in a statement: “This is the first instance of a Nasdaq-listed company being tokenized on a major public blockchain. Financial markets are undergoing a massive upgrade with Superstate.

Peer-to-peer transfers

The tokenized Galaxy shares can be transferred peer-to-peer between verified addresses, with each movement reflected instantly on Galaxy’s cap table. Therefore, the company gains real-time visibility into its shareholder base, with every change in ownership recorded onchain as it happens.

For investors, settlement of a transfer happens as soon as it is confirmed onchain, rather than on the day after a trade, or T+1, as in traditional equity markets. Ownership transfers have full legal effect so there may be opportunities to use the tokened shares as collateral, or in decentralized finance (DeFi) protocols as compliant models emerge. Transfers can also take place globally on a 24/7 basis.

“It lays the groundwork for what comes next: streamlined settlement, new liquidity venues, and integration with onchain decentralized financial infrastructure,”said Superstate in a statement.

Hiltner continued that Superstate’s technology not only allows a share to be issued, but puts a compliance perimeter around the shares as only white-listed protocols or wallets can touch those SEC registered equities.

“We permit a white list of people, entities and protocols through very rigorous policies and procedures that we have demonstrated to the SEC,” he added.

Half a dozen publicly traded companies are partnering with Superstate to put their equity onchain through the Open Bell platform according to Hiltner. They have to be a publicly reporting company with the SEC and produce audited financial statements.

Secondary trading

Although the Galaxy onchain shares can be transferred between authorized wallets, they are not yet allowed to be traded via Automated Market Makers (AMMs) and other DeFi platforms, which would unlock broader liquidity and utility for investors and issuers.

However, Galaxy noted in a blog that Paul Atkins, chairman of the SEC, has stated that the regulator will “create rational and workable rules of the road” for decentralized systems, including AMMs, within the securities markets. Galaxy wrote: “Superstate and Galaxy are both actively engaged with the SEC to help define a model for compliant AMM trading of public equities and we are confident that clear rules will soon emerge.”

Hiltner added that approval of secondary trading will result in more liquidity, more issuers onchain and eventually, capital being raised onchain. In order to improve secondary liquidity, Nasdaq has filed with the SEC for regulatory approval to trade tokenized equities that have the same shareholder protections and rights as traditional equities.

“We are confident that our model works,” said Hiltner. “However, if Nasdaq requires shares to be in the DTCC we may not be included but I think they will open it up.”

Ondo Finance, which provides technology to bring financial markets onchain, said in a comment to the SEC on the Nasdaq proposal that new market rules must be built on clear, public information available to all market participants to use when providing comments. The comment letter said: “Without more information about how the Depository Trust Company (DTC) will handle tokenized settlement, neither regulators, market participants, nor investors can properly assess how this proposal would function.”

In the crypto world, Backpack said in October this year that it had become one of the first centralized exchanges (CEXs) to support trading of tokenized public equities issued on Superstate’s Opening Bell platform. Backpack said it provides a regulated, compliant trading venue for qualified investors to access tokenized public equities, alongside crypto and stablecoins, within one seamless environment.

1/ Superstate has partnered with @Backpack as the first centralized crypto exchange to support native onchain equities.

Eligible non-US investors will soon be able to trade real, SEC-registered public company shares (not wrappers) alongside crypto and stablecoins. pic.twitter.com/8a3LMdnCsK

— Superstate (@SuperstateInc) October 15, 2025

“This positions Backpack as an early access point in the emerging market for onchain, SEC-registered securities, setting a precedent for how centralized exchanges can responsibly bridge the gap between traditional and decentralized finance,” said Backpack.

Hiltner said the engagement of exchanges means that he is optimistic that the ability to sell tokenized shares on either Nasdaq or onchain will eventually converge.

“The next phase is capital formation, so we have designs to enable issuers to be able to raise capital directly onchain and then issue more securities,” he added. “The pipes are laid, there is capital to be deployed and utility to be had.”