Swift has been working with financial institutions to show that its infrastructure can facilitate the transfer of tokens across public and private blockchains, as interoperability is key to allowing the nascent digital asset market to scale.

The infrastructure provider cited a survey which found that nearly all, 97%, of institutional investors believe tokenization will revolutionise asset management by increasing efficiency, reducing costs and enabling fractional ownership, opening up more opportunities to investors in traditional illiquid assets such as real estate. However, tokenized assets are currently managed across a number of blockchains and financial institutions need to build connections to each platform, significantly increasing operational challenges and cost.

A report from Swift, Connecting blockchains: Overcoming fragmentation in tokenised assets, said the initial feedback was that most institutions would prefer to evolve their existing infrastructures and applications, rather than having to build new infrastructure and technology stacks in order to access tokenized assets.

Tom Zschach, chief innovation officer at Swift, said in a statement: “For tokenization to reach its potential, institutions will need to be able to seamlessly connect with the whole financial ecosystem. Our experiments have demonstrated clearly that existing secure and trusted Swift infrastructure can provide that central point of connectivity, removing a huge hurdle in the development of tokenization and unlocking its potential.”

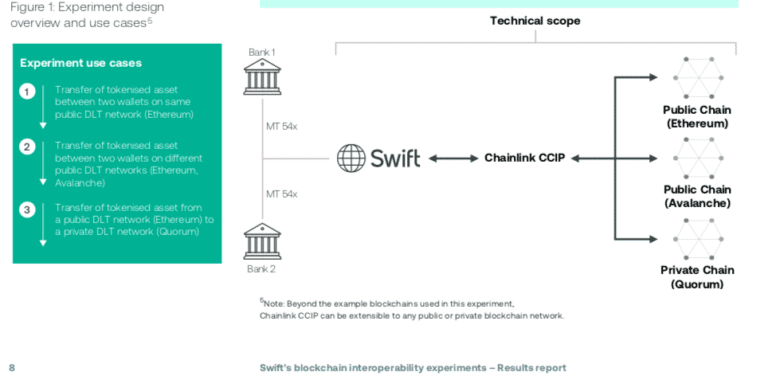

Swift carried out experiments with more than a dozen financial institutions, market infrastructures and Chainlink, a Web3 services platform. Participants included Australia and New Zealand Banking Group Limited (ANZ), BNP Paribas, BNY Mellon, Citi, Clearstream, Euroclear, Lloyds Banking Group, SIX Digital Exchange (SDX) and The Depository Trust & Clearing Corporation.

Alexandre Kech, head digital securities at SDX, said in a statement: “This interoperability exercise is critical to the understanding on how banks and FMIs can realise the promise of blockchain for institutional business, that is, the building of a multi-party, regulated global digital asset agnostic trading, settlement and asset servicing 24/7 infrastructure for issuers and investors.”

Transfers of simulated tokenized assets took place – between two wallets on the same public DLT network; between two wallets on different public blockchains; and between a public and private blockchain network.

Following the experiments Swift said it will continue to work with the financial services community on interoperability across multiple blockchains using their existing Swift capabilities and new open interoperability standards.

Further experiments will include different types of blockchain ledgers, including public permissioned ledgers, as well as on-chain and off-chain Delivery versus Payment (DvP) payment options.

The report said the most compelling case in the near term will be in the secondary trading of non-listed assets and private markets.